2025 OUTLOOK

Economic outlook: Global growth dependent on a resilient U.S.

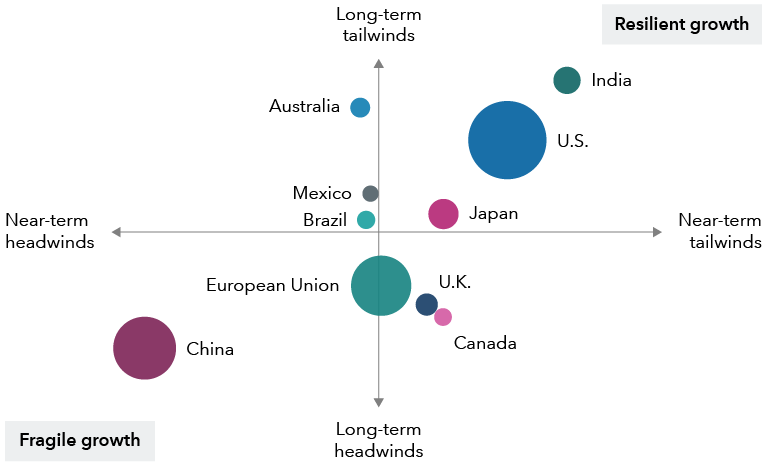

The world economy remains a mix of leaders and laggards. As inflation eases and central banks cut interest rates, the United States and India continue to drive global economic activity while Europe and China seek to kickstart growth. Here's what to watch for in the months and years to come.

Healthy U.S. economy remains a cornerstone of global growth

Sources: Capital Group. Country positions are forward-looking estimates by Capital Group economists as of December 2024 and include a mix of quantitative and qualitative characteristics (in USD). Long-term tailwinds and headwinds are based on structural factors such as debt, demographics and innovation. Near-term tailwinds and headwinds are based on cyclical factors such as labor, housing, spending, investment and financial stability. Circles represent individual economies. Circle sizes approximate the relative value of each economy and are used for illustrative purposes only.

2025 Outlook webinar

Welcome to the Benjamin Button economy

U.S. public debt: Where is the breaking point?

China stimulus - Game changer?

EQUITY OPPORTUNITIES

Stock market outlook: AI leads a broadening market

Artificial intelligence is transforming the economy and driving opportunity across tech, industrials and other sectors, but with valuations elevated and market participation broadening, investors may want to consider less-recognized opportunities among small-cap companies and dividend payers.

"Capital expenditure sprees are a feature, not a bug, of technological change."

- Jared Franz, U.S. Economist

5 growth themes for the next five years

AI spending spree: Where’s the payoff and what’s next?

Granolas: The equity giants that offer non-tech exposure

3 reasons utilities could be the next growth sector

Fixed income outlook: Resilient U.S. provides an anchor

The backdrop for fixed income next year remains strong despite elevated interest rates and higher volatility in the near term. Explore the segments of the bond market where our fixed income investment team finds value.

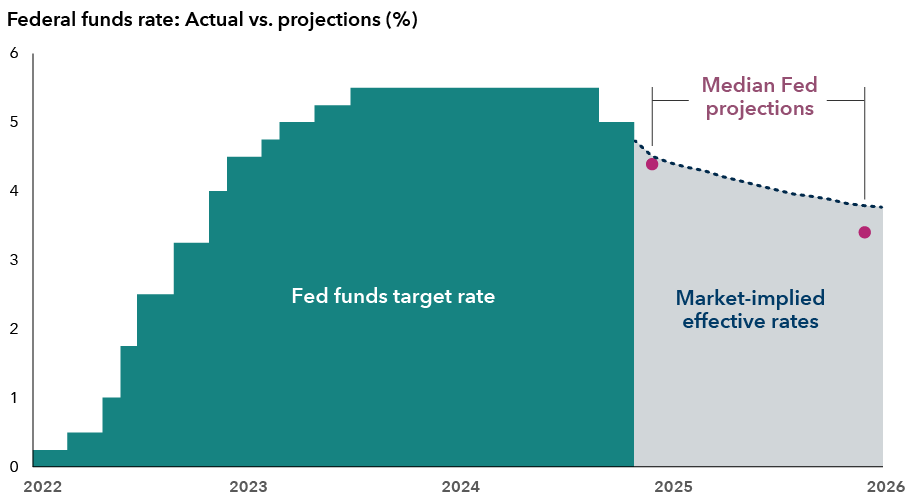

Strong economy could lead to elevated interest rates

Sources: Capital Group, Bloomberg, Federal Reserve. Fed funds target rate reflects the upper bound of the Federal Open Markets Committee’s (FOMC) target range for overnight lending among U.S. banks. Median Fed projections are as of September 18, 2024. Latest data available as of November 30, 2024.

How bonds could shine as interest rates decline

The macro landscape and implications for core fixed income portfolios

Municipal bonds remain attractive despite fading stimulus

Why the yield curve steepener should have more room to run

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week