China

Do proposed stimulus measures in China change the trajectory of its equity market and the economy? It will take more time to see what transpires, but recent actions are steps in the right direction, and as longtime China watchers, we are encouraged by the developments.

Following a slew of announced policy measures, including interest rate cuts, reductions in existing mortgage rates and billions in funds for state-owned firms to buy domestic equities, we think the intent of party leaders is now clearer.

Top policymakers have acknowledged they must stop the decline in home prices to shore up the economy and consumer confidence. This is a significant development and a change in stance from four years ago. The impact has been felt in the stock market, with the MSCI China Index rallying 16% the last week of September, although the pace of gains has since slowed.

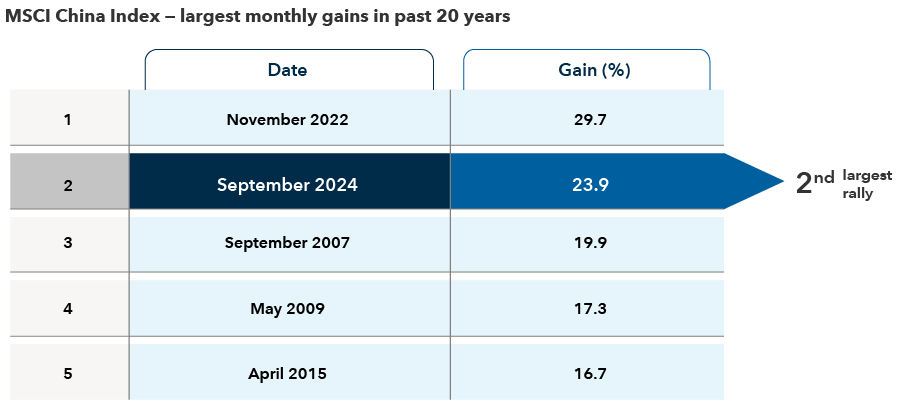

September’s rally was the second largest monthly gain in 20 years

Sources: MSCI, RIMES. Data reflects net returns in USD. Data as of September 30, 2024. Past results are not predictive of results in future periods.

Against this backdrop, these are our thoughts about investing in China now.

The latest stimulus measures signal change

Interest rate cuts are not new and have not significantly boosted equity markets in the past. But the apparent willingness of the government to focus on short-term growth rather than their medium-term ambitions is new, according to our Asia economist Stephen Green.

The government now aims to boost asset prices on the theory that sustained momentum could create a positive wealth effect, reversing the negative sentiment spiral — encouraging consumer spending and business investment. A notable shift is the People’s Bank of China’s willingness to accept riskier assets, such as stocks and ETFs, as collateral for borrowing.

A rebound in consumer confidence would help equity prices

We believe consumers must gain more confidence in the government’s array of stimulus measures if China’s stock market is to find a level of support and potentially move higher over time. Consumers have been cautious and more price conscious. They have been retrenching as well as deleveraging, focusing on repaying their mortgages.

On the upside, households have ample horsepower. The savings rate in China — the highest in the world — remains elevated even after COVID-induced lockdowns ended in late 2022. If some of the money can be routed to consumer spending and the country’s stock market, that would help improve China’s economic trajectory.

There were encouraging signs during the Golden Week holiday (October 1–7). Spending rose above 2019’s pre-pandemic level. Home buying activity also perked up in the bigger cities of Beijing, Shanghai and Shenzhen. And in Macau, a popular entertainment destination for gaming and shopping, there continue to be indications of recovery, with overall visits for 2024 tracking higher than last year.

China’s equity market has rerated but has room to expand

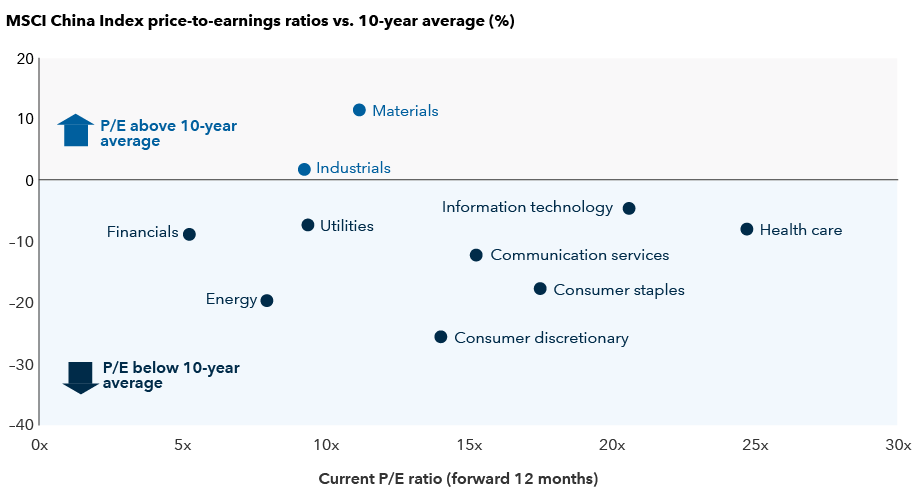

Valuations for some companies got ahead of fundamentals during the recent rally. That said, overall valuations for many Chinese stocks remain attractively valued, with the MSCI China Index trading at a discount to its 10-year average and the broader MSCI Emerging Markets (EM) Index. The MSCI China Index traded at 10.8 times earnings on a forward 12-month basis as of September 30, compared with 12.4 times for the benchmark EM index.

Valuations for most sectors trade below 10-year average

Sources: MSCI, RIMES. Forward price-to-earnings (P/E) ratios reflect the current share price relative to the consensus estimate for earnings per share on a forward 12-month basis. Data as of September 30, 2024.

There are signs of fundamental change that may boost valuations and improve returns on invested capital. Regulators are encouraging companies to pay more in dividends and pursue stock buybacks to improve shareholder returns, mirroring Japan’s playbook. Companies are prioritizing capital returns, notably among China’s leading internet companies, many of whom have increased their dividends and/or pledged to undertake share buybacks. Several of these companies have large amounts of cash on their balance sheets and trade at deeper discounts than their U.S. peers, despite having better technology in some cases.

For sentiment to improve, corporate earnings in China, which have weakened over the past year, will have to improve over the next six months.

Fiscal policies aside, what would likely be a big boost for sentiment is further support for China’s private sector economy. This is not just a real estate crisis but more importantly a domestic confidence crisis. Restoring confidence among entrepreneurs and the global venture capital community could help drive a sustainable recovery in the economy and capital markets.

Stock choice is key following recent market rally

Despite the rally, we still see value in certain areas of China’s market, but one must be selective. We’re constructive on domestic consumer brands in staples and sportswear. We also favor certain internet service platforms, mobile video game operators and travel-related companies. Broadly speaking, we are focused on companies that face waning industry competition, have the potential to improve margins, and can produce steady cash flows, especially in an uncertain policy and geopolitical environment.

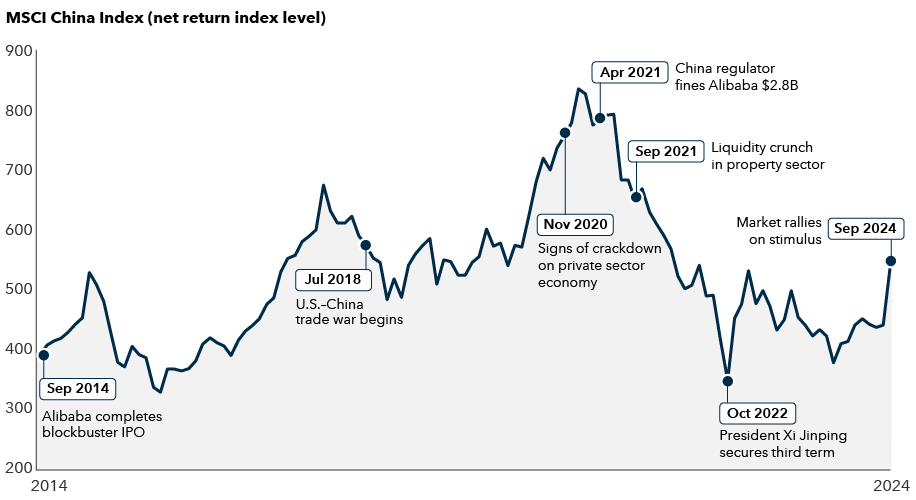

Stock picking in China has been crucial over past decade

Sources: MSCI, RIMES. Data reflects price level on a net basis. Data as of September 30, 2024. Past results are not predictive of results in future periods.

At this juncture, we are more positive about the direction of policy and are waiting to see the impact of proposed stimulus measures on various parts of the economy. China's economic challenges are significant, but the government is taking steps to address them, and hopefully will do increasingly more until it works. Why? China is a far different economy than two decades ago. The middle class is much larger, the population is digitally-savvy with innovative technology at their fingertips, and for China to be the geopolitical power that it aspires to be, it must have a strong economy. They also want to maintain social stability.

In previous periods of economic stress in China (2014, 2018 and 2021), party leaders have stepped up when they sense maximum pain in the economy. Furthermore, the regulatory headwinds that drove down share prices in recent years are abating, and at the margin, the policy environment is becoming more benign.

Bottom line

Big picture, we have to see whether this combination of monetary and proposed fiscal stimulus is going to change the trajectory of China’s economy from deflation to inflation, not only in property prices, but overall consumer prices. If the stimulus is not enough, deflation will persist, similar to what Japan experienced, and consumers will have the incentive to save. If modest inflation takes hold, both in property prices and in consumer prices, we could see a return of confidence and growth. In general, stimulating consumption is easier and cheaper but more temporary, whereas stabilizing the property market is tougher, more expensive but more powerful.

The MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 714 constituents, the index covers about 85% of this China equity universe.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

-

Emerging Markets

-

Global Equities

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Victor Kohn

Victor Kohn

Saurav Jain

Saurav Jain

Kent Chan

Kent Chan