Liability-Driven Investing

EXPLORE

LIABILITY-DRIVEN INVESTING

Capital Group’s LDI Solutions Team provides strategic solutions to unique pension challenges to help limit downside risk.

At a glance: LDI at Capital Group

OUR TEAM

Capital Group’s LDI Solutions Team

- Serves as the bridge between our investment team’s security-level implementation and our clients’ broader strategic oversight of their plans and investments

- Analyzes liabilities and assets holistically, yet thoroughly, to uncover opportunities for hedging solutions to contribute more effectively to positive plan outcomes

- Customizes LDI solutions in strategic collaboration with our clients across a range of benchmarks, guidelines, vehicles and other sponsor-specific preferences

Gary Veerman

Head of Institutional Solutions

Colyar Pridgen

Lead Pension Solutions Strategist

Greg Garrett

LDI Investment Director

Irene Chen

LDI Solutions Analyst

Reflects current team as of December 2024. Investment directors do not have portfolio management responsibilities in the strategy.

Our latest LDI Insights

-

Beyond tracking error: Evaluating long credit managers

-

Liability-Driven Investing

Five considerations when diversifying an LDI program -

Defined Benefit

Public pensions: new discount rate, new strategy?

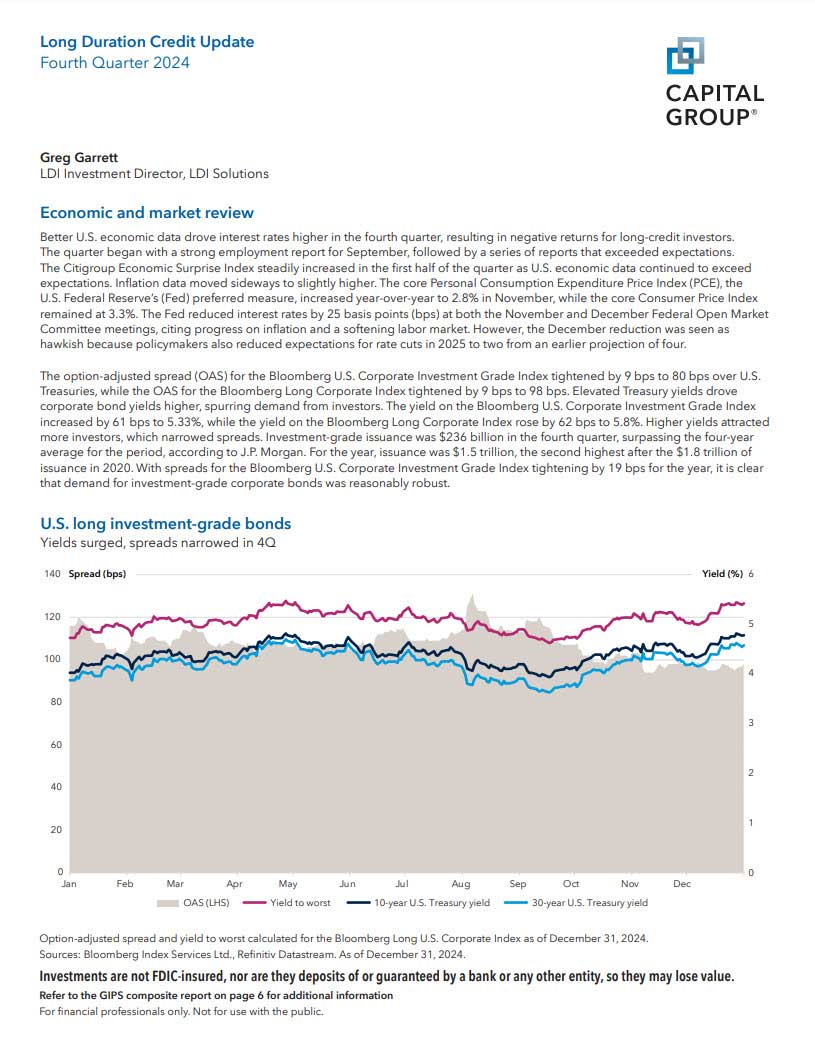

Quarterly results

FIXED INCOME

Quarterly review of our long duration credit strategy and results

Our latest videos

See the U.S. long bond market’s components and credit quality come to life

Connect with our LDI team.

Our dedicated LDI Solutions Team has experience in pension plan risk management across assets and liabilities and can help address your plan’s unique needs.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses.

This and other important information is contained in the prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only.

Advisory services offered through Capital Research and Management Company (CRMC) and its RIA affiliates.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.