Defined Benefit

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

A recent change in actuarial reporting standards makes this an opportune moment for public pension plan sponsors to take a fresh look at the composition of their fixed income allocations. Since February, the Actuarial Standards Board has required that actuarial reports for public pensions reflect plan liabilities using a discount rate based on the yields of high-quality bonds, much like the approach that corporate pension plans take. This new requirement supplements, but does not replace, the discount rate approach that public plans have long used, which is based on long-term expected returns.

Throughout the lengthy public discourse preceding the reporting change, many public plan sponsors and advisors rightly pointed out several differences between public and corporate pensions, including the indefinite time horizon of most public plans and the ability of sponsors to generate revenue via taxation. Due to these differences, public plans will retain the traditional expected return-based discount rate as their primary discount rate.

The differences between public and corporate pensions also lead to differing investment strategies. Public plan sponsors tend to prefer investment strategies that can capitalize on their lengthy time horizons. These sponsors focus on total returns over the long term, while their corporate pension counterparts tend to embrace liability-driven investing (LDI) strategies to manage shorter-term funded status volatility.

Mitigating volatility in public plans

The actuarial reporting change is unlikely to drastically alter public plans’ use of their traditional discount rate or their overarching investment philosophy. However, the new discount rate and resulting liability create a secondary implied funded status that could experience greater volatility than the traditional measure of the funding level. Bond yields change constantly in the marketplace, whereas a discount rate derived from expected return changes only when the plan revises its asset allocation or return assumptions.

At a minimum, because public pension operations are often under a microscope and their financials are so publicly accessible, the new secondary discount rate could create a risk of “bad optics.” Mitigating some of that volatility would be worthwhile for public plans, especially if it can be done within the confines of the existing total-return-oriented investment philosophy.

Consequently, the actuarial reporting change may prompt public pension plan sponsors to reconsider the makeup of their fixed income holdings. They can consider whether the existing fixed income profile best aligns with plan objectives, or if improvements could be made. Closer inspection may show allocations to actively managed long duration credit would better align with long-term return goals compared to existing fixed income. Potentially dramatic reductions in the funded status volatility implied by the new discount rate could be icing on the cake.

Here are three other points to consider for public pensions assessing the composition of their fixed income allocations.

1. Long bonds may be the fixed income style of choice for many long-term total return investors

Although public pensions’ indefinite time horizons make them well-positioned to ride out market volatility in pursuit of outsized returns, they do also seek to manage plan asset volatility. Some plans use longer-dated bonds to mitigate risk, but many shun them, which can cause them to miss out on the potential risk-mitigating benefits when return correlations between equities and bonds are low. These benefits, along with long-dated fixed income return expectations, have only become more attractive with the run-up in bond yields that began last year.

New discount rate basis: High-quality long duration corporate bond yields

Source: Internal Revenue Service. As of June 30, 2023.

Note: Chart displays yields on high-quality corporate bonds of maturities greater than 20 years, as represented by IRS minimum present value (one-month average) third segment rates.

Public plan sponsors can consider implementing a move to longer duration through active management, ideally with managers taking numerous diversified and well-researched active security selection positions that seek to capitalize on a lengthy time horizon.

2. Public plans’ discount rates tend to follow the direction of long-term bond yields

For corporate pensions, discount rates are tied directly to market yields on long duration bonds, so they tend to be more responsive to shifts in fixed income markets. However, even under their traditional expected returns-based discount rate, public pension plans’ liabilities are sensitive to bond yields in the long run, which is what matters for long-term investors. While the speed at which market-based yields are reflected within liabilities is much slower for public pensions than corporate pensions, the capital market assumptions that drive their return expectations ultimately tend to move directionally with secular trends in yields.

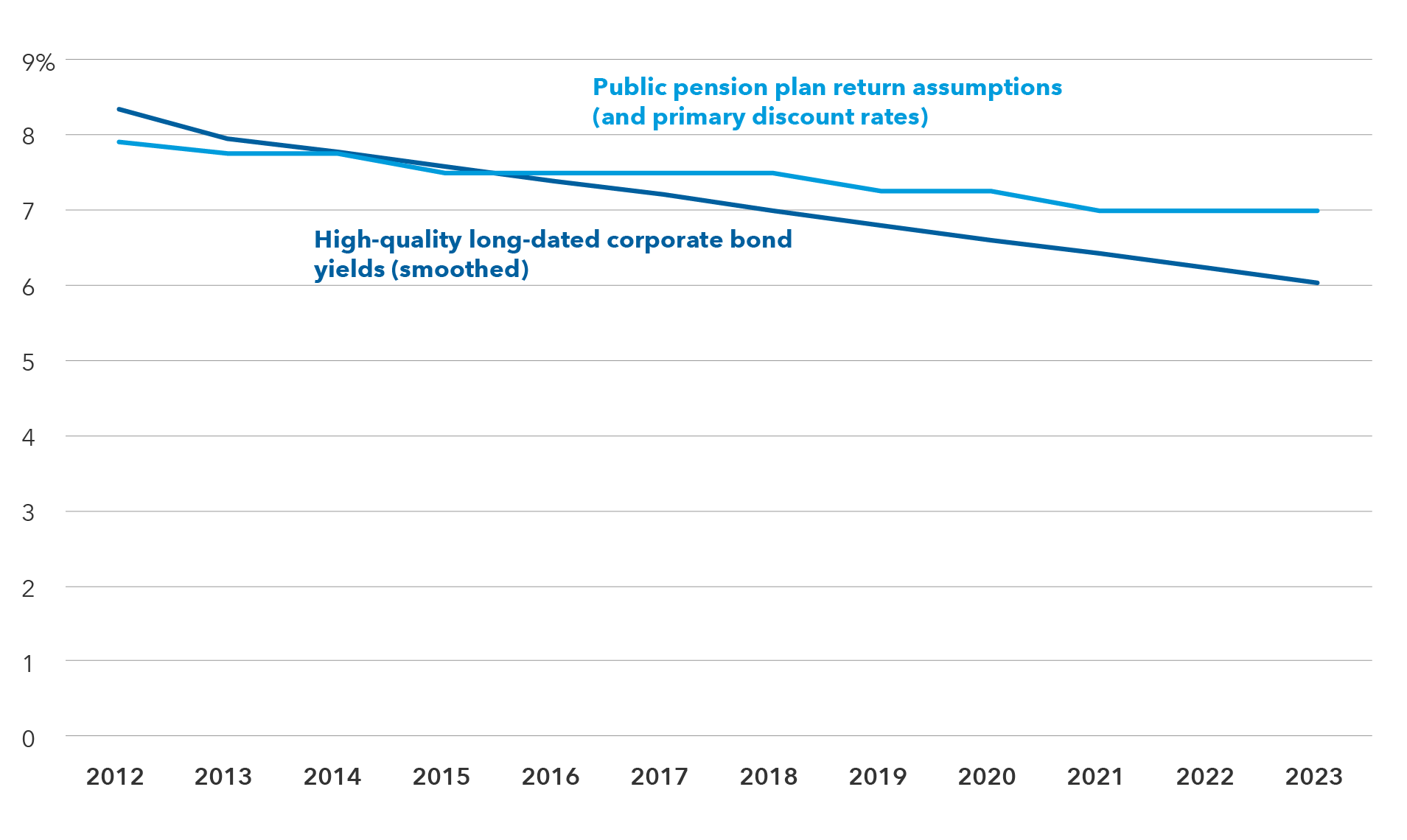

Public pension return assumptions ultimately reflect bond yield movements

Sources: Internal Revenue Service, National Association of State Retirement Administrators (NASRA)

Note: Chart compares smoothed, 25-year average third segment rates published by the IRS with the median investment return assumptions of 131 public pension plans based on NASRA data for plan years 2012–2023. As of March 31, 2023 (NASRA data).

3. Long bonds can offer a measure of protection during rare (black swan) events

The Governmental Accounting Standards Board (GASB) requires public pension plans with insufficient funding levels to use high-quality 20-year tax-exempt general obligation municipal bond rates as a portion of the primary discount rate. Consequently, public plans’ primary discount rate can be exposed to sudden outbreaks of market volatility. Whether or not a particular plan is sufficiently funded to avoid this GASB 67 requirement,1 the high-quality bond-yield-based discount rate represents a “shadow liability” that can emerge in black swan situations when it is most painful. Investing in long bonds can offer a degree of insulation for funded status, helping to mitigate the potential double whammy of an extreme market drawdown and imposition of a muni bond component to the discount rate.

Conclusion

Public pensions have historically not utilized much long duration within their fixed income allocations. While there are sensible reasons why use of these instruments may differ in manner or scale as compared to corporate plans, it may be time for public pensions to take a fresh look at long duration. The new actuarial reporting requirements are the latest and highest profile reason for this, but a close inspection through a variety of other lenses may confirm the strategic suitability of the asset class for these investors. Incorporating long bonds into strategic allocations — particularly long credit — should not require a wholesale adoption of LDI across the board but should dovetail well with some existing investment philosophies.

Don't miss our latest insights.

Our latest insights

-

Portfolio Construction

-

Defined Benefit

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

1 The requirement that public plans with insufficient funding levels use municipal bonds as a portion of the primary discount rate is set forth in GASB Statement No. 67, Financial Reporting for Pension Plans.

Funded status is a measure of the difference between the fair value of a plan’s assets and its benefit obligations. A discount rate is applied to the plan’s future benefit obligation to calculate its present value.

Liability-driven investing (LDI) is an approach that focuses the investment policy and asset allocation decisions on matching a pension plan’s current and future liabilities.

Long credit refers to investment-grade (BBB/Baa and above) U.S.-dollar-denominated fixed-rate taxable corporate and government-related debt with at least 10 years to maturity.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.