Defined Benefit

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

For years, retirement plan sponsors have expressed a preference for defined contribution (DC) plans over defined benefit (DB) plans. Why? To oversimplify a bit, there’s really no such thing as a funding deficit in DC plans. But few have stopped to consider that there’s really no such thing as a funding surplus in DC plans, either. That mentality is shifting, due largely to an upward shift in interest rates over the past couple of years that has placed many DB plans into perhaps unfamiliar overfunded territory.

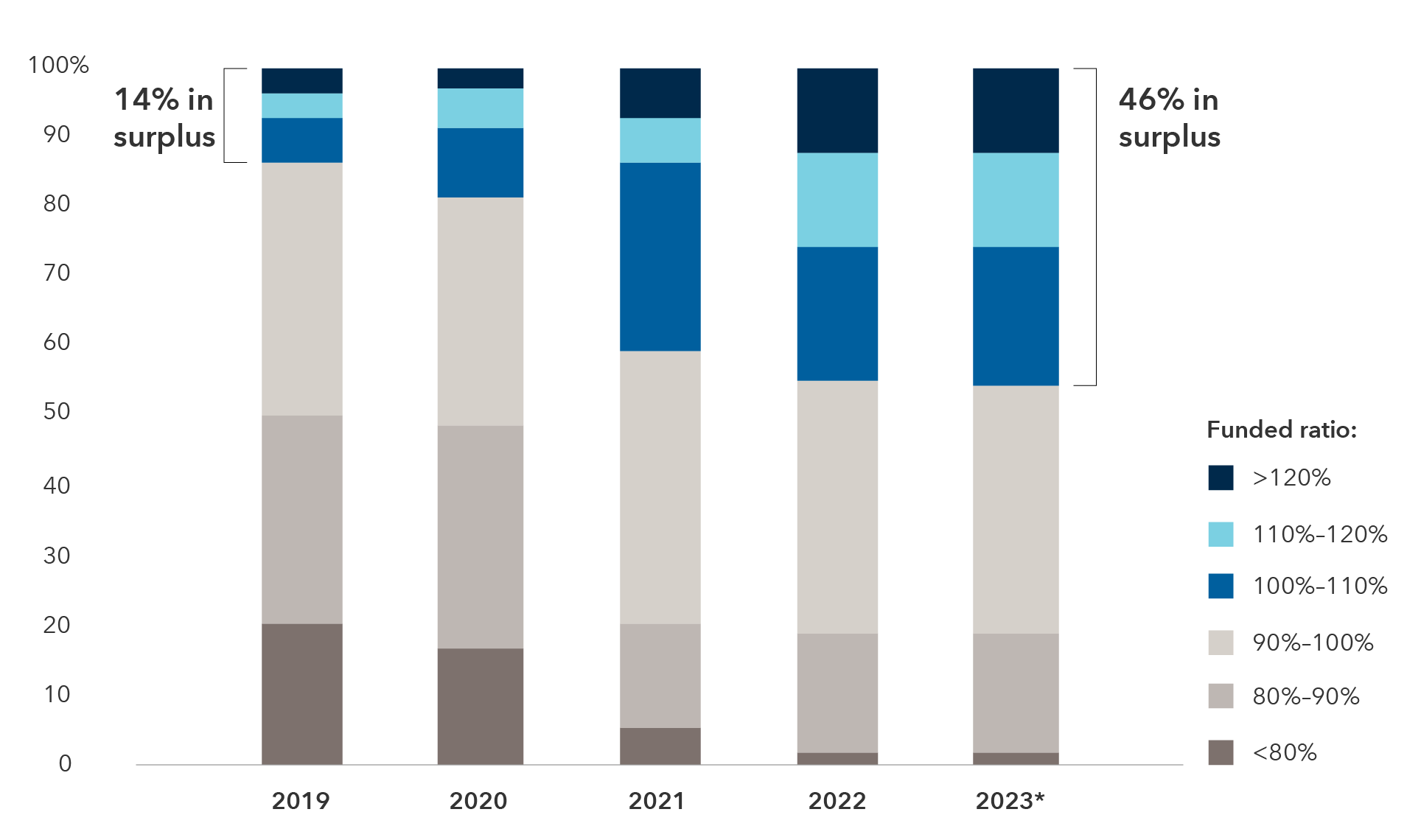

A surge in plans with funding surpluses

Sources: Capital Group, Milliman Corporate Pension Funding Study (2020–2023 editions).

*Data for 2023 reflects Capital Group projections.

Chart shows the distribution of funded ratios for all plans in the annual studies of the 100 U.S. public companies with the largest DB pension plan assets, as of the end of the applicable fiscal years. Some companies in the Milliman studies had fiscal years that differed from the calendar year.

It turns out that some plan sponsors like the new territory, and they even like their DB plans again. While the newfound steady pension income goes a long way in explaining the change of heart, some sponsors are finding other ways to derive utility from their funding surpluses. For instance, employers have explored opening new (or reopening existing) cash balance plans to provide employee retirement benefits in a more contribution-efficient and/or tax-efficient manner.

A cash balance plan is a defined benefit plan that represents the promised benefit in terms of a stated account balance. Participants’ accounts are credited with pay credits that are typically a percentage of the participant’s compensation, and interest credits that are typically based on a fixed or variable rate tied to an underlying index.

As plan sponsors explore their defined benefit and defined contribution options, here are some questions they should consider.

1) Objectives: What is your purpose or goal in opening the DB plan to new accruals? Is the primary goal related to desirable elements of the DB system, such as promoting employee retention? Is it to diversify the DB and DC benefits for participants? Or is the goal to utilize the DB surplus to enable a reduction in an employer’s DC contributions and, if so, over what time frame?

Sponsors may find themselves with an overfunded DB plan, and unattractive bids from insurers to terminate the plan, especially if they’ve already transferred some of the most desirable risks off their balance sheets. Add that to the painful excise tax sponsors face upon asset reversion at termination, and they are understandably looking for other means of utilizing the surplus.

Top of the list is to spend down the surplus via participant cash balance accruals. With the accounting benefit directed to employees, sponsors can proceed to recapture some share of the economic benefit by reducing or eliminating DC contributions.

Participants are likely to be skeptical of any changes, and such disruptions to retirement programs should certainly not be made lightly. Sketch out what the exercise looks like from start to finish, even if it may not play out exactly that way when the time comes. Understand the extent to which economic benefits of the surplus are to be divided among stakeholders, over time, and anticipate participant reaction and HR implications.

2) Plan design: What sort of DB plan will you sponsor, and how rich will the benefit accruals be? If it’s a cash balance plan, how will pay credits be determined? And what interest crediting rate will be established? If this is replacing an employer’s DC contribution, how will these benefits compare to forgone retirement savings?

Participants are likely to directly compare any reduction in DC employer contributions to any increase in pay credits, all expressed as a percentage of pay. Plan accordingly. Consider whether pay credits will be level across participants, or whether they may vary by factors such as an employee’s age or length of service.

Interest crediting should be considered in tandem with investment strategy (see below). Sponsors take a variety of approaches, usually referring to U.S. Treasury yields (of tenors varying by plan), with or without some explicit minimum. Anticipated interest crediting levels may not be perfectly comparable to expected investment returns within DC plans given significant differences in risk. Be prepared for participants to potentially try to draw direct comparisons anyway if one plan is substituting for another. Some of these issues can be partially addressed through the emerging plan design of interest crediting that mimics actual market returns.

3) DB investment strategy: How will DB investment strategy be approached? How will such decisions promote the maintenance of at least a modest surplus, particularly given the current level of variable-rate premiums that the Pension Benefit Guaranty Corporation imposes when deficits exist?

Investment strategy for cash balance plans is quite dependent on the nature of the interest crediting rate. Furthermore, liability-minded sponsors may be more focused on the sum of the account balances or the accounting liability, each of which behaves differently in response to time and risk factors. Ultimately, the nuance of such decisions is highly plan specific.

As a general theme, cash balance liabilities may be less readily hedged than more traditional pension liabilities, where certain fixed income investments possess risk and return profiles that can largely offset market-driven changes in liabilities. By comparison, the risk and return profiles of cash balance liabilities are often more complex.

Sponsors may instead focus on balancing risks such as interest rate risk, credit spread risk, equity risk, active risk, etc. Active management, especially that rooted in fundamental credit research, can play an important role in diversifying the sources of potential returns. Successful implementation can also preserve and grow a buffer against liability shocks from changes in mortality, regulation, credit ratings, curve construction and other such challenging-to-estimate sources.

Sponsors may also look to separate pools of liabilities (e.g., traditional versus cash balance) or assets (e.g., reserve versus surplus) to help refine the investment strategy.

4) DC investment lineup: Does your DC plan have the right lineup, or does it need revision in the context of a new supporting or legacy role?

Evaluate the level of equity within asset allocation solutions such as target date funds. It's important to understand whether the level of equity risk is still appropriate for participants with a new defined benefit income that may most closely resemble fixed income.

Plan sponsors that have custom target date solutions should evaluate the rationale for the customization given that the benefits offered have changed. Comparison to off-the-shelf options for potential efficiency is also warranted.

Finally, evaluate the overall retirement readiness of the general population. Doing so can help plan sponsors understand the value of all employer offered benefits and how that translates into retirement success using the investment options offered.

5) Participant communications: How are participant communications being managed to ensure employees feel comfortable with the rationale for any changes? Will they have the information they may need to take any appropriate compensatory savings or investment-related actions?

Retirement plan design is not a core expertise for most plan participants. They therefore should hear a clear and concise explanation for any plan design changes. They may read a range of narratives about high-profile exercises of this sort, but with the right communications and plan design, they should understand the benefits of participant and sponsor sharing in the use of any DB surplus.

Effective communication can also guide participants toward wiser savings and investment decisions. In the long run, such actions may also prove beneficial to the employer, with potential favorable impacts ranging from easing nondiscrimination testing to the prepared and orderly retirement of the workforce.

Conclusion

Solid improvements in DB plan funding levels in recent years have prompted plan sponsors to explore options for those surpluses, including (re)opening the plan to cash balance benefit accruals. To make a sound decision, sponsors must grapple with a broad range of considerations surrounding their objectives, potential plan designs, investment strategy and participant communications. Capital Group’s LDI Solutions team is available to help plan sponsors think through these issues and weigh the impact of different approaches on financial outcomes and risks to both participants and employers.

Don't miss our latest insights.

Our latest insights

-

Liability-Driven Investing

-

Defined Contribution

-

-

Liability-Driven Investing

-

Regulation & Legislation

Active risk refers to the risk that is created as an active investment manager seeks to exceed the returns of a benchmark index.

A cash balance plan is a defined benefit plan that represents the promised benefit in terms of a stated account balance. Participants’ accounts are credited with pay credits that are typically a percentage of the participant’s compensation, and interest credits that are typically based on a fixed or variable rate tied to an underlying index. Upon retirement, participants may elect to receive the benefit as a lump sum or a lifetime annuity.

A credit spread is the difference in yield (the expected return on an investment over a particular period of time) between a government bond and another debt security of the same maturity but different credit quality. Credit spreads measure the perceived riskiness of a corporate bond relative to a safer investment, typically the equivalent government bond; the wider the spread, the riskier the corporate bond. A period of widening (increase in the spread) reflects an increase in this perceived credit risk.

A defined benefit pension plan is a workplace retirement plan to which the employer makes contributions and promises a defined retirement benefit to the plan participant.

A defined contribution plan is a workplace retirement plan to which the plan participant makes contributions, which may be partially or fully matched by the employer.

Duration refers to the sensitivity of a bond’s price to changes in interest rates.

Equity risk is the risk of fluctuations in the market price of an equity security.

Funded status is a measure of the difference between the present value of a plan’s assets and its future benefit obligations. A funding surplus occurs when the value of a plan’s assets exceeds its benefit obligations; a funding deficit occurs when the plan’s benefit obligations exceed its assets.

PBGC premiums refer to the pension insurance premiums set by Congress. Sponsors of defined benefit pension plans pay annual premiums to the Pension Benefit Guaranty Corporation (PBGC) for the cost of insuring pension benefits.

Target date funds are retirement savings vehicles that shift to a more conservative asset allocation over time.