Regulation & Legislation

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

The U.S. Department of Labor (DOL) recently expanded its nearly 50-year-old fiduciary rule to include more types of investment advice and more people who provide professional advice for a fee. While the changes primarily affect financial services providers, there are a few noteworthy areas for employers who offer workplace retirement plans.

Proponents of the rule changes say they will help mitigate conflicts of interest, while critics say they will reduce access to investment advice and education for investors.

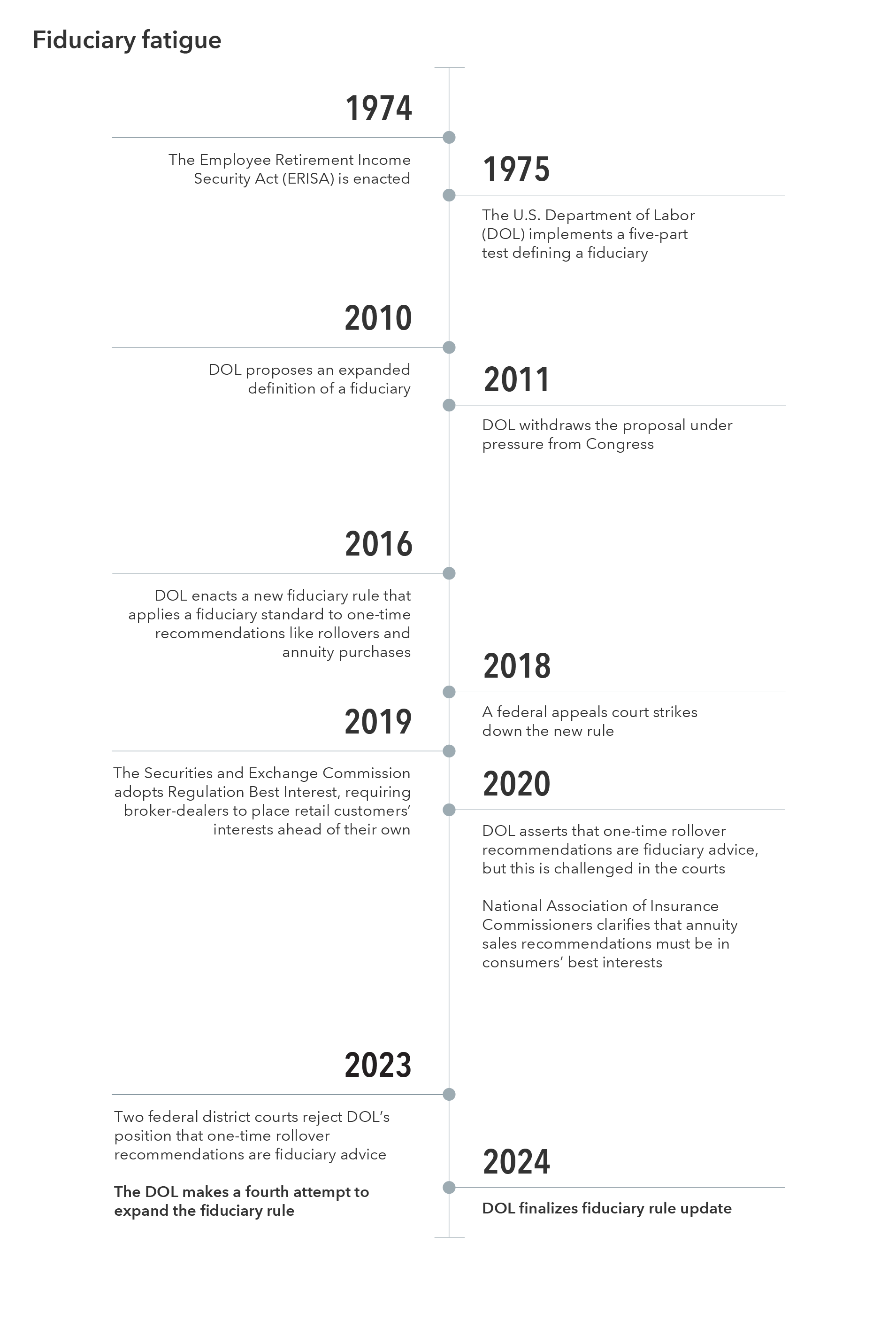

The rule update is the latest in a series of attempts by the DOL to revise the definition of a fiduciary. These efforts reflect changes in the marketplace since enactment of the fiduciary rule in 1975, including the shift to defined contribution (DC) plans from traditional pensions and the growth of the individual retirement account (IRA) market largely through rollovers. The DOL’s previous attempt to rewrite the rule was struck down by a federal appeals court in 2018.

Source: Capital Group. As of April 25, 2024.

Potential impacts on plan sponsors

Employers that offer workplace retirement plans could see several potential impacts from the rule changes. Here we highlight six key areas:

1. Human resources departments get a pass. The DOL’s revised rule addresses a long-standing question about whether human resources (HR) employees are fiduciaries when they communicate with participants about investing in the company’s retirement plan. The DOL definitively states that HR employees are not fiduciaries for two reasons: first, they do not regularly provide professional investment advice as part of their jobs; and second, their salaries do not constitute a fee associated with providing investment advice to plan participants. This is a positive development for employers because it should make it easier for HR employees to discuss investment options with participants, such as recommending that employees who are overwhelmed by the available investment choices consider a target date fund.

2. Unlike savings recommendations, distribution recommendations are viewed as fiduciary advice. A recommendation that a plan participant increase their saving rate is not considered an investment recommendation under the expanded rule. But it does treat recommendations for distribution of a participant’s plan assets as a fiduciary investment recommendation even if no securities are discussed. In the DOL’s view, inherent in a distribution recommendation is a recommendation to sell securities. Among the potential implications, this could make it more difficult for a plan’s service providers to recommend drawdown strategies such as lifetime income options.

3. Rollover and annuity recommendations are under scrutiny. A key aim of the rule’s expansion was to definitively apply a fiduciary standard to one-time recommendations for retirement plan rollovers and annuity purchases. While the DOL takes the position that these recommendations are fiduciary recommendations if there is ongoing advice in the rollover IRA, some courts have concluded that these recommendations currently fall outside the fiduciary standard because the old rules require that investment advice be provided on an ongoing basis in the plan to rise to a fiduciary level. This clarification should be a welcome change for plan sponsors who want to keep retirees in their plan. It will require financial advisors to perform an in-depth comparison of the institutional retirement plan’s investment options, fees and services to those of a retail individual retirement account to determine whether a recommended rollover is in the investor’s best interests.

4. Recordkeepers and other service providers could be more constrained. Employers should also be aware of the potential impact on recordkeepers and other third-party vendors, who may be forced to decide whether and when they are acting as fiduciaries. For instance, a recordkeeper’s call center personnel could be fiduciaries under the revised rule when they discuss plan-specific investments or rollovers. Even basic tools like drawdown calculators on recordkeepers’ participant-facing websites could be in the crosshairs if they were seen as providing individualized recommendations.

5. Higher risk of co-fiduciary liability. A related concern for employers is the risk of liability associated with breaches of fiduciary duty by a vendor or service provider, such as a recordkeeper’s call center. For example, a recordkeeper making rollover recommendations to plan participants is giving fiduciary advice under the DOL’s expanded rule. If that recordkeeper is a financial institution guiding participants to its own products, it could be in breach of its fiduciary duty to put the investor’s interests ahead of its own, potentially exposing the employer to liability. This could put the onus on plan sponsors to increase due diligence and monitoring of third-party service providers.

6. Stance on investment education is reaffirmed. As part of its rulemaking, the DOL has reaffirmed its existing guidance regarding the distinction between investment education and advice. This maintains the sponsor’s ability to advise participants to do things like diversify their investments or even to hold suggested percentages of their account balances in certain asset classes, so long as they don’t suggest specific investment products. However, it is not completely clear how the existing education guidance aligns with the expanded fiduciary definition, so it may be prudent for employers to review their educational tools with an eye on this shift in the regulatory backdrop.

The future is uncertain

With the rule scheduled to take effect on September 23, 2024, it will be in place before a potential change in administration following the U.S. presidential election in November. That said, the DOL may face legal challenges given the strong objections from various corners of the financial services industry. This could result in a challenging compliance environment with interested stakeholders taking steps to comply with a rule that may well be revoked in the courts or reopened in a new administration.

Don't miss our latest insights.

Our latest insights

-

Portfolio Construction

-

Defined Benefit

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

A defined contribution plan is a workplace retirement plan to which the plan participant makes contributions, which may be partially or fully matched by the employer.

A fiduciary is a provider of financial and investment advice with a legal obligation to place the interests of the investor ahead of its own.

An individual retirement account (IRA) is a tax-advantaged retirement savings vehicle.

A retirement plan rollover occurs when an investor transfers assets held in one eligible retirement account to another.