U.S. Equities

Chart in Focus

After much anticipation, the Federal Reserve kicked off its monetary easing cycle in September with a 50-basis-point reduction of the federal funds rate. Treasury yields rallied ahead of the meeting, ending the prolonged inversion of the yield curve: 10-year yields moved above 2-year yields for the first time since July 2022.

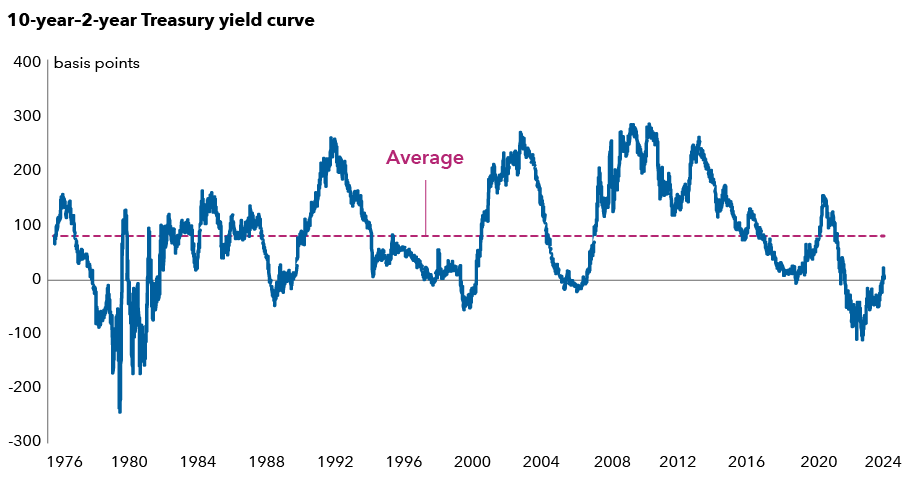

Yield curve remains well below historical average level

Source: Federal Reserve Bank of St. Louis. Data as of October 10, 2024. The 2s10s Treasury curve represents the 10-year Treasury yield spread over the 2-year Treasury yield.

Capital Group’s interest rates team has a long-held conviction in a yield curve steepener. This can happen either by short-term yields falling more than long-term yields and/or long-term yields rising more. This should normalize the curve to be upward sloping. Now that the Fed has delivered its first policy rate cut, the team expects the curve could steepen more meaningfully.

The chart above shows the difference between the 10-year yield and 2-year yield remains notably smaller than its 50-year average. In the post-Volcker era, when the curve previously inverted, it has tended to steepen significantly after moving back into positive territory. The interest rate team now favors greater emphasis on steepening in this portion of the curve.

They also expect yield curve positioning to complement attractive opportunities in sectors, such as corporate and securitized markets. A steepening bias should help hedge several potential adverse economic scenarios for risk assets.

The Fed’s messaging suggests it believes current policy is restrictive, and the rate reduction cycle is just beginning. A significant decline in inflation, from over 9% in mid-2022 to 2.5% in August, has given the Fed additional capacity to ease policy rates. Valuations also indicate further curve steepening potential beyond what is priced in by markets.

A more pronounced slowdown in economic growth or deterioration in the labor market could drive the front-end of the yield curve lower. Meanwhile, the resilience of the U.S. economy makes a hard landing or recession scenario less likely, but the risk may be underestimated by markets. Weakness in the economy or a sustained rise in unemployment could trigger a larger than expected Fed response, leading to a greater steepening of the curve.

Additionally, concerns about the high U.S. fiscal deficit and higher supply of Treasuries could resurface and put upward pressure on long-end yields, especially as investors demand higher term premiums. With the deficit at high levels for a non-recessionary environment, there’s potential for further steepening, even with resilient economic growth.

The Volcker Shock — A period of historically high interest rates, ignited by Federal Reserve Chair Paul Volcker's choice to raise the central bank's key interest rate to curb inflation. Volcker served as Fed chair from 1979 to 1987.

A yield curve illustrates the yields on similar bonds across various maturities. An inverted yield curve occurs when yields on short-term bonds are higher than yields on long-term bonds. Yield curve steepening occurs when long-term rates rise more than short-term rates, or short-term rates fall more than long-term rates.

Don't miss our latest insights.

Our latest insights

-

-

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Anmol Sinha

Anmol Sinha