U.S. Equities

Utilities

A summer heat wave won’t be the only reason for a surge in electricity demand. Megatrends such as the rise of artificial intelligence and its intensive energy needs have boosted the earnings potential of utility companies.

Investors are zeroing in on utilities as the next potential growth sector, says Caroline Randall, portfolio manager for The Income Fund of America®. “I view the electricity network companies as the silent giants of the energy transition. We’ve reached a pivotal point where companies will need to invest more heavily in the United States electric grid, which should increase their earnings and dividend potential.”

Here’s why utilities, long known as reliable dividend payers, shouldn’t be ignored by growth investors.

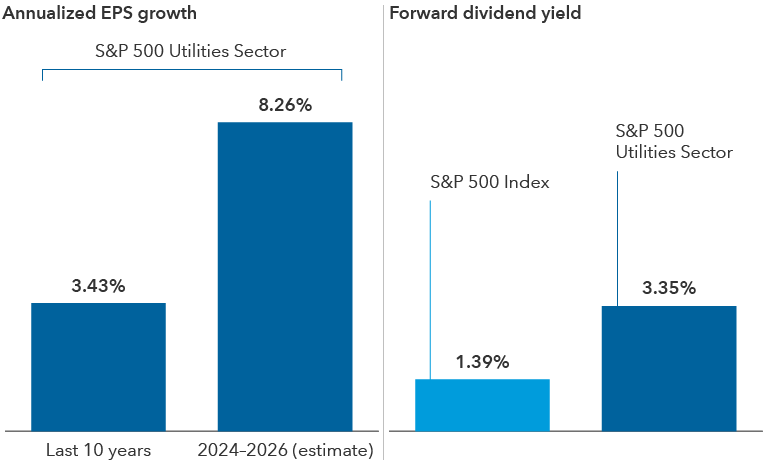

Earnings expectations have jumped for utilities

Sources: Capital Group, FactSet, Standard & Poor's. Forward dividend yield from FactSet is based on current consensus expectations for the forward 12-month dividends per share. As of July 23, 2024. Past results are not predictive of results in future periods.

1. Aging electric grid needs an overhaul

With most of the U.S. electric grid dating back to the 1950s and 1960s, it’s time to update the system. “We produce a lot of electricity in this country from natural gas and coal, and many of these sources will be retired or replaced over the next 20 to 30 years,” says Taylor Hinshaw, portfolio manager for SMALLCAP World Fund®.

Wildfires and floods are also stressing the system, he adds. Pacific Gas & Electric and Southern California Edison have had to contend with hardening their networks against disasters, in addition to procuring clean sources of energy to meet emission standards.

Increased capital expenditure is necessary even without the expected boom in power demand, which Hinshaw estimates will increase 3.5% annually over the next decade from the current level of around 1.0%. All that spending leads to potential earnings growth as regulators allow companies to recoup their investments through rate increases.

Meanwhile, despite ongoing debates about fossil fuels versus wind and other forms of renewable energy — the transition toward the latter is already underway. The Inflation Reduction Act of 2022 includes broad incentives for clean energy uptake and has benefited states across the political spectrum.

“Certain parts of the law could get changed under a new administration, but I don’t see a future where companies stop investing in renewables,” says utilities analyst Andre Meade. Still, soaring demand for electricity means that natural gas and other fossil fuels have a long shelf life.

2. Utilities are powering the AI boom

It’s no secret that AI consumes a lot of electricity. One query to ChatGPT uses the same amount of energy as keeping a single bulb lit for 20 minutes, according to research firm Allen Institute in July 2024.

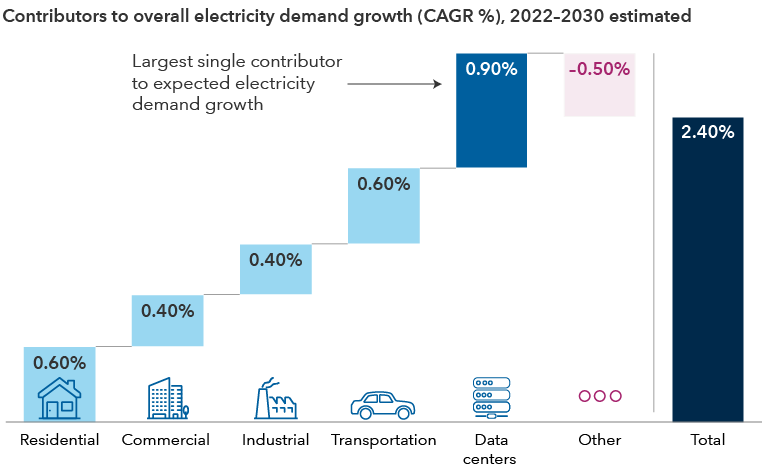

Data centers jolt demand for electricity

Sources: Goldman Sachs, U.S. Energy Information Administration (EIA). Estimates from Goldman Sachs as of April 28, 2024. CAGR is the compound annual growth rate. “Other” includes the impact of energy efficiency improvements and the change from categories not listed.

Tech companies are taking their energy needs into their own hands. This year, Amazon purchased a 960-megawatt data center campus from Talen Energy for $650 million, with plans to buy power from Talen’s neighboring nuclear power plant. Stocks have soared for companies with exposure to nuclear energy, with Constellation Energy up nearly 50% year to date as of July 24, compared to the S&P 500 Index return of around 14%.

In a sign of what’s to come, Dominion Energy is building a $10.3 billion to $11.3 billion offshore wind farm to help meet demand and comply with emissions legislation. The company currently provides electricity to most data centers in the United States, which are largely located in northern Virginia’s “data center alley,” according to ratings agency Standard & Poor’s. California is a distant second, with dozens of other markets in the Southeast, Texas, Ohio and Arizona planning facilities.

Hinshaw foresees regulators incentivizing companies to develop more capacity, much like Dominion’s offshore wind project. That’s because the increase in data centers could tighten electricity supply across the country. Concerns have already surfaced about potential grid reliability as critical infrastructure is used more often when electricity demand peaks.

Building new capacity does not come without risks. Namely, what if demand requirements fall short? On that front, fierce competition for electricity has given utilities negotiating power when it comes to constructing new data centers. This includes upfront payments and even refunds from tech companies if the build-outs don’t go as planned, according to Meade. “A utility will not want to invest to serve a 1,000-megawatt data center and see 200 megawatts show up,” he says.

3. Made in America: Reshoring ignites energy demand

Companies have embraced reshoring or moving manufacturing back to the United States, as the pandemic and geopolitical events caused major disruptions to supply chains.

“It’s a trend that’s here to stay, in part because it provides high-quality manufacturing jobs, which have a positive impact on the local economy,” Hinshaw adds. Moreover, while some trends, such as the energy transition, may slow under a Republican-led government, reshoring resonates under both parties.

Industries that have large energy requirements — semiconductors, pharmaceuticals and autos — are part of the reshoring wave. Within semiconductors, Intel plans to roll out its foundry in the U.S. with funds from the CHIPS and Science Act (Creating Helpful Incentives to Produce Semiconductors).

Companies are being more strategic and considering the possibility of factory shutdowns, labor shortages and other risk factors. Most companies are creating multiple supply chains, and there’s a general desire to avoid manufacturing in countries with import tariffs, such as China.

Can utilities offer the best of value and growth?

Tailwinds over the coming decade spell growth opportunities for utilities. “This is absolutely not just about AI,” stresses Hinshaw. “If you look ahead a decade, trends such as moving industrials onshore and electrifying home appliances are enough to increase electricity demand markedly.”

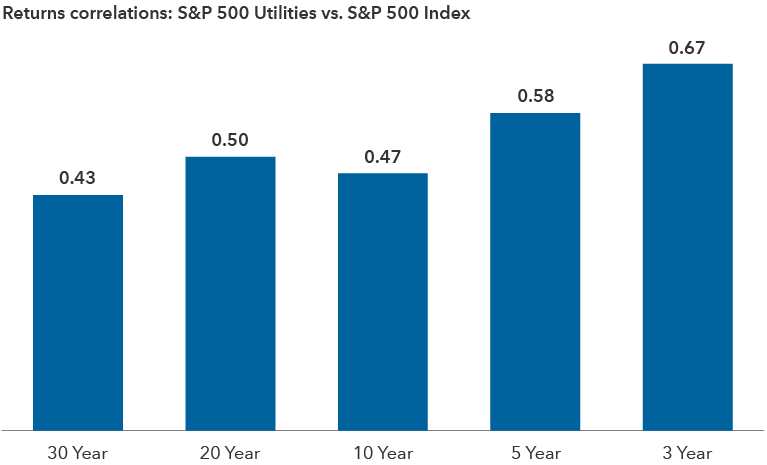

Utilities have recently shown higher correlation to the S&P 500 Index

Sources: Capital Group, Morningstar, Standard & Poor's. As of June 30, 2024.

Add to this the sector’s reputation as something of a bond proxy for its ability to provide some income and stability during past periods of equity volatility. Utilities have typically offered reliable income for investors, with utility stocks within the S&P 500 Index having a historical dividend yield between 3% to 5%. And investors often turn to utility stocks when the economy weakens since they have tended to hold up well compared to the S&P 500 Index.

Utilities should continue to retain their dividend attributes, but the sector may be more volatile going forward as more growth investors become interested in the stocks. “These are not your grandfather’s utilities,” Meade concludes.

Correlation is a statistical measure of how two securities or indexes move in relation to each other. A correlation ranges from negative 1 to 1. A positive correlation close to 1 implies that as one moves, either up or down, the other will move in “lockstep,” in the same direction. A negative correlation close to negative 1 indicates the two have moved in opposite directions.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

S&P 500 Utilities Sector comprises those companies included in the S&P 500 that are classified as members of the GICS utilities sector.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Don't miss our latest insights.

Our latest insights

-

-

Global Equities

-

Economic Indicators

-

-

Asset Allocation

RELATED INSIGHTS

-

U.S. Equities

-

Global Equities

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Taylor Hinshaw

Taylor Hinshaw

Andre Meade

Andre Meade