Chart in Focus

When it comes to identifying investments in smaller and faster-growing companies that have the potential to compound over the next decade, India is a promising place to hunt.

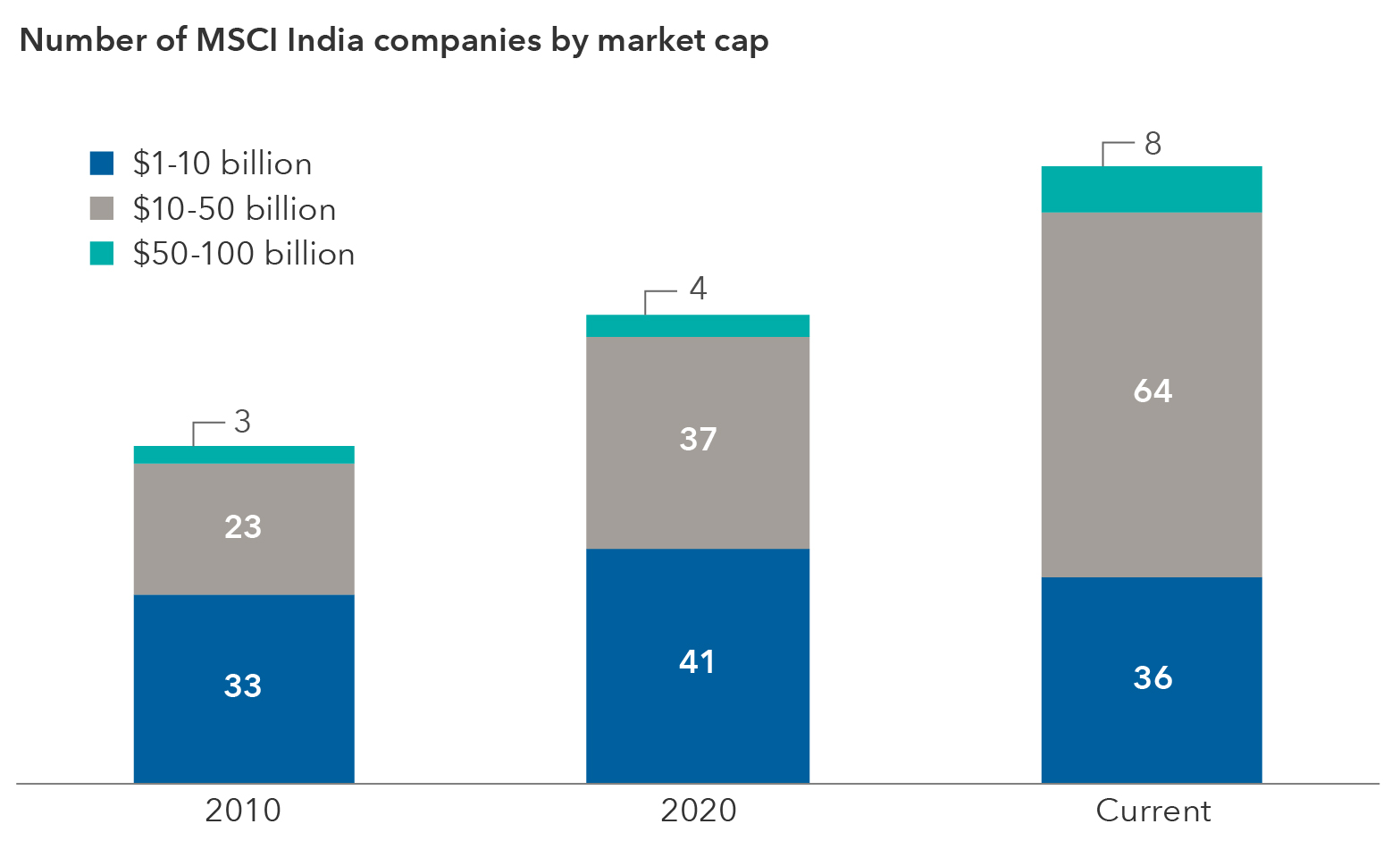

Smaller companies — those with a market capitalization between $1 billion and $10 billion — made up one-third of the $1.2 trillion MSCI India Index as of February 28, 2024. And opportunities are expanding. India's booming economy, growing housing market and digital infrastructure create fertile ground for small-cap companies to flourish.

With significant government investment in infrastructure, India is also becoming a viable alternative to China for manufactured products such as mobile phones, home appliances and computers. These factors have resulted in a much larger opportunity set than a decade ago, ranging from beverage producers to building products companies to chemical suppliers, homebuilders and private hospital operators. In financials, there's also a new crop of wealth management firms, home mortgage lenders and mobile-based consumer finance platforms.

The challenge is that valuations in aggregate appear stretched in the near term, leaving little margin for error. India's stock market is trading at record highs, and valuations have become expensive in some cases. As of March 7, the MSCI India Index traded at 22.2 times forward earnings — above its 10-year average of 18.9 times. Members of our investment team remain selective but also recognize that India is a high-growth market.

India's equity market has grown in the small- and mid-cap space

Sources: Capital Group, MSCI, RIMES. Data for 2010 and 2020 as of December 31, respectively. Current data as of February 28, 2024.

For example, if a company is currently trading at 40 times earnings with the potential to grow earnings by 20% per year in the foreseeable future, the stock may be fairly valued and not that expensive in the long run. For these reasons, we believe it is important to conduct bottom-up research to sift through the opportunities.

Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The MSCI India Index is designed to measure the performance of the large- and mid-cap segments of the Indian market.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Don't miss our latest insights.

Our latest insights

-

-

Chart in Focus

-

Chart in Focus

-

Chart in Focus

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Brad Freer

Brad Freer