World Markets Review

Chart in Focus

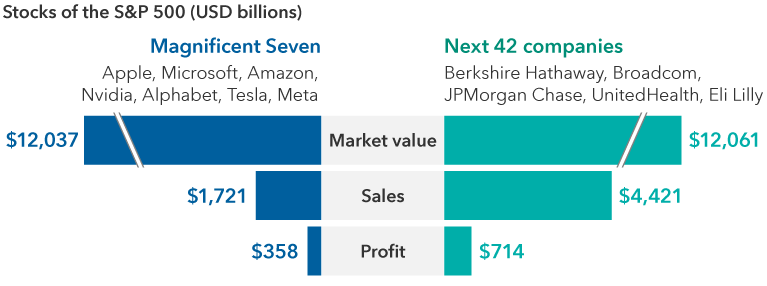

The Magnificent Seven stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – now sport a market cap of around $12 trillion. Looking further into the market, the sales and profitability of the next $12 trillion in market cap are represented by 42 companies from a broad set of industries ranging from tech and health care to financials and consumer companies.

Can the Magnificent Seven maintain their dominance?

Sources: Capital Group, LSEG. Next 42 companies represent stocks following the Magnificent Seven, ranked by market capitalization, with the above stocks topping the list. Sales are the net sales (or revenues) of the relevant item reported in the last 12 months. Profit is represented by the trailing 12-month operating profit. As of December 31, 2023.

Both the 12-month forward sales and earnings for this next set of companies making up a $12 trillion market cap are higher than for the Magnificent Seven, according to LSEG’s data as of December 31, 2023 – yet another data point indicating U.S. stock market performance could broaden in the coming years, pending earnings outlooks.

Our focus remains on valuations given the rise in share prices for the Magnificent Seven. The S&P 500 has a forward price-to-earnings (P/E) ratio of about 15.5x excluding the Magnificent Seven, while the Magnificent Seven has a P/E of about 35x, according to data compiled by FactSet as of January 2, 2024. Earnings growth estimates in 2024 bring the division into high relief – the Magnificent Seven boasts 20.8%, with the S&P 500 at 11.5%, and S&P 500 sans-Magnificent Seven at 6.7% respectively. For 2025, earnings growth estimates for those three groups are projected at about 17%, 12% and 6.7%, respectively. Longer-term earnings estimates for the M7 remain higher, but the uncertainty band around them would also be higher. Hence, the need to diversify.

There’s a strong case to be made for the companies apart from their stock performance. The Bloomberg Magnificent 7 Total Return Index advanced 107% in 2023 versus the overall S&P 500 Index at 24%, largely because the positive fundamentals more than offset headwinds from rising interest rates. In 2023, these companies implemented stronger cost discipline through headcount reductions and capital reallocation to more profitable projects.

Sound balance sheets and strong cash generation give the Magnificent Seven an edge to invest in research and development, while also investing in artificial intelligence (AI) to potentially drive growth in the coming years. Last year, these companies in aggregate spent over $170 billion in capital expenditures and over $200 billion on research and development on initiatives that might have a secular impact on the economy, such as AI applications.

Risks to the group include elevated investor expectations after strong earnings in a choppy economic environment. Additionally, signs of global economic weakness could impact certain big-cap tech stocks more than others. Heightened geopolitical tensions and regulatory questions may also linger throughout 2024.

Nevertheless, investors may want to consider some exposure to the Magnificent Seven and also a broader set of stocks within the S&P 500 -- as well as non-U.S. markets, where in some cases valuations are reasonable and prospects for both top-line and bottom-line growth look promising.

The Bloomberg Magnificent 7 Total Return Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS).

The S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely held common stocks.

Bloomberg Index Services Limited. Bloomberg® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Don't miss our latest insights.

Our latest insights

-

-

Asset Allocation

-

Markets & Economy

-

Artificial Intelligence

-

International

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

David Polak

David Polak