Chart in Focus

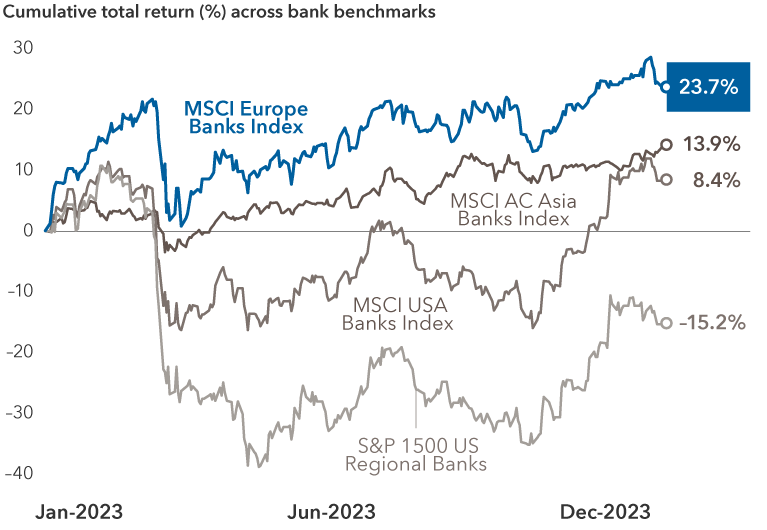

American comedian Rodney Dangerfield often joked that he never got any respect. Perhaps the same can be said of European banks. Since 2020, European banks have faced three major shocks: the COVID-19 pandemic, Russia's invasion of Ukraine and a rescue merger of Credit Suisse in the wake of Silicon Valley Bank's collapse. And in 2023, share gains for European banks outpaced their counterparts in the U.S. and Asia as the chart shows.

Despite outpacing peers, European bank stocks still face some skepticism

Sources: Capital Group, MSCI, RIMES, Standard & Poor's. Data reflects period from December 31, 2022, through January 15, 2024. Past results are not predictive of results in future periods.

Yet, European banks still trade at a significant discount relative to global peers. Investors shaken by the banking crisis in early 2023 are taking a cautious approach. On a price-to-book basis, the MSCI Europe Banks Index trades at 0.74 times book value for the next 12 months, slightly below the 10-year average. For comparison, the MSCI USA Banks Index trades at 1.05 times book.

The 34 banks in the MSCI Europe Banks Index trade at 6.2 times projected earnings for the next 12 months, compared with 9.4 times earnings for the 14 banks in the MSCI USA Banks Index. What's more, European banks trade at roughly a 50% discount to the broader MSCI Europe Index on a forward price-to-earnings basis despite positive earnings revisions since 2020. This suggests the market is anticipating a sharp deterioration in bank earnings, which is a possibility if there is a severe recession in Europe and if Germany's industrial production continues to weaken. But fundamentals within Europe's banking sector appear strong, and the industry has structurally changed since the 2008 Great Financial Crisis.

Profitability is high, balance sheets are solid and banks are returning significant excess capital through buybacks and dividends. In an environment where interest rates normalize around 2% to 3% and Europe avoids a major recession, valuation multiples could expand and help drive total stock returns, providing international and global equity investors with select opportunities.

The MSCI Europe Index captures large and mid cap representation across 15 developed markets countries in Europe. With 425 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across the European developed markets equity universe.

The MSCI Europe Banks Index is composed of 34 large and mid-cap stocks across 15 countries in Europe.

The MSCI AC Asia Bank Index captures 95 large and mid-cap stocks across developed market countries and emerging markets countries in Asia.

The MSCI USA Banks Index captures 14 large and mid-cap banks in the United States.

The S&P 1500 Regional Banks Sub-Industry Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Don't miss our latest insights.

Our latest insights

RELATED INSIGHTS

-

-

Global Equities

-

Economic Indicators

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Anna Adamo

Anna Adamo