Quick Take

Macro Brief

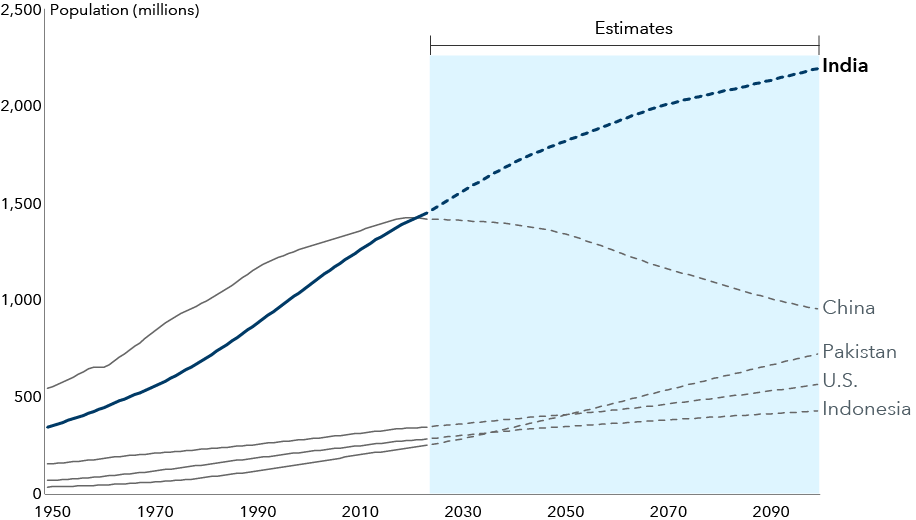

Ongoing talk of India’s demographic dividend is easy to understand: The country recently overtook China as the world’s most populous nation and over the next 20 to 25 years is set to become the largest contributor to the global working age cohort. Estimates suggest India’s working age population will increase another 63 million by 2030 and 128 million by 2040.1

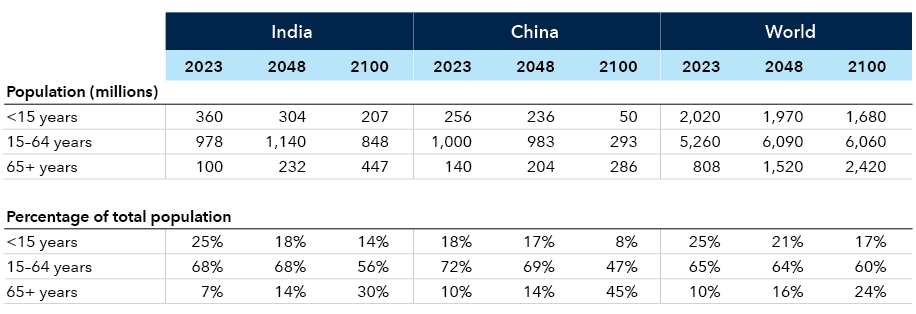

At present, 43% of India’s population is below 25 years old, and its median age is just below 29, with the working age number predicted to climb above 1.1 billion by 2040 (69% of the total). Gross domestic product (GDP) per capita is expected to rise, doubling to $5,000 in the next decade.2 That will be a major driver of consumption, with discretionary spending likely to rise faster than staples.

Good jobs are a challenge for India, along with attracting young people to the manufacturing sector without a reset in wages, according to Capital Group’s India specialist Anirudha Dutta. By 2040, 69% of India's population will be of working age, with 46% employed in agriculture,3 contributing 17% to GDP. India is poised to benefit from its demographic dividend as workers transition from rural to urban areas, taking up jobs in the secondary and tertiary sectors. This shift could increase productivity and household earnings, though wage growth would remain modest due to an ample labor supply.

While the share of agriculture in employment declined from 60% in 1999 to 49% in 2012, the share of manufacturing only rose from 10% to 13% and has stagnated. To reach the Lewis turning point (when surplus rural labor moves into manufacturing) in the next 15 years, India will need to absorb 16 million people in new jobs at increasing levels of productivity every year.4

Since first taking office in 2014, India’s Prime Minister Narendra Modi has championed pro-business reforms and facilitated growth through improvements to infrastructure, domestic manufacturing and broader consumer lending. Over the last 10 years, India has far outpaced the broader emerging markets benchmark. The MSCI India Index has posted a cumulative total return of 205%, versus an 85% gain for the MSCI Emerging Markets Index (over the past 10 years as of March 25, 2025). But the MSCI India Index has faced pressure over the past 12 months due to concerns about high valuations. Going forward, growth opportunities across India’s equity markets will remain, although short-term volatility from evolving U.S. tariff policy is likely. Modi’s now leading a coalition government after failing to secure a majority in the 2024 election.

India has already become the world’s most populous country

Sources: United Nations, World Populations Prospects (2024). Projections from 2025 through 2100 are based on the UN’s high scenario.

When India created 169 million new jobs between 2018 and 2024, 78% of the incremental employment came from agriculture (making up 52%), construction (13%) and trade, hotels and restaurants (13%). Furthermore, 75% of the new employment was self-employed and 6% were casual laborers.5

Despite manufacturing stagnation, however, there are positive signs in the sector. The pandemic and geopolitical developments over recent years have suggested India’s manufacturing could surge as the world tries to build resilience in its supply chains. Although there is also an ongoing shift toward deglobalization and reshoring. While India looks unlikely to replicate the success of the Asian Tigers like Taiwan in this space, we see signs of a low-end manufacturing ecosystem beginning to develop, including for items such as mobile phone assembly.

Meanwhile, India’s fertility rate may be declining faster than other regions at a similar stage of development and prosperity. Barring a few large states, most of India is estimated to have a fertility rate below replacement levels of 2.1.6 The country is also projected to have the largest elderly population in the world over the next two decades, with its over 65 population projected to grow by 7% to 232 million. In the same period, children (zero to 14 years old) are projected to shrink by 7% from 360 million in 2023 to 304 million in 2048.

India’s population growth may have peaked

Sources: Capital Group, United Nations Development Programme estimates.

That equates to India already peaking in population growth. In 2021, it added 20 million to its population, but by 2023, growth declined to 12.7 million. United Nations Development Programme forecast India’s working age population will start declining in 2045 onward.

If India is unable to gainfully employ its youth and foster their aspirations, it risks social unrest, and the demographic dividend could well turn into an obstacle. There are other challenges — deglobalization, reshoring, climate change, technology advancements, AI and automation. Internal issues also exist, including a north–south divide, low education rates, skills training and health care outcomes. None of these in themselves would derail Indian economic growth, but they can certainly cause a dent.

1Sources: Capital Group, United Nations Development Programme forecasts

2Sources: Capital Group, People Research on India’s Consumer Economy (PRICE) ICE 360° Surveys

3Periodic Labour Force Survey, Press Information Bureau of India, as of September 23, 2024. Kotak Institutional Equities, as of December 23, 2024.

4Institute for Human Development, India Employment Report 2016

5Capital Group, United Nations Development Programme forecasts. Periodic Labour Force Survey, Press Information Bureau of India, as of September 23, 2024. Kotak Institutional Equities, as of December 23, 2024.

6United Nations, World Population Prospects 2024

Asian Tigers: The economies of Hong Kong, Taiwan, Singapore, and South Korea. Driven by exports and rapid industrialization, the four Asian Tigers have steadily retained a high economic growth rate since the 1960s, joining other wealthy nations.

The Lewis turning point is a theory in economic development that describes when a country's surplus labor moves from agriculture to manufacturing.

MSCI Emerging Markets Index is a free-float-adjusted market-capitalization-weighted index designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indexes.

The MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market. With 156 constituents, the index covers approximately 85% of the Indian equity universe.

Stay informed with our latest insights.

Our latest insights

-

-

Markets & Economy

-

Emerging Markets

-

-

Quick Take

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Anirudha Dutta

Anirudha Dutta