Markets & Economy

Target Date

- A shift toward participant outcomes and away from fee-based litigation continues, especially within target date products.

- Differences in returns continue to meaningfully surpass differences in fees, so a balanced approach to comparing both is prudent.

- Monitoring and measuring long-term consistency can make all the difference for fiduciaries.

Plan sponsors face ongoing scrutiny over the performance of their qualified default investment alternative (QDIA) selections, especially within target date products. In the past couple of years, several legal cases have been filed against plan sponsors and fiduciaries alleging Employee Retirement Income Security Act (ERISA) violations tied to the underperformance of their selected target date funds. While some of those cases have been dismissed, several of them have advanced to class action status.

With the panoply of target date funds (TDFs) available for plan sponsors and fiduciaries to choose from — running the spectrum from fully active to fully passive and with differing approaches to various asset class exposures and other characteristics — this increase in litigiousness raises the stakes when it comes to QDIA manager selection and monitoring. A sole focus on fees has never been enough to justify the choice of QDIA, and now participant outcomes net of fees (as well as their durability and consistency) are increasingly called into question.

Not only is choosing and keeping an underperforming QDIA solution a potential legal threat for plan sponsors, but it can also be very costly. After years of litigation, UnitedHealth Group agreed to settle its class action lawsuit in December 2024. The company agreed to pay $69 million to about 300,000 current and former participants of its 401(k) Savings Plan, according to a court filing.

In the past, judges have been appropriately skeptical of returns-focused litigation. Now that some of these cases have been elevated to class action status, it signals a significant shift that may spark even further scrutiny, especially given the wide dispersion of investment results among providers.

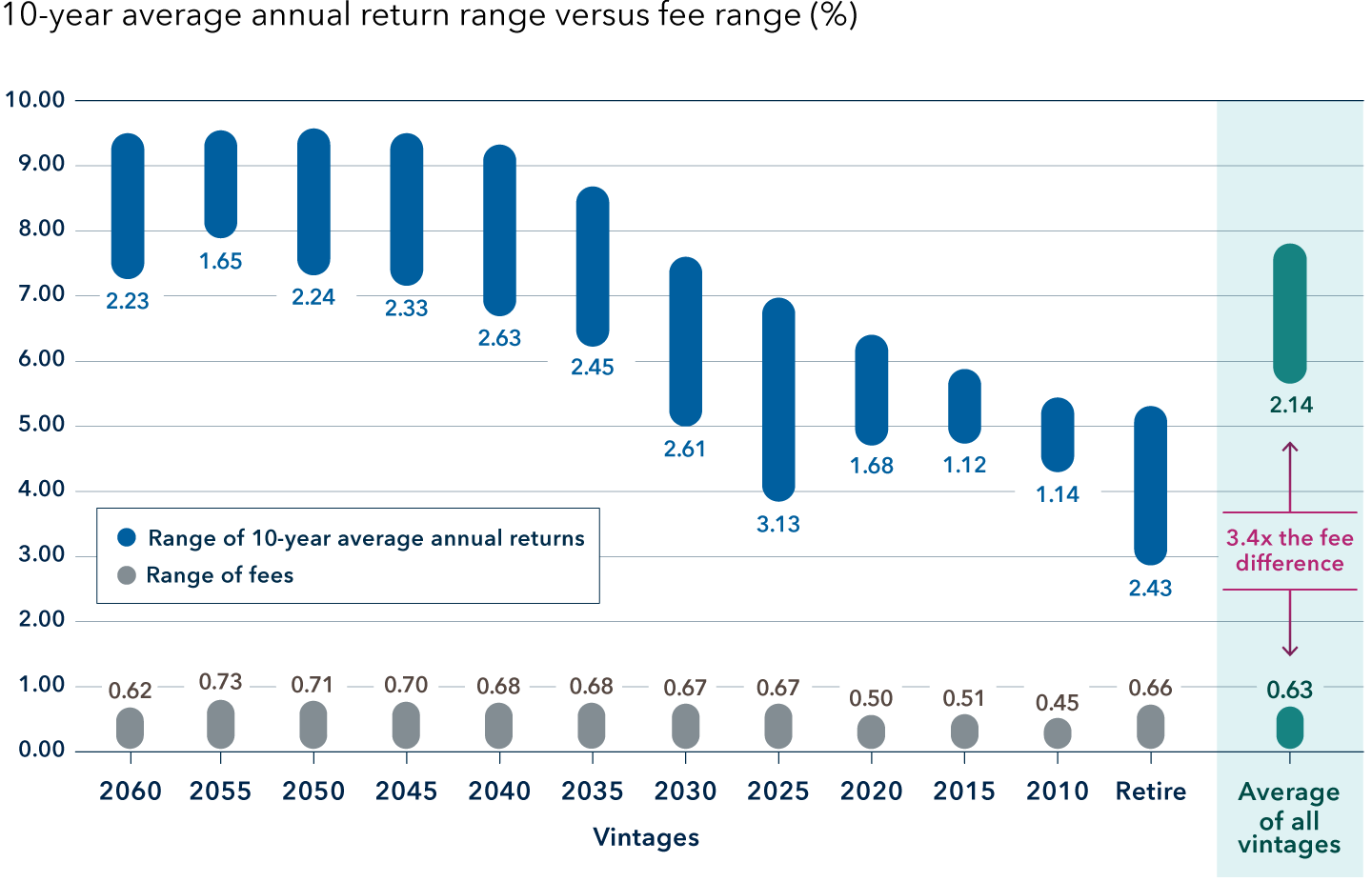

On average, the dispersion of participant outcomes has been 3.4 times greater than the dispersion of fees among target date providers.

Dispersion of target date fund returns far outpaced difference in fees

Source: Capital Group, using data obtained from Morningstar as of December 31, 2024. Data shown is of the lowest-cost mutual fund share classes with a sufficient track record for each peer target date series. Represents 33 mutual fund target date series, excluding managed payout funds and target date series that are only available in wrap accounts or launched after January 1, 2015. Past results are not predictive of results in future periods.

Given this context — a fresh focus on the relative outcomes and results generated by target date funds, not just their cost — it’s reasonable for plan fiduciaries to review their approach to monitoring and evaluation, given that the variability of industry outcomes dramatically outpaces the differences in cost. A myopic focus on cost within the overall selection process seems to miss the point: The retirement futures of participants depend much more on what target date solution providers can deliver in terms of capital appreciation, portfolio income and downside resilience than on the expense ratios they charge.

In the paper below, we take a closer look at the long-term consistency in the American Funds Target Date Retirement Series® in terms of both return and risk and how it compares to its largest peers.

You must be logged in to download the PDF.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

World Markets Review

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Rich Lang

Rich Lang

Polina Tsybrovska

Polina Tsybrovska

Kia Haseli

Kia Haseli