Market Volatility

Asset Allocation

- When equities decline, owning true core bonds is vital.

- High yield and other credit is strongly correlated to stocks.

- Beware of bond funds reliant on credit when volatility strikes.

U.S. equities have seen steep declines in recent weeks following all-time highs, ending a period of exceptionally low market volatility with credit markets near historic low levels in yields and spreads. In such an environment, investors who have taken a disciplined approach to portfolio construction and who have treated their bond allocation as the safer part of their overall allocation – one that provides some protection when equities sell off – are likely to have fared better. They would have reduced higher yielding investments and waited for a good re-entry point to the sector.

As equity markets experience a sharp decline, a true core bond fund with low-risk exposure should have avoided such a decline. This enables an investor to preserve capital and allows for a rebalancing opportunity by selling a bond fund and then buying equities during the stock downturn.

Risk markets are near highs in price.

Since the end of the financial crisis, investors have experienced very strong returns from U.S. equity markets. Starting in 2009, the Standard & Poor’s 500 Composite Index has had nine years of strong, positive returns averaging nearly 16% annually through 2017. February marks the current economic expansion’s 104th month, which had been helping stock markets to thrive. And while there may be room for this equity bull market to continue despite recent volatility, on average, expansions have historically only lasted about 60 months.

This upward trend continued as 2018 began. Although some investors and analysts said that the pace of returns and the level of equity markets concerned them, only recently have stocks experienced turmoil in the face of risks, such as:

- Potential changes in monetary policy accommodation from the U.S. Federal Reserve, the European Central Bank and the Bank of Japan

- Uncertainty surrounding fiscal policy in Washington

- Increased geopolitical unrest

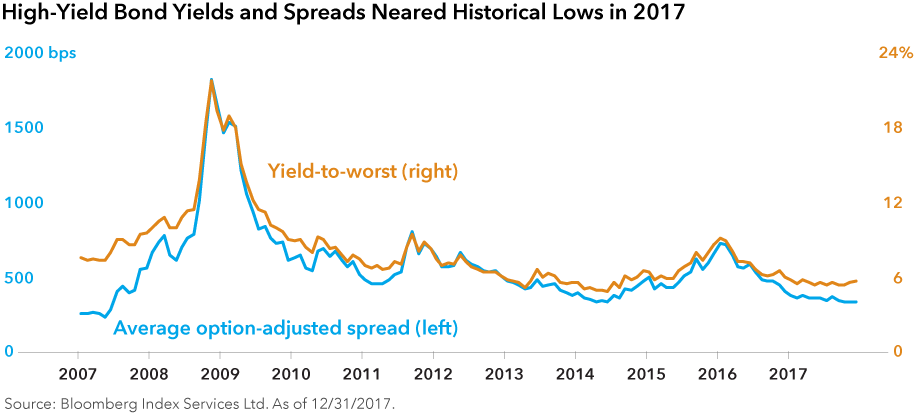

High-yield bonds delivered solid results in the risk-on environment. Annualized returns for the U.S. high-yield market have averaged nearly 14% during the nine-year period from 2009 to 2017. However, at the end of 2017, the average yield for the U.S. high-yield market had fallen to below 5.7% and credit spreads tightened to 343 basis points above Treasuries.

In this environment, investors stretched for yield by moving down the credit-quality spectrum, increasing holdings in issuers rated CCC and below. As strong demand has continued, we are now starting to see covenant protections for bondholders being diluted or removed from indenture documents. As a result, investor protection has diminished materially. Investors appear to be accepting more covenant risk for even less compensation as they stretch for yield at precisely the wrong time.

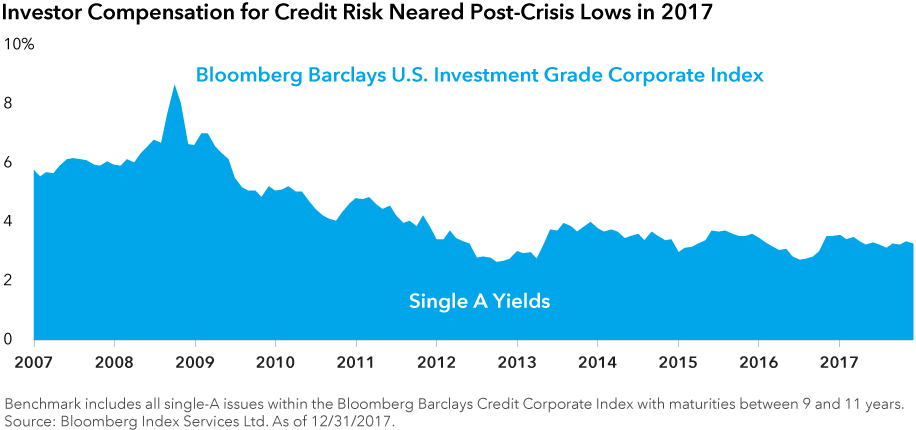

Lastly, yields in the investment-grade corporate bond market have fallen as well. In 2007, just before the financial crisis, investment-grade credit spreads tightened to approximately 85 basis points above Treasuries. By the end of 2017, credit spreads for high-quality issuers were approaching 90 basis points, and the yield on single-A-rated corporate bonds maturing in 10 years was nearing 3.3%, depending on the issuer. However, the yield in June of 2007 was approximately 6% for similar issuers and maturities. Current yields seem low, especially since balance sheets are weaker, having been levered up to 2007 levels. Credit quality is only marginally better than in 2007, but debt service costs are lower due to reduced coupon payments.

Know how a bond fund is invested and its associated equity correlation risk.

As investors reach for yield, many have allocated a large portion of their fixed income assets to the categories labeled “strategic income,” “multisector” or “nontraditional” fixed income. In general, these strategies have performed well in recent years by having significant allocations to the U.S. high-yield and investment-grade corporate bond sectors.

With these two fixed income sectors seemingly fully priced and near historic lows in yields and spreads, “income” or “high-yielding” strategies could be at risk of either fundamental spread widening or sharp price declines due to their often surprisingly high correlation to U.S. equity markets in a risk-off environment. Funds in Morningstar’s Multisector Bond category at the end of 2017’s third quarter had an average of 36% of investments allocated to the high-yield sector, resulting in a correlation to equities of 0.63 over the past three years (the closer an investment’s correlation to equities is to one, the more correlated it is to equities).

When an equity correction or other risk-off event occurs, such as the one we’ve recently seen, fixed income funds highly correlated to stocks could experience steep losses. Over such periods, a true core bond fund, like the Bond Fund of America® (BFA), strived to provide income while maintaining a low correlation to U.S. equity markets. This enables investors to rebalance back into equities and maintain their asset allocation discipline.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Our latest insights

-

-

Market Volatility

-

-

Artificial Intelligence

-

Interest Rates

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Luke Farrell

Luke Farrell