Market Volatility

Bonds

- High-quality corporate bonds are a core bond strategy.

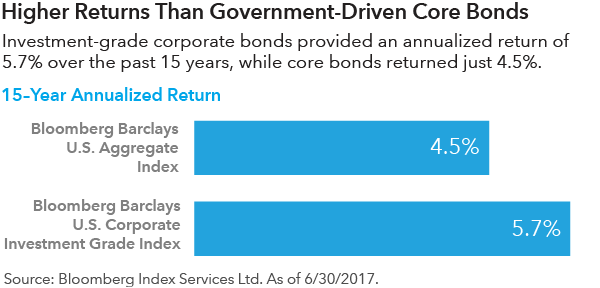

- They can provide more income than government-backed bonds.

- Research-driven corporate bond funds have advantages.

In the recent market rally that has been characterized by a risk-on sentiment across most asset classes, investors have gravitated to high yield and leveraged bank loans or income strategies with a heavy allocation to these extended sectors of the market. As we approach the late stages of this market rally, we think it is appropriate for investors to take a fresh look at their credit exposure.

The role of corporate bonds in a portfolio

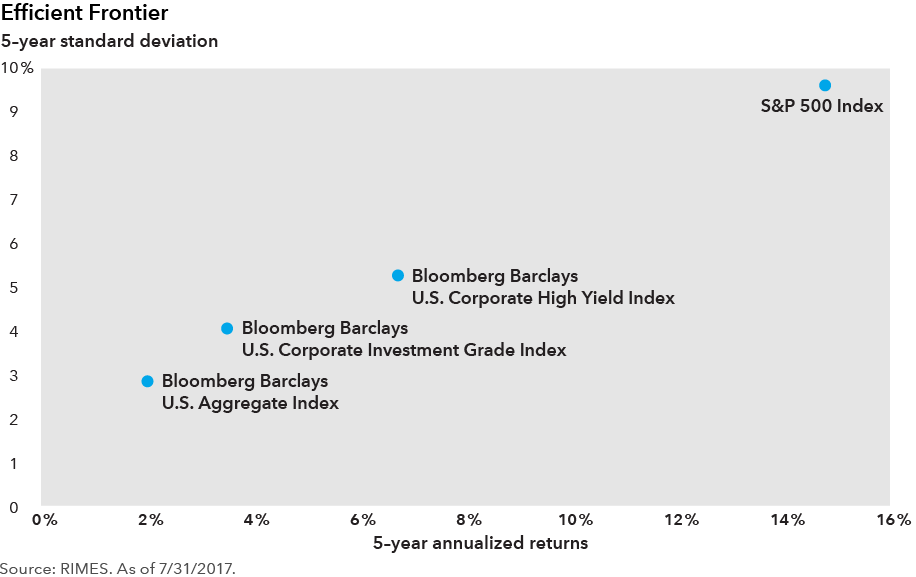

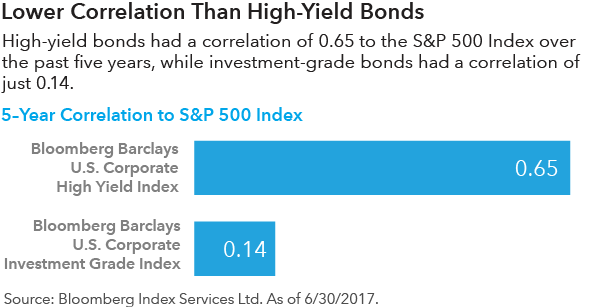

We believe that investment-grade corporate bonds provide an attractive risk-return trade-off as a core bond fund allocation. On a long-term, secular basis, prudently managed corporate bond funds can play an important role in portfolios. Corporate bonds have historically provided income, diversification from equity holdings, as well as principal preservation.

The relationship between return and volatility can be illustrated through an efficient frontier chart. Although investors can tack on higher average returns with asset classes like high yield or emerging markets, these bonds make for poor portfolio stabilizers when economic shocks hit.

The research advantage

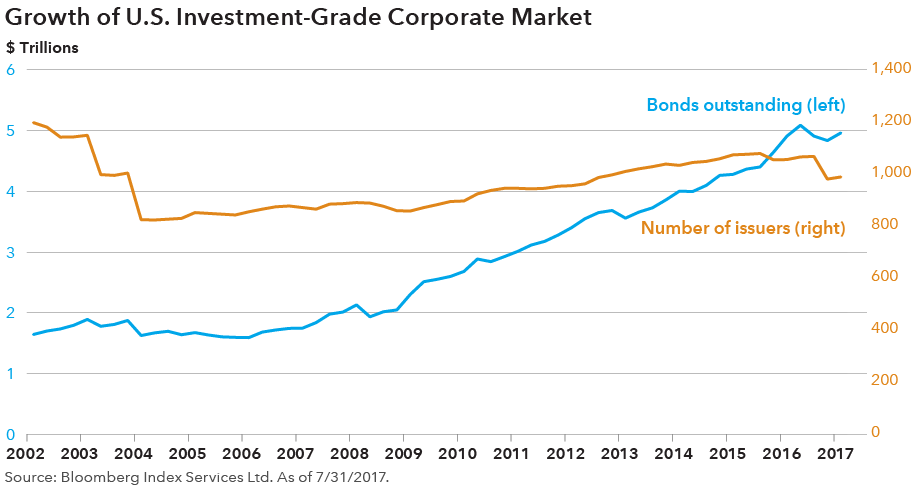

U.S. investment-grade corporate bonds are historically an under-researched asset class. This provides an opportunity for managers like Capital Group who use deep fundamental research. The IG corporate market has matured and become much more liquid, with a market capitalization of $5 trillion and over 1,000 issuers. This allows investors to build well-rounded, diversified corporate bond portfolios.

But that is highly dependent on strong credit selection. While credit quality is high across the asset class, a dispersion of returns occurs across issuers, sectors and ratings. Managers assessing individual securities can take advantage of this dispersion to identify the most attractive investment opportunities on a risk-adjusted basis.

Passive pitfalls

In contrast, since fixed income indices are market-value based, the most indebted issuers within each asset class are the most heavily weighted issuers. Thus, relying on passive index-based strategies means that investors are more exposed to the market’s most indebted issuers. Managers assessing individual issuers can avoid this passive pitfall by investing in debt that provides adequate risk-based returns based on issuers’ capital structures, and can capitalize on relative value opportunities they identify in the market.

Passive strategies also require new issuance to be included in the index, while managers can invest selectively based upon an issuer’s merits. Passive index-based strategies must rebalance based upon changes in market valuations, potentially requiring buying when prices are high or selling when prices are low; in contrast, managers who rely on research, buy and sell based on relative value.

U.S. IG bonds are a core asset class, providing income, diversification from equity and principal preservation. Long-term investors to the asset class have the potential to receive higher income than a government bond-driven core fund, and are less exposed to volatility than they would be in a high-yield focused multisector bond fund. An allocation to an IG corporate bond fund can improve the risk and return profiles of investors’ broader investment portfolios.

Past results are not predictive of results in future periods.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

Market Volatility

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

David Bradin

David Bradin