Market Volatility

Asset Allocation

- Low quality intermediate bond funds have been strong.

- But these funds have relatively high equity correlations.

- This may amplify total portfolio losses when stocks plunge.

- This group hasn’t outpaced high quality peers longer term.

- With credit spreads tight, diversifying equities is vital.

Investors have traditionally considered fixed income to be the stable part of their asset allocation, emphasizing high-quality government and investment-grade bonds. But as interest rates fell steadily in the aftermath of the 2008 financial crisis, many investors turned to funds emphasizing lower quality investment-grade corporate (BBB/Baa and above) and high-yield (BB/Ba and below) bonds in order to boost income. While these strategies provide higher yields and have delivered attractive returns in recent years, they also generally move in greater lockstep with equity markets.

So how should investors balance these competing objectives of income and diversification? And more generally, what is the appropriate role of bonds in a client’s portfolio?

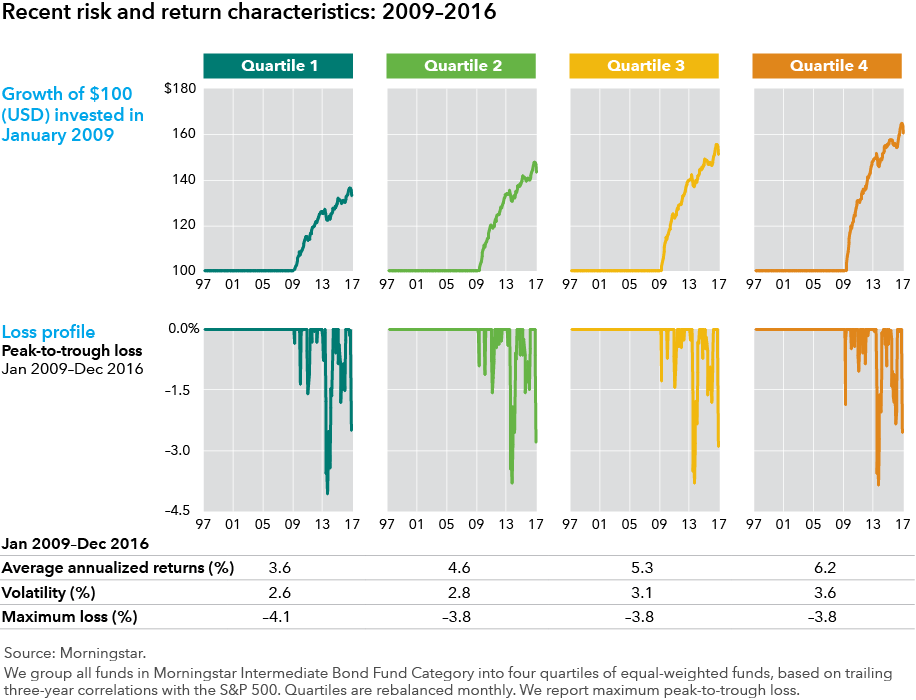

Historical data provides some context. For our analysis here, we have sorted the universe of funds in the Morningstar Intermediate Bond Category into four equal quartiles, which are rebalanced monthly based on trailing three-year correlation with the Standard & Poor’s 500 Composite Index. The top quartile also includes the highest quality bond funds with an average correlation of -0.05 to equities and less than 3% invested in high-yield bonds. In contrast, the fourth quartile includes the lowest quality bond funds with an average equity correlation of 0.42 and almost 12% in non-investment grade bonds.

The results for low-credit-quality intermediate bond funds (Quartile 4) have been quite impressive since the financial crisis. These highest quartile funds (Quartile 4) have outperformed the first- and second-quartile funds by an average of 2.6% and 1.6% (annualized) respectively, from 2009 to 2016. In 2013, when news of the Federal Reserve tapering its bond purchases roiled fixed income markets, the highest quartile funds lost only 3.8%, compared to 4.1% for the higher credit quality funds (Quartile 1). In this environment, where the potential for a rise in interest rates was the main market concern, exposure to credit helped to effectively diversify interest rate risk.

All that glitters is not gold.

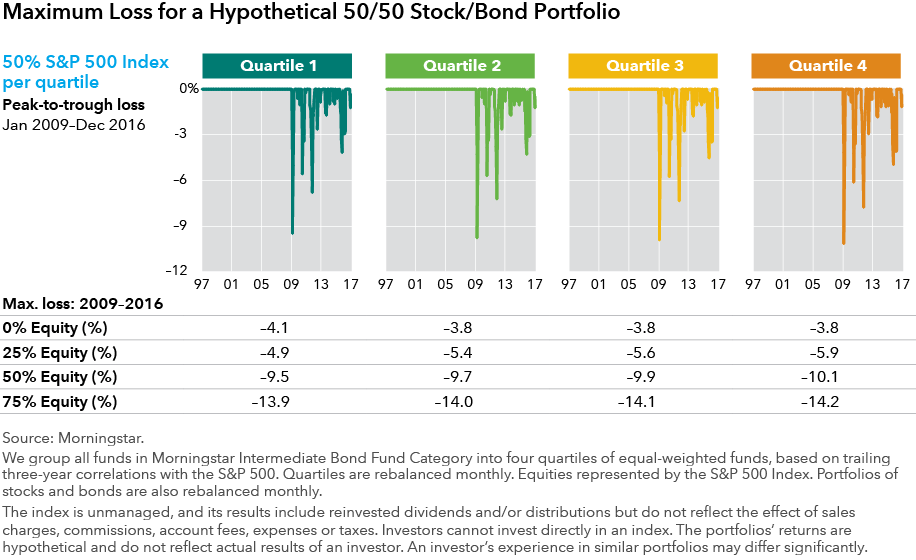

While recent results have been compelling, several considerations suggest caution. First, while credit-heavy bond funds can mitigate interest rate shocks, potential losses from adverse equity markets can dwarf the impact of rising interest rates, as illustrated below.

For a typical portfolio with at least 50% in equities, the 2013 period was a mere blip in terms of market stress. Instead, the periods with most stress were at the end of the financial crisis in early 2009, during the discussions about a potential downgrade of U.S. sovereign debt in 2011, and when crude oil declined precipitously in 2015. During these longer and more significant stress periods, the credit-heavy intermediate bond funds experienced larger losses than their high-quality counterparts, amplifying total portfolio risk. In fact, portfolios ranging from 25% to 75% equities would have all experienced their largest losses if their fixed income portfolio was invested in the lowest credit-quality, bottom-quartile funds.

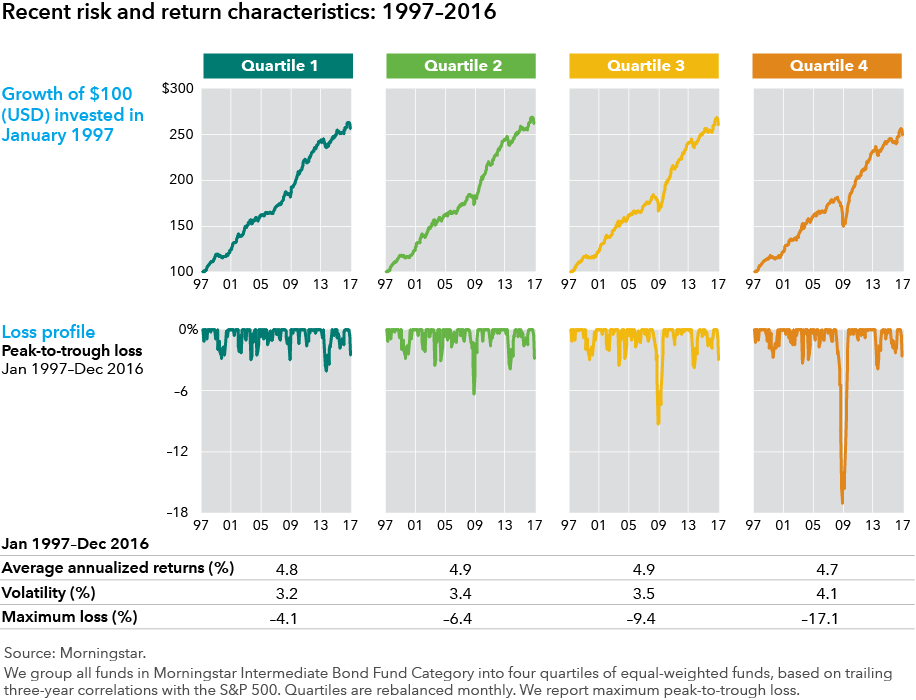

Second, while it is tempting to extrapolate from the post-crisis period, it does not represent a full market cycle. The results look markedly different if we roll back the clock 20 years, as shown in the charts below. While lower quality, bottom-quartile funds provided a relatively smooth ride during the U.S. economic recovery, they were anything but placid in the preceding years. Bottom-quartile funds lost 17% during the financial crisis and had 12-month losses in 29 episodes since 1997. In contrast, high-quality, top-quartile funds would have lost just 4% and had only 22 episodes of 12-month losses.

This illustrates a general principle: in periods of market stress, the prospect of higher defaults and lower recovery rates can widen credit spreads in low-quality bonds, while at the same time being subject to much lower liquidity. These factors expose lower quality intermediate bond funds to significant event risk and can result in large losses.

Crucially, periods of significant losses wiped out accumulated gains from lower quality funds. Over the last 20 years, bottom-quartile funds underperformed the other three quartiles despite having the highest yields and highest volatility. These findings are not merely confined to recent history. Cornell and Green (1991)* studied bond fund results from 1960 to 1989 and found that low-quality funds offered little excess return, as market corrections substantially eroded the yield advantage from these funds. Skillful managers may add value; however in aggregate, lower quality and credit-heavy intermediate bond managers may simply be picking up pennies in front of the proverbial steam roller.

Bond funds should behave like bond funds.

These findings illustrate the critical role that bond strategies must play in providing diversification and risk mitigation at the total portfolio level. Investors should seek to monitor their fixed income funds’ correlations to equities and remain vigilant against bond funds that start to behave more like equities. Investors may feel tempted to reach for income, but funds that do so regularly through lower quality securities face a higher hurdle for success. Advisors should seek to evaluate the sources of returns from their investments. Portfolio managers who can generate additional returns through interest rate risk management and investment-grade issuer selection can play a larger role in client portfolios.

In our view, fixed income portfolios fulfill four roles in an investment program – equity diversification, income, capital preservation and inflation protection. It is important to have a well-rounded fixed income program that includes strategies that satisfy all these four goals. Focusing just on income at the cost of equity diversification and capital preservation, can create unintended risks both at the strategy and the asset allocation levels.

These findings may be especially relevant today. Credit spreads have tightened significantly since the end of the crisis. At the same time, bond covenants have loosened. As a result, investments in high-yield and lower quality, investment-grade credits could face sharp losses in the next equity market correction. Before that storm hits, investors may consider moving into bond funds that behave like bond funds.

*Cornell, Bradford, and Kevin Green, 1991, The investment performance of low-grade bond funds, Journal of Finance 46, 29–48

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch, as an indication of an issuer’s creditworthiness.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

© 2017 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Market Volatility

-

-

Artificial Intelligence

-

Interest Rates

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Sunder Ramkumar

Sunder Ramkumar

Vincent Fu

Vincent Fu