Market Volatility

Risk

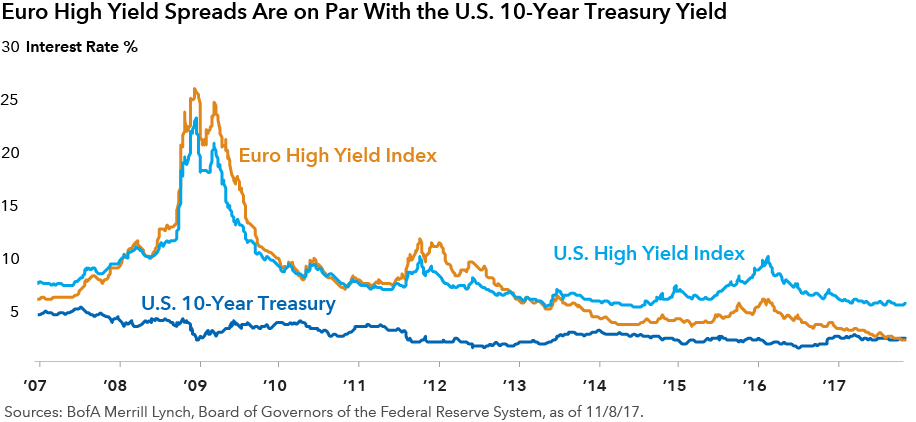

The financial crisis that occurred a decade ago continues to impact markets. Some distortions across both equity and bond markets have warranted new or different approaches to investing. Ultra-low interest rates across developed markets have spurred investors to expand their horizon for newer — and riskier — sources of income investments. In the bond market, that thirst for yield may be exposing some investors to excessive credit risk. One sign of this: the interest rates on euro-zone high-yield bonds have fallen to the point where they are on par with the U.S. 10-year Treasury yield, which is traditionally considered a “risk-free” rate due to the U.S. government’s high credit quality. While rates on U.S. high-yield bonds are higher than Treasuries, the low level of euro high yields does raise concerns that investors might be reaching too far out on the risk spectrum for income. Searching for yield and taking on excess risk for such little reward could leave investors exposed and unprepared for a more difficult financial market. Selecting fixed income investments based on in-depth research and appropriate risk evaluation will likely be key to preserving capital during a market downturn.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.