Artificial Intelligence

Twenty-five years ago in March, the tech-heavy Nasdaq Composite reached its peak, marking the bursting of the dot-com bubble. Investors may have this on their minds as many leading artificial intelligence stocks have run into a wall.

Will the AI revolution be a repeat history lesson of the dot-com period?

So far in 2025, five of the so-called Magnificent Seven tech stocks that have invested aggressively in AI — Apple, Microsoft, NVIDIA, Amazon and Alphabet — declined, lagging the broader S&P 500 Index through March 25.

Two developments have caused investors to question the wisdom of spending billions to build out data centers: news that Chinese firm DeepSeek developed a less expensive AI model and Microsoft’s disclosure that it will be pumping the brakes on some data center projects. A third concern is the broader market volatility brought on by tariffs imposed by the Trump administration.

Although these are important considerations for investors, surprise twists are inevitable in the development of any emerging technology, according to U.S. economist Jared Franz.

"Alternating periods of excitement and disappointment are common with new technologies,” Franz explains. “What is different with AI is that it is happening so rapidly. New models are rolled out every two weeks. Investors should expect more surprises. But over the long term, make no mistake: AI will have a profound impact on the economy and everything we do.”

Indeed, the build-out of the technology has transformed the American economic landscape, bolstering regions of the country left behind by the digital economy and driving opportunity for businesses outside the tech sphere. Here are four factors to consider when evaluating AI’s impact and how investment opportunity may be evolving.

1. AI is transforming the American heartland

Although the stocks may be volatile, the companies continue to spend aggressively, as is evident from the view on the ground.

American made: AI is transforming the U.S. economic landscape

Sources: Capital Group, DataCenterMap.com. Primary markets refer to data center locations with large energy demands in excess of roughly 800 megawatts; secondary markets refer to locations with relatively smaller energy demand but typically higher growth; tertiary markets refer to newer markets where hyperscaler companies may be able to source more affordable or cleaner energy with negligible colocation presence. As of February 2025.

The AI revolution has shifted from a cloud story rooted in Silicon Valley and other tech hubs to a story of reindustrialization and economic transformation across the Midwest, southwest and mid-Atlantic. The search for locations with enough land, access to plentiful power resources and skilled labor has led to staggering levels of construction in Arizona, Texas, Louisiana, Ohio and a host of other states.

Take, for example, Columbus, Ohio, a beneficiary of the AI boom with more than 40 data centers on more than 3,600 acres in suburban New Albany. All of the Magnificent Seven companies have data centers in New Albany, and Intel is building a $28 billion semiconductor manufacturing facility in the same business park.

“I learned early in my career that you can't really appreciate a 10% growth rate until you see it with your own eyes, so we wanted to see what these tens of billions of dollars of investment looked like,” says Capital Group accounting analyst Dane Mott, who led a team of economists and political analysts to Columbus in late 2024. “What we saw were cranes all over the skies, heavy trucks full of dirt on the highways and construction everywhere you looked.

“It reminds me of my trips to China 20 years ago,” Mott says. “These large swaths of former farmland and open skies are transforming seemingly before our eyes,” he adds.

Such projects around the country are driving demand not only for advanced semiconductors and other core technologies, but also power, electrical equipment, cooling systems, land and skilled labor.

2. Demand is shifting, not slowing

In light of February reports that Microsoft is canceling plans for some data centers, could this represent a peak for the AI build-out?

“I would say demand is shifting. Aggregate demand has not really changed across the industrial value chain,” says investment analyst Nate Burggraf, who covers U.S. industrial companies that support data center construction. “It continues to outrun supply across power sources, electrical equipment, HVAC (heating, ventilation and air conditioning) and labor.”

Microsoft has said its plans to invest $80 billion in data centers in 2025 remain unchanged, and other hyperscalers continue to invest aggressively. Database giant Oracle and Japanese tech investor Softbank are joining with OpenAI to build campuses, and Meta has disclosed plans for a $10 billion, 2.2 gigawatt data center in northeast Louisiana.

The Microsoft news does appear to signal a shift in focus on the types of AI investments they are making, Burggraf explains. There are two types of AI workloads: training models, which are the primary engines of AI, and inference models, which generally require smaller, more regional data centers with different computing and power needs.

Then there is the breakthrough by DeepSeek, which relates to AI training workloads developed more cheaply using less advanced chips. Although the news has not dissuaded hyperscalers from spending aggressively, more efficient data centers will likely have implications for industrial companies across the value chain.

“These dynamics could dampen the order growth and pricing power of some of the suppliers of cooling and electrical equipment, for example,” Burggraf adds. “So investors need to be selective going forward.”

3. Follow the bottlenecks

What are the primary areas of investment across the data center supply chain?

The data centers that form the backbone of AI and the broader digital economy are not uniform in design. They can range from 200,000 to one million square feet and can cost billions of dollars to build, much of which is dedicated to technology, including servers and a massive amount of semiconductors. They must have access to a great deal of power as AI equipment consumes seven or eight times the energy required for cloud and other less intensive computing needs.

Where AI infrastructure money is spent

Sources: Capital Group, DgtlInfra.com. Dollar figures are based on estimated costs per square foot and may not correspond directly to category percentages. Actual build costs vary widely based on location and specific data center requirements. Square footage estimates from DgtlInfra.com as of November 2023.

Data centers also require millions of dollars invested in land, electrical systems that include generators, transformers and switchgears, as well as cooling equipment to prevent the servers from overheating.

The unprecedented demand for data servers over the past two years has triggered bottlenecks. Quickly identifying those bottlenecks and companies positioned to relieve them could benefit investors. “A year ago, there were bottlenecks at every point on the supply chain,” Burggraf says. “But some have slackened a bit faster than others.”

In the case of HVAC equipment, for example, demand continues to outpace supply, but the situation is improving, and lead times have reduced a bit. HVAC manufacturers like Carrier Global, AAON and Modine Manufacturing have all disclosed plans to invest in manufacturing capacity. “Similarly, lead times for orders of electrical equipment — transformers, switchgear to protect servers — have improved but demand continues to outstrip supply,” Burggraf explains.

Two areas that continue to have acute bottlenecks are power generation and labor. Wait times to be connected to the power grid have risen as high as six years in some areas, Burggraf notes. GE Vernova, for example, has said its backlog for heavy duty gas turbines stretches to 2029. The company also makes smaller turbines that can be used in smaller regional data centers, as do competitors like Caterpillar and Cummins.

With regard to skilled labor, companies like Comfort Systems and Quanta Services are expanding headcounts for technicians who can install HVAC and electrical equipment and build transmission and distribution systems.

4. Overinvestment is a feature of innovation

DeepSeek’s breakthrough sent shockwaves across the AI landscape and caused investors to ask: Is this level of spending necessary or prudent? The tech giants investing aggressively in pursuit of AI dominance certainly have the resources to continue spending. And as the technology evolves and competitive landscape shifts, the likelihood of overinvestment is pretty high, Franz says.

“It is important to remember that overinvesting is a feature, not a bug, of any major advance in technology,” he says. At some point the companies will shift their focus to investing more efficiently. To be sure, over the longer term there will be winners and losers in the race to dominate AI. But any excesses are unlikely to result in a Global Crossing, the dot-com telecommunications company that invested heavily in telecom infrastructure before filing for bankruptcy. Unlike Global Crossing, which never turned a profit, today’s tech hyperscalers generate healthy earnings and free cash flow. However, investors shouldn’t be surprised to see another Cisco Systems, which in March 2000 was the most valuable company in the world. While today Cisco Systems is recognized as a key contributor to internet and cloud infrastructure, the company has yet to return to its March 2000 market capitalization peak. The bottom line: Valuation is an important consideration even when investing in great companies.

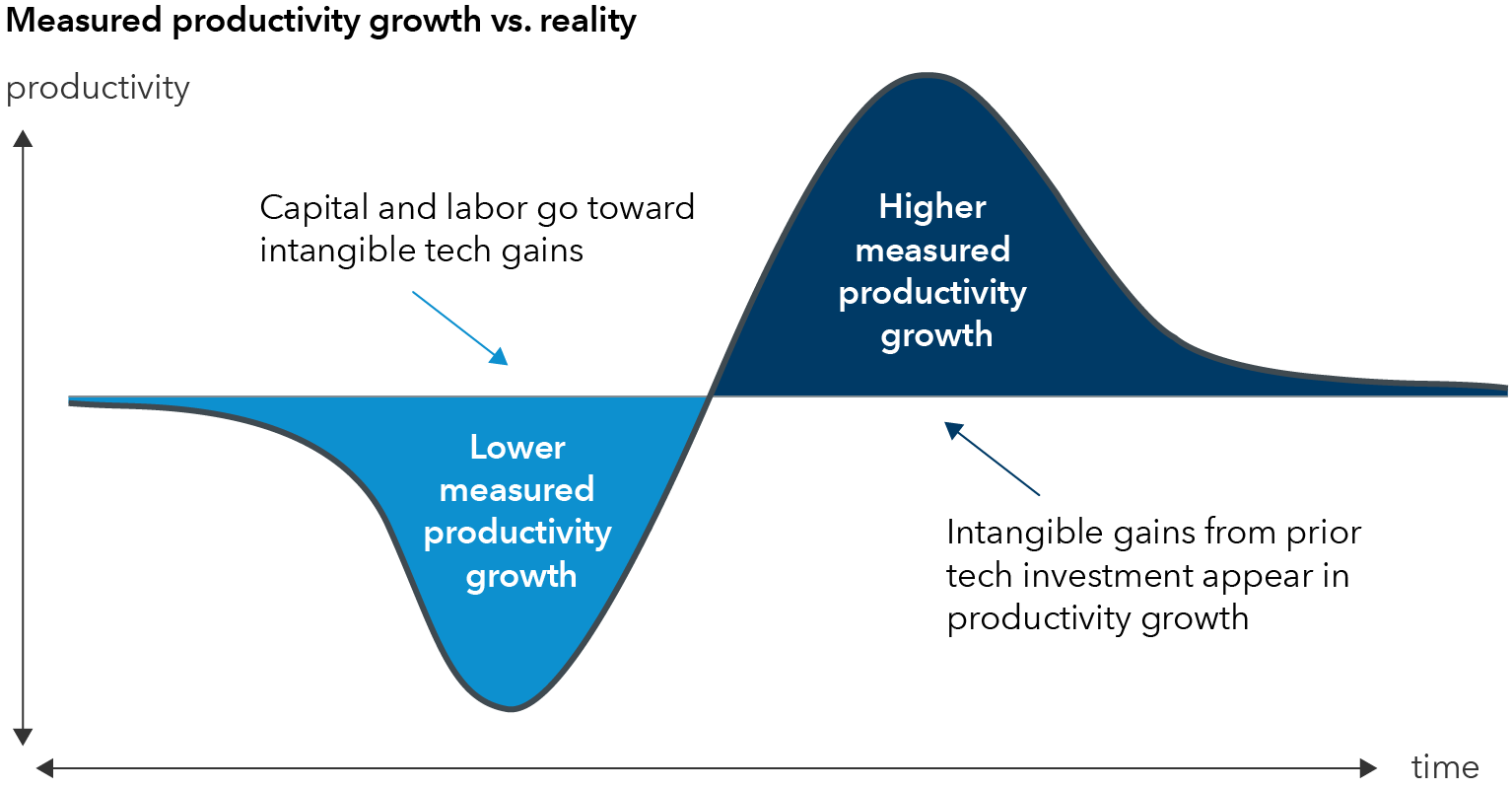

Productivity gains from new technologies often take years to surface

Sources: Capital Group, MIT Initiative on the Digital Economy. The productivity J-curve illustration shows the lag effect that the introduction of new technology can have on total factor productivity (TFP). TFP is measured as the change in aggregate economic output that is not associated with changes in either capital or labor input and approximates the impact of technology change.

Finally, although the rush to build out AI infrastructure has proceeded at lightning speed, adoption of AI tools at the enterprise level has been slow. “Adapting to technologies takes time as users learn new processes,” adds Franz. “The economic benefits may not be evident for years.”

Artificial intelligence has the potential to evolve into a general purpose technology with implications far beyond the tech, energy and industrial sectors. “I believe it’s going to have a profound impact on everything we do in the next decade,” Franz concludes.

The same could also be said for AI’s impact on investors.

Hyperscalers are large-scale cloud service providers that offer computing power and storage to organizations and individuals globally.

The Magnificent Seven refers to seven large U.S. technology companies — Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla — that represent a large proportion of the S&P 500 Index.

Switchgear is a centralized collection of circuit breakers, fuses and switches (circuit protection devices) that function to protect, control and isolate electrical equipment.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Emerging Markets

-

Global Equities

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Nathaniel Burggraf

Nathaniel Burggraf

Jared Franz

Jared Franz

Dane Mott

Dane Mott