Bonds

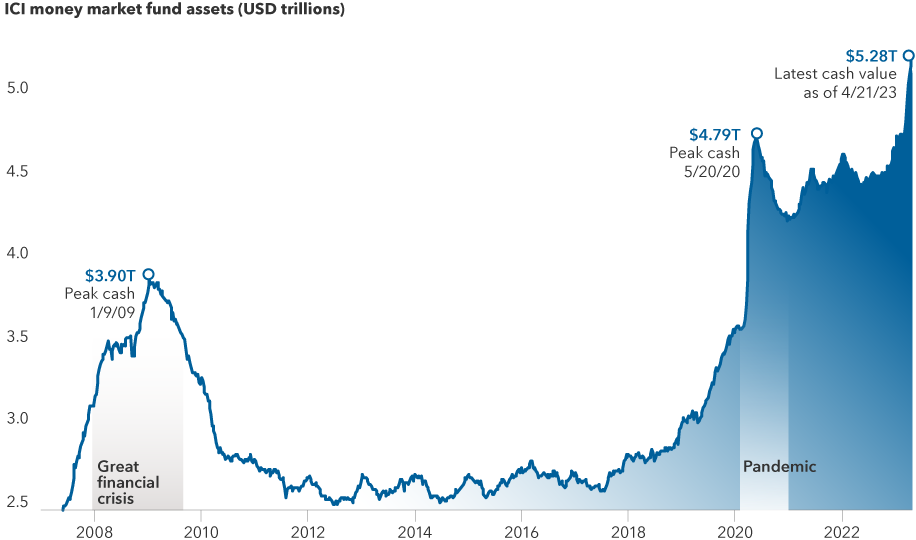

With the Federal Reserve’s rate hikes potentially over, this year is already shaping up to be a favorable one for fixed income returns following a dismal 2022. Investors who rushed for the exits last year, sending money market fund levels soaring to $5.2 trillion, may be wondering if it’s time to retrace their steps.

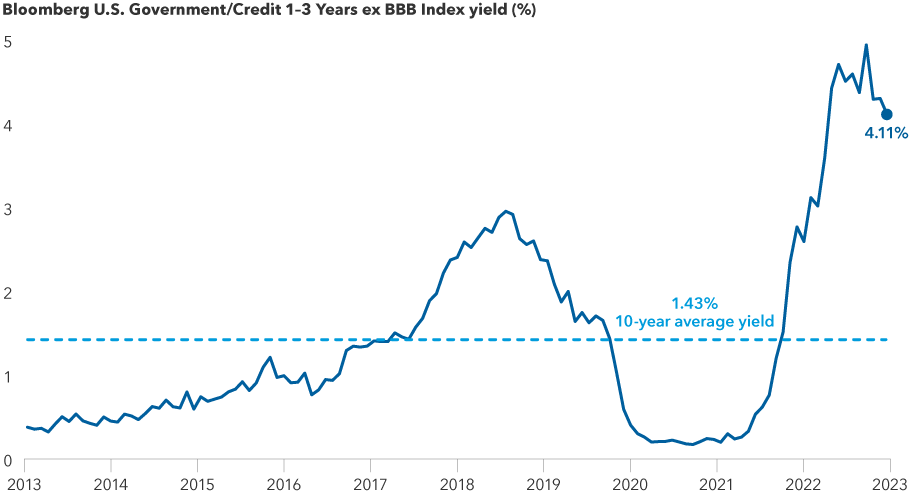

At the same time, last year’s painful market reset may have held a silver lining. Short-term bond yields have risen from near rock-bottom levels. They touched their highest figures in more than 15 years and remain compelling at an average of around 4% in early May. In certain parts of the market, high-quality AAA-rated bonds are yielding in the range of 5% to 6%, helping to provide attractive income as well as some cushion against further potential volatility.

“Starting valuations are one of the most attractive parts of today's short-term bond market,” says Vince Gonzales, fixed income portfolio manager for Short-Term Bond Fund of America® and Capital Group Short Duration Income ETF. “There's a lot of incremental value compared to what you can get in cash-like investments, with some additional risk.”

Investors have flocked to cash, driving up money market fund holdings

Sources: Capital Group, Bloomberg Index Services Ltd., Investment Company Institute (ICI). Data as of April 21, 2023.

The Federal Reserve raised interest rates by 0.25 percentage points in early May, a continued slowdown from its pace of rate increases in 2022 and one which many Fed watchers predict may be its last. As the Fed nears a possible pause or pivot, the market may be hitting an inflection point.

“Whenever you think about the end of a rate hiking cycle and the potential beginning of a cutting cycle, the front end of the Treasury curve has tended to be the most sensitive,” Gonzales says. “That presents opportunities for positioning in rates and in credit.”

What goes up, must come down

A big question facing investors is just how long short-term bond yields may remain at historically high levels.

While yields fell somewhat after the Silicon Valley Bank collapse, there is still potential for them to tick higher given the strength of the U.S. economy, which could hinder a Fed pivot. John Queen, fixed income portfolio manager for Intermediate Bond Fund of America®, notes that market players have largely split into two camps over whether the Fed has accomplished its mission of taming high inflation.

“Every time we get a new report that supports one camp or the other, you see significant volatility in the market,” Queen says. “That makes short-term bonds really interesting, where you’re getting a higher yield for longer than expected and you’re also a little more protected amidst the volatility.” He adds that shorter term bonds have lower duration, a measure of interest rate risk, compared with longer term bond strategies.

Short-term bond yields hit highest levels in more than a decade this year

Source: Bloomberg. Yields shown are yield to worst. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. Average yield calculated using data from January 2013 to May 2023. Data as of May 4, 2023.

Two-year Treasuries are currently yielding about 0.48 percentage points more than 10-year Treasuries, a phenomenon known as a yield curve inversion that’s a common precursor to a recession. For comparison, 10-year Treasuries have yielded, on average, about 1.2 percentage points more than two-year Treasuries over the past two decades. A meaningful decline in short-term yields may occur if the yield curve reverts to its typical positive slope. These inversions typically unwind sometime after the Fed’s final rate hike.

“If inflation remains stickier than expected and the economy holds up, then we may be in for higher rates than the market’s currently pricing in,” Queen says. “My view is that rates will stay higher longer than market consensus, and the curve will probably stay inverted longer as well.”

If inflation remains sticky, the Fed may have less runway to raise rates compared to 2022 given troubles in the banking sector and concerns over a recession. Still, if rates drift higher, the higher income potential from higher starting yields would be a strong offset to any adverse price movements. If rates remain at these higher levels for longer, that could provide a longer horizon to earn attractive income.

To be sure, the market expects rates to fall somewhat but potentially remain at much higher yields than in the recent past. This presents the possibility of not just price appreciation but also compelling income to continue in the near term.

Markets anticipate the two-year Treasury yield will decline but remain elevated

Source: Bloomberg. Average yield calculated using data from May 2013 to May 2023. Data as of May 4, 2023.

Some investors may be tempted to time their reentry to the market, watching inflation reports and the Fed for an all-clear signal. But they may find that they miss a market rebound.

“As information emerges on the direction of the economy, the market moves very, very quickly to incorporate that data,” Queen explains. “By the time there's clarity, the market may have already moved.”

For those investors that remain concerned about timing, dollar cost averaging (the practice of investing a fixed dollar amount on a regular basis, regardless of the share price) may provide an attractive way to reenter the market and pursue higher total return opportunities compared with cash or cash-like investments, depending on investment objectives and tolerance for greater risk.

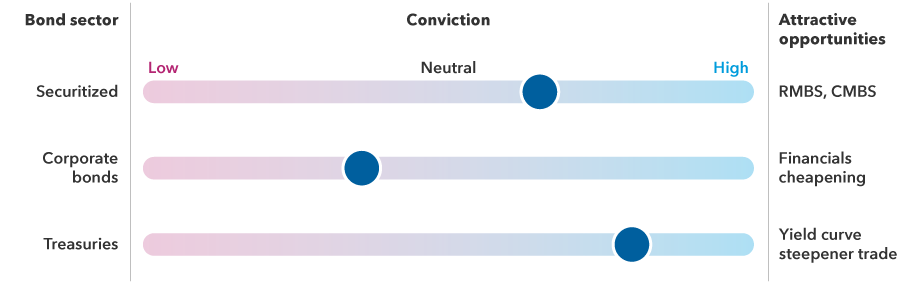

A deeply negative yield curve may already be offering opportunity. Some of Queen’s portfolios indicate a high conviction that the yield curve will steepen (meaning short-term yields fall and/or long-term yields rise). This strategy involves a portfolio taking more exposure than its benchmark index to shorter term Treasuries with the expectation that these yields will decline and the value of the bonds will rise. This is then paired with lower exposure to longer term Treasuries, with the expectation that those yields will drift higher.

Queen noted that he’s hedged this steepener trade with a shorter duration position, relative to benchmark indices. In a falling rate environment, the steepener position will likely notch gains while the duration position may incur relative losses. The opposite would be true in a rising rate environment.

“I think both will work out positively over time,” Queen explains. “But in the short run, they're balancing each other out.”

Hunting for opportunities in short-term bonds

The short-term debt universe has breadth, ranging from Treasuries to corporate bonds and securitized debt. Investors receive a risk premium, or spread, on top of comparable Treasury yields when investing in sectors like corporates and asset-backed securities. Spreads are currently at attractive levels near or above their long-term averages.

“It presents so many different opportunities and types of high-quality credit exposures that you can construct within a portfolio,” Gonzales says. “We think the potential is there to amplify returns in terms of sector allocation and security selection.”

To be sure, a darkening outlook for the economic environment calls for discretion.

“We're still cautious on the outlook for credit over the next six to 12 months,” Gonzales adds. “We think there’s potential for continued volatility and further spread widening as the economy is likely to face headwinds and possibly slide into recession. It highlights the importance of focusing on sectors that have been resilient and avoiding areas that have deteriorating credit profiles.”

Gonzales is finding opportunity in securitized debt, especially in the residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS) markets that have underperformed the broader market year to date. He also sees value in high-quality consumer-oriented areas of the market such as auto asset-backed securities (ABS), and areas with resilient cash flows, such as securities linked to mobile phone contracts.

“Everyone's talking about how attractive money market funds are, but you're able to buy very high-quality securities — not just from a rating standpoint but from an underlying credit structure standpoint — at yields that are about 1.5 to 2 percentage points in excess of what money market funds currently offer,” Gonzales says. “I think it really highlights the value proposition of targeting an attractive yield on a very high-quality short-duration portfolio.”

Opportunities within sector and security selection

Source: Capital Group. Based on Vince Gonzales’ market view.

In RMBS, the market is now more appropriately pricing in the risk of a continued decline in home values. Rate volatility has started to decline, unlocking opportunity in sectors where there’s greater clarity on prepayment variability and cash flows. Attractive areas include reperforming loan (RPL) deals, where previously delinquent loans have returned to performing status and borrower leverage levels are meaningfully lower than newly originated loans following several years of home price appreciation.

The CMBS market presents both risks and opportunities, with high-quality AAA-rated bonds providing attractive spreads at low leverage levels, according to Gonzales. Some property types, such as industrial warehouses, are riding high on the back of stable long-term leases and strong occupancy levels. Meanwhile, others have faltered due to the pandemic. Office real estate, particularly older buildings and those with fewer amenities, are under well-documented strain due to the negative impacts of remote work. Deteriorating office fundamentals may not yet be fully priced into the market, and investors may want to tread carefully.

In corporate bonds, where high-rated, short-term issuance is concentrated in the financial sector, opportunities are emerging as bonds have cheapened on the heels of banking industry turmoil.

“We definitely have a fair amount of room to add within financials where we see opportunities,” Gonzales says, adding that higher quality, more liquid areas of the market, such as big U.S. money center banks, are starting to look attractive.

Opting for a smoother ride

Whether it’s the path of interest rates, a potential recession or geopolitical risks, investors are parsing numerous variables in determining their next moves.

“As we think about all the uncertainties, it makes sense to remind ourselves of why we buy bonds in the first place,” Queen says. He offers the analogy of heading on a long distance road trip and opting to drive a sensible sedan over a fast but finicky race car. “We own bonds as part of a broader portfolio aiming to basically smooth the ride and lower volatility.”

When looking at the fixed income landscape, short-term bonds stand out for their attractive valuations and limited volatility, providing an attractive steppingstone from cash.

Unlike mutual fund shares, investments in U.S. Treasuries are guaranteed by the U.S. government as to the payment of principal and interest.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds). Income from municipal bonds may be subject to state or local income taxes. Certain other income, as well as capital gain distributions, may be taxable.

Bonds and other debt securities are subject to credit risk, which is the possibility that the credit strength of an issuer or guarantor will weaken or be perceived to be weaker, and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Changes in actual or perceived creditworthiness may occur quickly.

Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities.

Investments in mortgage-related securities and other asset-backed securities involve additional risks, such as prepayment risk and interest rate risks. They are also subject to the risk that underlying borrowers will be unable to meet their obligations and the value of property that secures the mortgage may decline in value and be insufficient, upon foreclosure, to repay the associated loans. Investments in asset-backed securities are subject to similar risks.

Money market funds generally invest in high-quality, short-term fixed income investments issued by the U.S. government and corporations and are subject to strict diversification and maturity standards. While money market funds are not guaranteed by the U.S. government, they seek to maintain a stable net asset value of $1 per share.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

Dollar cost averaging or regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Bloomberg U.S. Government/Credit 1–3 Years ex BBB Index is a market-value weighted index that tracks the total return results of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to three years, excluding BBB-rated securities. Results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Vince Gonzales

Vince Gonzales

John Queen

John Queen