Market Volatility

U.S. Equities

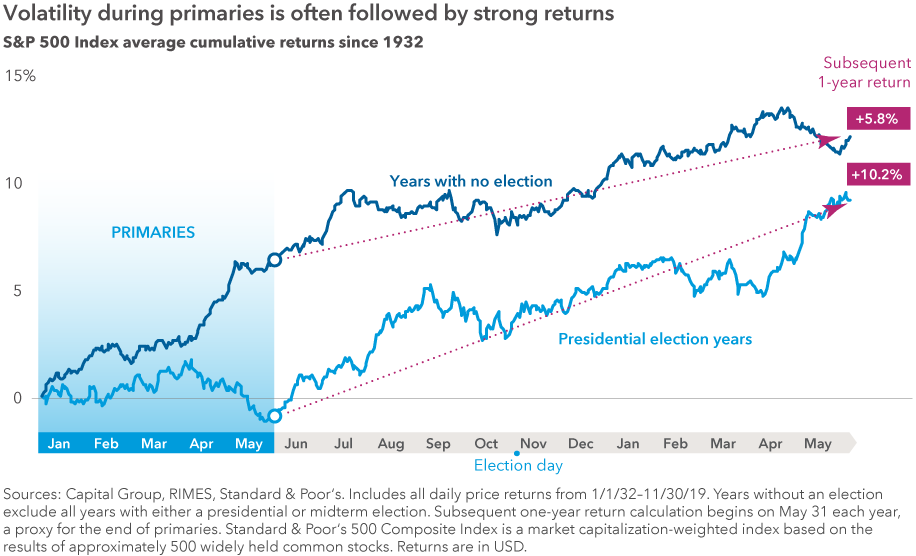

- Patient investors can do well in election years, but brace for market volatility.

- Will there be a recession in 2020? Not if a strong consumer sector holds up.

- It's not too late to prepare portfolios for rougher seas ahead.

"If voting made any difference, they wouldn't let us do it," Mark Twain once quipped. All kidding aside, as we head toward a pivotal U.S. presidential contest in November, investors may be worried that a contentious election season, or a certain outcome, could push the U.S. economy into recession and send markets into a tailspin.

But a look at history shows that presidential elections have made essentially no difference when it comes to long-term investment returns.

What has mattered is staying invested. Looking at election results back to 1932, U.S. stocks have trended up regardless of whether a Republican or a Democrat won the White House. Investors who held on for at least a year were rewarded for their patience, though they had to withstand heightened volatility during the primaries.

Election-related volatility can in fact produce select opportunities. Pharmaceutical and managed care stocks have recently come under pressure amid political criticism of private sector health insurance. That, in turn, has resulted in some attractive company valuations for investors who believe that a government takeover of the nation's health care system isn't imminent.

"Investing during an election year can be tough on your nerves," explains Capital Group portfolio manager Greg Johnson, "but it's mostly noise and the markets carry on. Long-term equity returns are determined by the value of individual companies over time. So it's better to stay invested than sit on the sidelines."

U.S. economy not immune to external headwinds

The election cycle is sure to command investors' attention throughout 2020, but by no means will it be the only concern weighing on sentiment. The damaging U.S.-China trade war, political turmoil in Europe, slowing growth abroad and other factors are contributing to a spike in uncertainty and having a tangible impact on the American economy. Growth slowed to an annualized rate of 1.9% in the third quarter of 2019, and the International Monetary Fund expects growth of 2.1% in 2020, less than full-year expectations for 2019 as of this writing.

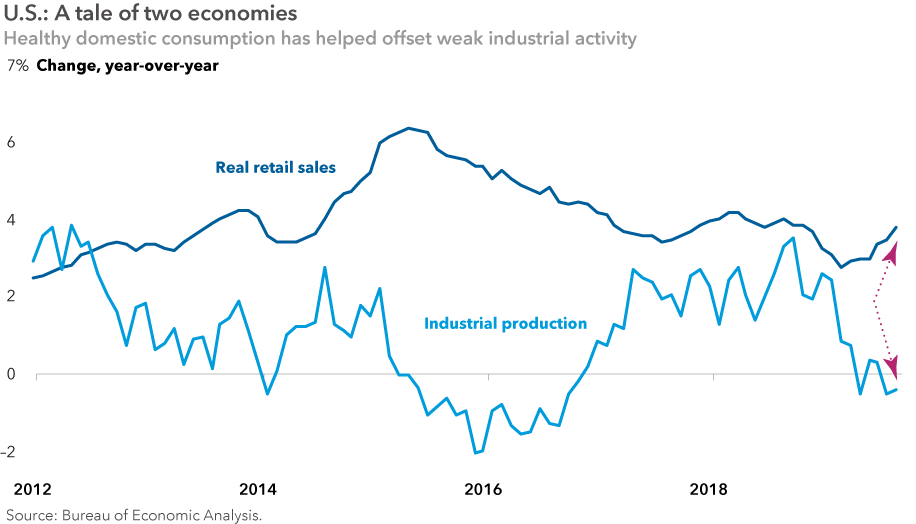

This slowdown has been felt particularly within manufacturing, which has come under pressure from tariffs imposed by the U.S. and China. U.S. industrial production declined 0.1% in September 2019, its first year-over-year decrease since 2016.

Is a recession coming in 2020?

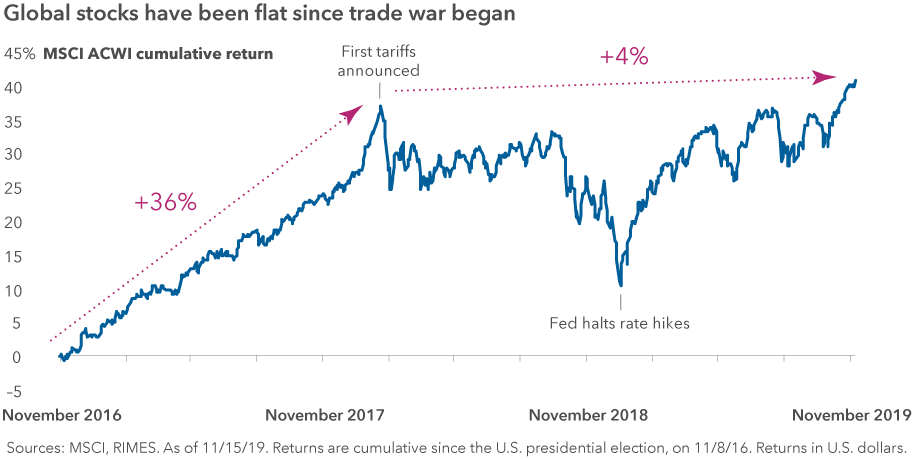

Rising tariffs and slowing growth have commanded the attention of policymakers and investors alike. Seeking to extend the cycle, the U.S. Federal Reserve reversed course on policy, halting steps to tighten monetary supply, then cutting interest rates three times in 2019. Major central banks around the world took similar action. In other words, the interest rate outlook continues on its "lower for longer" path. These steps helped global stocks remain flat since the U.S. first imposed tariffs. U.S. stock returns, as measured by the S&P 500, have been more favorable than global equity returns.

Easy monetary policy in the year ahead should provide a supportive environment for economic growth and equity prices. That doesn't mean conditions will be rosy, but it does make a U.S. or global recession unlikely in 2020, says Capital Group economist Darrell Spence. "It takes a while for interest rate cuts to have an impact," Spence explains. "The central bank actions we've seen this year won't really kick in until the first half of 2020. Whether that will be enough to offset the negative factors weighing on global growth remains to be seen."

Look for the U.S. consumer to power through

Could the slowdown in industrial output and business investment spread to the broader economy? Not likely. In the U.S., manufacturing and export activity each account for about 12% of economic output, so the impact of the trade war has been more muted than in other economies. Consumption, which accounts for more than two-thirds of the American economy, remains reasonably healthy.

Indeed, U.S. unemployment remains below 4%, wage growth has been solid and consumer spending healthy. "We are seeing a tale of two economies," says Spence. "While manufacturing has been weak, solid employment and wage gains are providing support for growth in purchasing power. If this consumer strength continues, I believe it can offset weakness elsewhere in the economy."

Furthermore, while the U.S.-China trade conflict is complex and likely to linger for years in some form, there is always a chance that more progress could be made in negotiations between the countries, boosting near-term growth and sending markets higher.

"Because global trade is so complex and there are so many elements involved, it would be very difficult to base any investment decisions on an expected outcome," says equity portfolio manager Alan Berro. "Even if trade issues put further pressure on the economy, investors should remember that smart companies are fluid and can adapt to changing circumstances. Many companies have already begun reconfiguring their supply chains, for example."

Seek opportunities to upgrade equity portfolios

Of course, when it comes to the business cycle, it's better to be early than to be wrong. Given that investors must contend with rising late-cycle conditions, election year uncertainty and slowing external growth, it's not too soon to ensure that equity portfolios are well-balanced and positioned for downturns.

To do this, many investors may shift toward so-called value-oriented investments. The problem is, the value label can be misleading: Not all value-oriented investments have acted defensively during recent periods of stock market volatility.

Playing defense? Upgrade with higher quality dividends

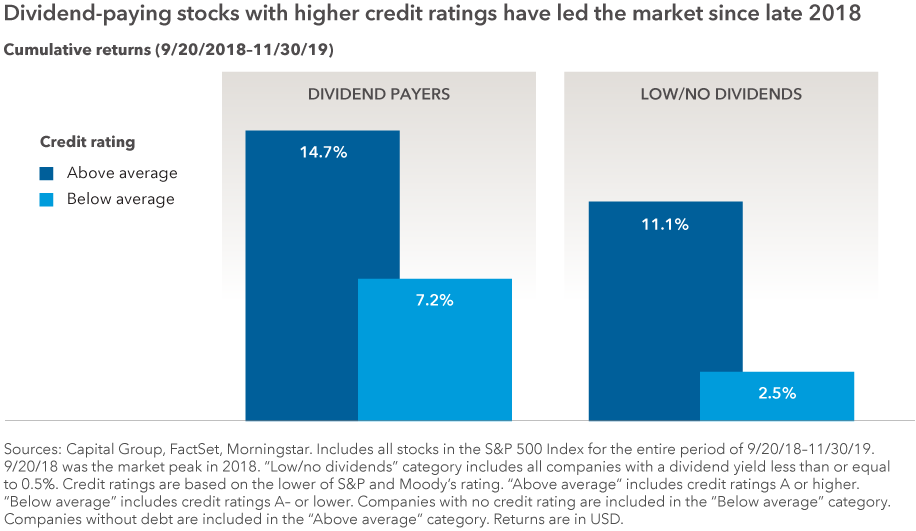

Instead, investors may want to focus on a mix of companies that can generate growth across economic cycles and companies in defensive areas of the market that can sustain dividends.

"I look for companies that can act defensively when volatility rises, but can participate if the market advances," says Joyce Gordon, a portfolio manager with four decades of investment experience. "I focus on dividend-paying companies with strong free cash flows and underlying earnings growth that have weathered previous bear markets."

Between September 20, 2018, and September 30, 2019, a period of trade-related volatility, dividend payers outpaced companies that paid little or no dividend. What's more, dividend payers with above average credit ratings outpaced those with lower credit ratings.

"I steer clear of companies that have taken on too much debt," notes Gordon. "Companies at the lower end of the investment-grade spectrum can struggle to fund themselves in a recession, increasing the risk that they might cut their dividends."

Companies with solid credit ratings that have paid meaningful dividends can be found across a range of sectors. Some examples include UnitedHealth, Microsoft, Procter and Gamble, and Home Depot.

Look for companies with pricing power

Storm clouds on the economic horizon will sometimes lead to rain, but well-managed innovative companies adapt to changing circumstances, giving them the potential to thrive regardless of the forecast.

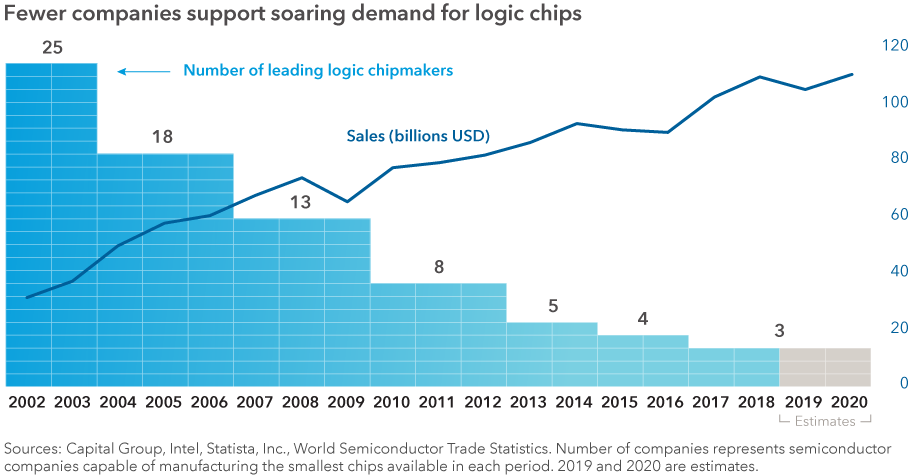

Consider semiconductors: Once an industry with dozens of competitors subject to volatile boom-and-bust cycles, today the few remaining companies that specialize in chip manufacturing, including Taiwan Semiconductor and Intel, enjoy a relatively smoother cycle.

This consolidation has helped increase pricing power, scale and profit margins as it has coincided with a robust demand for specialized chips to power smartphones and fuel advances in artificial intelligence.

"The need for these chips will expand," says equity portfolio manager Steve Watson. "And thanks to better discipline among the competitors, we have not seen prices collapse when demand has slowed. This pricing power can be even more powerful in a time of historically low rates."

Other sectors potentially benefiting from pricing power include online retail, where platform companies like Amazon can demand lower prices from suppliers and pass them on to consumers; and aerospace, where aircraft makers Boeing and Airbus are seeking to benefit from soaring demand for air travel in China and other markets around the world.

"Boeing is a company that has rightly come under severe criticism for its handling of two fatal crashes involving its 737 Max aircraft," notes Berro. "These events were tragic. But Boeing has been producing airplanes for its entire history, and they are one of only two companies worldwide building planes. They will address these problems and continue to make planes."

With millions of people in Asia boarding a plane for the first time each year, both Boeing and Airbus have backlogs totaling more than eight years of production.

For more on positioning portfolios for volatility, read: Investing ahead of a recession: 5 mistakes to avoid

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

Standard & Poor's 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. Standard & Poor's 500 Composite Index ("Index") is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

The Russell 1000® Value Index measures the performance of large-cap value segment of the U.S. equity universe. Source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2019. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

The Morningstar U.S. large value category measures the performance of large-cap value funds of the U.S. equity fund universe. ©2019 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Alan Berro

Alan Berro

Joyce Gordon

Joyce Gordon

Darrell Spence

Darrell Spence