Market Volatility

Asset Allocation

- Defensive stocks aren’t easy to define in the age of disruption.

- Traditionally defensive companies may have trouble living up to their reputation.

- Some growth-oriented stocks may display defensive characteristics.

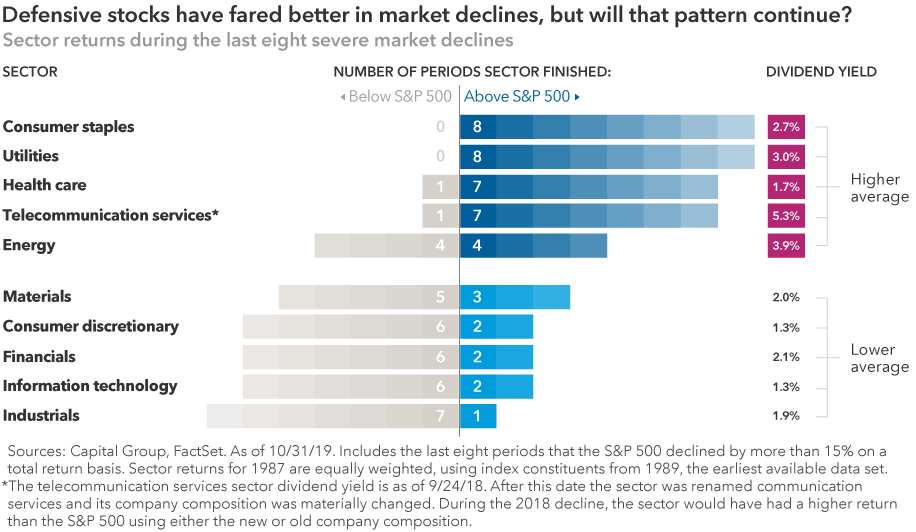

What’s a defensive stock? It’s a simple question that used to have a simple answer. In years past, defensive stocks were reliable, conservative, boring investments in the consumer staples, utilities and health care sectors. These companies generated steady cash flows, paid solid dividends and didn’t have “dot-com” in their names.

More recently, however, there’s been a discernable shift in investor views of what constitutes a defensive stock. Many businesses that were previously considered defensive — including food, tobacco and telecommunications firms — have been disrupted by technology advancements, changing consumer behavior and fierce competition in a global economy.

As investors search for defensive stocks ahead of the next recession, they may find that a broader definition is warranted.

“A defensive stock is one in which a company’s earnings and revenues have the potential to hold up fairly well during a recession,” explains Alan Wilson, a portfolio manager with The Growth Fund of America®.

“So the key question is, will the companies that have displayed defensive characteristics in the past continue to do so in the future? I’m not so sure about that,” Wilson says. “It may depend a great deal on the cause of the next downturn.”

Food for thought

For decades, food companies have been considered classic defensive investments. People need to eat, right? Indeed, during the global financial crisis in 2008–2009, some food-related companies held up relatively well compared to the overall market, including McDonald’s, Panera Bread and Walmart. But that was before the business found itself being disrupted by new entrants like Amazon, changing consumer tastes, massive consolidation and competition from online food delivery startups.

Kraft Heinz is one example of a food industry giant that stumbled as consumers increasingly embraced fresh food and organic options over processed products. In February, Kraft Heinz took a $15.4 billion write-down on the value of some of its struggling brands, which include Velveeta, Maxwell House and Miracle Whip. The company also cut its dividend by 36%.

"Traditional industries like the food business face some challenges and may not be as defensive as we once thought,” says Jonathan Knowles, a portfolio manager with New Perspective Fund®. “Like so many other industries, it’s going through a period of disruption that is altering the investment landscape.”

Is the best defense a good offense?

Knowles believes the definition of a defensive stock has changed in recent years. It may now include companies with strong earnings growth, innovative products, pricing power and the ability to shake up the status quo in established industries.

“Lots of people might disagree with me,” Knowles says, “but I would argue that a company like Google parent Alphabet has some defensive characteristics, based on its cash flow and dominant position in the internet search market.” Knowles puts Facebook in this category, as well.

These are growth-oriented companies by most measures, Knowles adds, but they may still hold up well in a sustained downturn based on their robust earnings potential, ability to innovate and relatively attractive valuations.

Examining growth companies

Defensive stocks are often associated with traditional value investing, but select growth stocks certainly shouldn’t be overlooked, adds Lisa Thompson, a portfolio manager with Capital Group.

“In some of the relatively minor market downturns we’ve seen in recent years, there are many examples of quality growth companies that have done better than the overall market,” Thompson explains. “They tend to be companies with strong management and solid balance sheets that can navigate through difficult environments.”

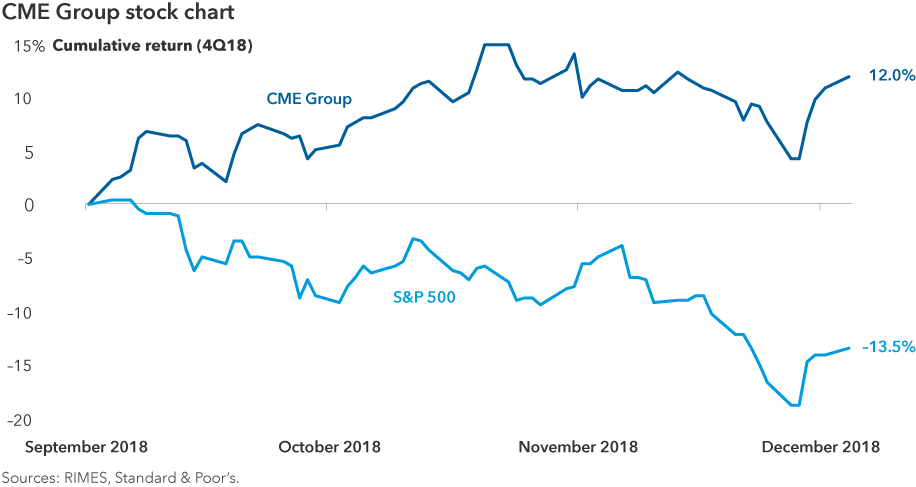

Moreover, some growth-oriented stocks can show countercyclical characteristics. One example is CME Group, the Chicago-based exchange company that facilitates trading in derivatives, options and futures. CME’s revenue has tended to rise during periods of extreme market volatility.

As trading activity increased, CME’s stock price has generally done the same — as happened in the fourth quarter of 2018 when the S&P 500 declined by nearly 14%. During that period, CME’s stock price rose 12%.

Utilities stocks may also maintain solid defensive characteristics in a downturn, provided they are run by competent, experienced management teams and operate in a market with a stable or growing population.

Search for quality dividends instead of “value”

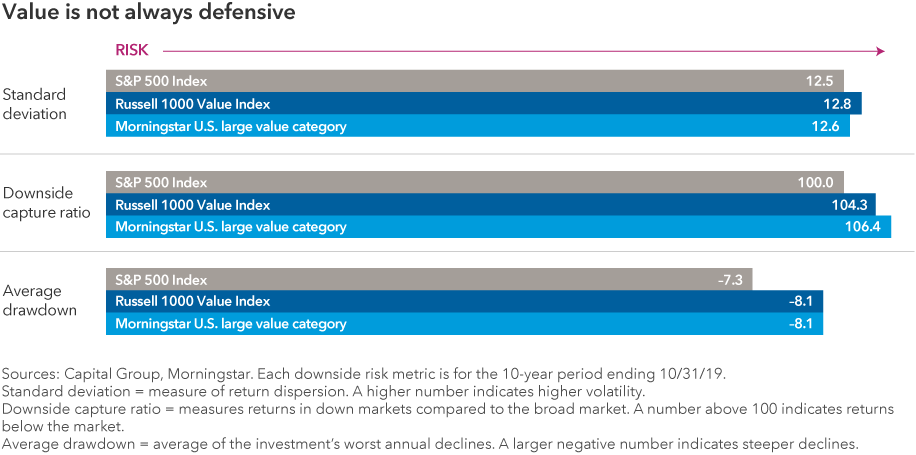

Just as it used to be easier to identify defensive stocks, it also used to be relatively straightforward to pick a defensive investment strategy for your portfolio — just shift to a value-oriented index and call it a day.

But it’s important for investors to understand that value stocks aren’t always defensive. For example, many stocks that are included in popular value indexes don’t pay dividends and don’t have high credit ratings. About 22% of stocks in the Russell 1000® Value Index paid dividends of less than 0.1% in 2018, and roughly 40% of the rated companies in that index carried ratings of BBB– or lower. Companies with questionably high debt levels are also not uncommon.

A missed debt payment or a ratings downgrade could send share prices tumbling. A better strategy may be to focus on higher quality companies that are most likely to maintain consistent dividend payments, says Capital Group portfolio manager Joyce Gordon, principal investment officer of the dividend-focused American Mutual Fund®.

“It all comes down to fundamental research on individual companies,” Gordon explains. “Different types of companies can provide downside protection in different types of markets. It’s our job as investors to figure that out — one company at a time.”

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

The Russell 1000® Value Index measures the performance of large-cap value segment of the U.S. equity universe. Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2019. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

The Morningstar U.S. large value category measures the performance of large-cap value funds of the U.S. equity fund universe. ©2019 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

related insights

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Joyce Gordon

Joyce Gordon

Jonathan Knowles

Jonathan Knowles

Lisa Thompson

Lisa Thompson

Alan Wilson

Alan Wilson