Macro Brief

If the U.S. budget deficit keeps growing, will the dollar’s bull run finally come to an end? That question is top of mind for many investors, who are starting to worry that soaring fiscal spending could depress demand for Treasuries among non-U.S. buyers, which could send the dollar spiraling downward.

However, a crisis of this nature does not seem likely, primarily because the U.S. current account appears balanced, relative to history.

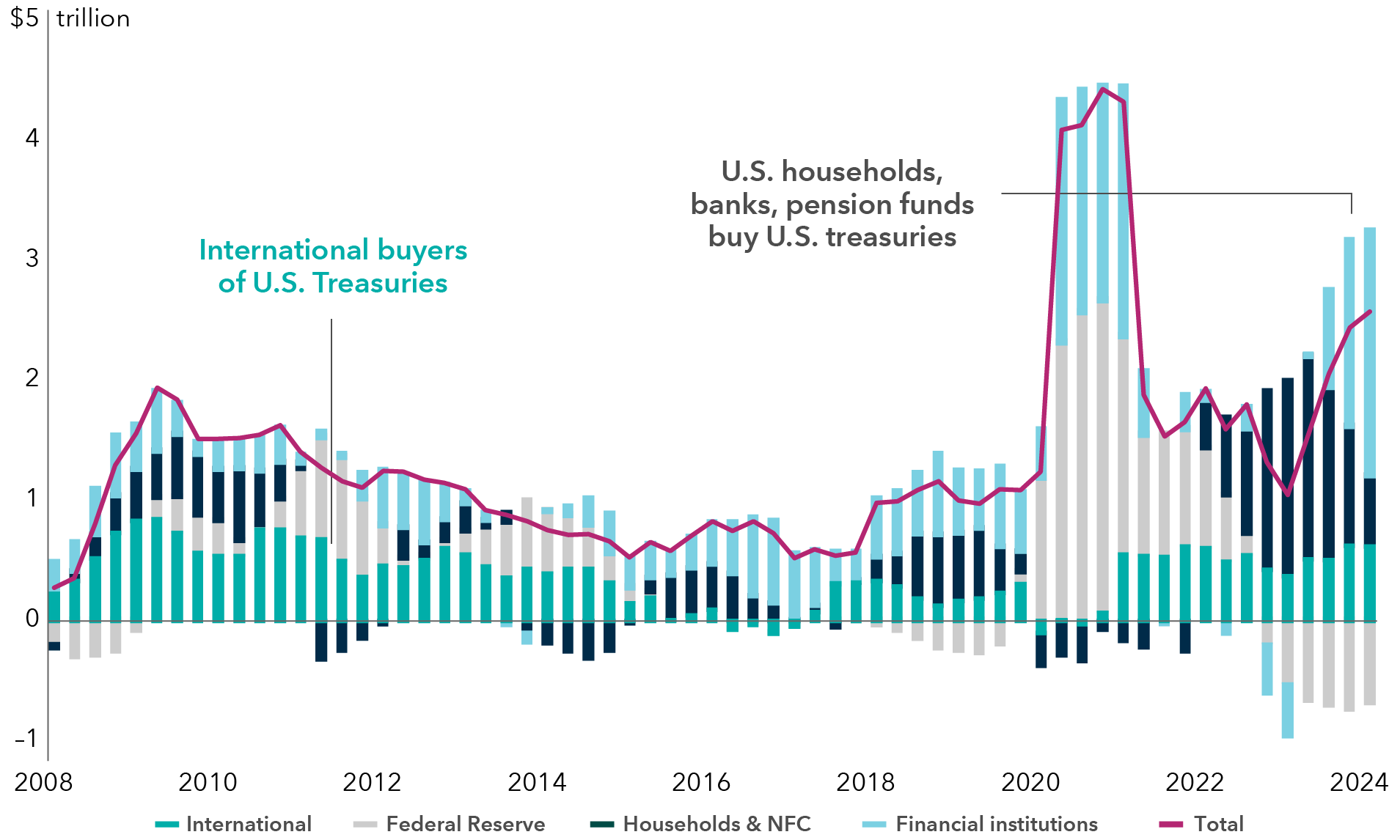

Government borrowing must be financed by either the U.S. private sector or international investors willing to purchase government bonds, which results in the U.S. running a current account deficit. While in the past, a significant portion of U.S. borrowing was funded by non-U.S. investors, the composition of the buyer base for Treasury securities has evolved over the last 20 years. Today, the deficit is mostly funded by domestic savings.

To be sure, unchecked fiscal spending could create problems and lead to higher rates in the U.S. But even if Treasuries sell off, I believe the dollar could escape relatively unscathed.

U.S. domestic savings have grown alongside budget deficits

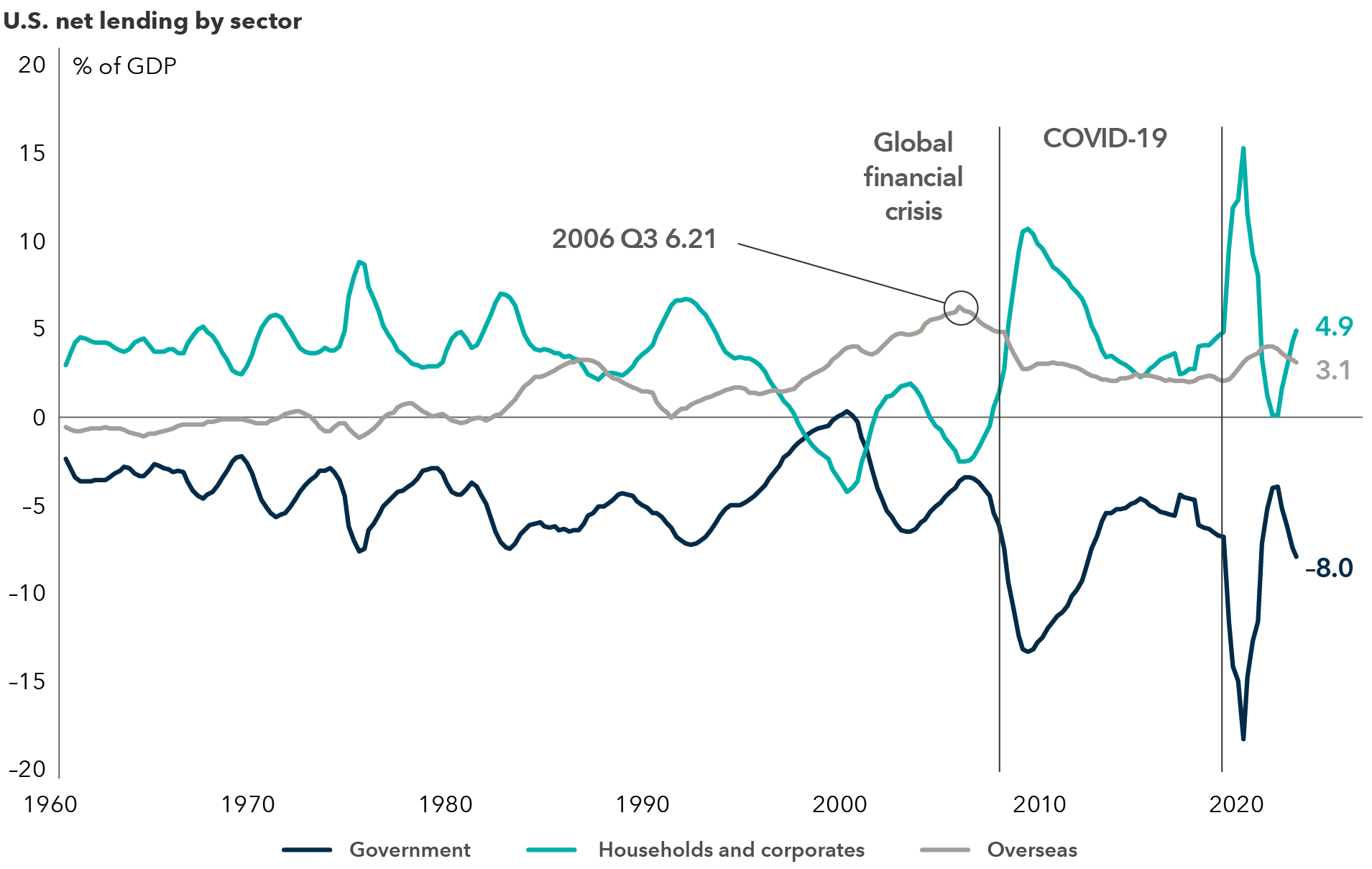

The U.S. federal budget deficit is currently around 8% of gross domestic product (GDP). From 1960 until the global financial crisis (GFC), the budget deficit averaged around 5% of GDP. Since 2007, it has been closer to 6%, partly because of higher government spending in response to the GFC and the COVID-19 pandemic.

Yet as the budget deficit has grown, so too have U.S. private sector savings. Prior to the GFC, when both the U.S. government and the U.S. private sector were borrowing heavily, there was a private savings deficit. But in recent years, savings have since risen to a surplus of nearly 5% of GDP. That’s a big contrast to the 2003–2006 period, when both the government and the U.S. private sector were borrowing heavily.

The U.S. current account deficit peaked at 6% in 2006 but has steadily narrowed since and currently stands at around 3% of GDP as of the start of 2024. This is not historically high.

The U.S. current account deficit has been trending downward

Sources: Capital Group, U.S. Bureau of Economic Analysis. Data as of January 1, 2024. Chart shows a four-quarter moving average.

Who is buying U.S. Treasuries?

Prior to the GFC, international investors largely financed the U.S. government budget deficit. Now, the U.S. private sector, specifically households, banks and pension funds, are the primary buyers of Treasury securities. The current account deficit has been trending lower since the first quarter of 2022 and is currently only about half of its peak level, reached before the GFC.

Who funds the U.S. budget deficits now?

Sources: Capital Group, U.S. Federal Reserve. Data as of January 1, 2024. NFC = non-financial corporations.

The Federal Reserve has been both a buyer and seller of U.S. Treasury bonds through its quantitative easing and tightening programs. More recently, the Federal Reserve has been a net seller of Treasuries. So, while the government deficit is high, it is largely financed by the savings surplus of the U.S. private sector (5% of GDP) and not by international investors, leading to a relatively small U.S. current account deficit of 3% of GDP. If real (adjusted for inflation) interest rates remain high, U.S. private savers should have an incentive to buy Treasuries and help fund the U.S. government.

The bottom line

While investors may be spooked by the growth in U.S. deficit spending, the potential problems that could result may not have a dramatic effect on the currency.

There are scenarios that could lead to a weaker dollar, such as a Trump administration taking control of the Fed and backstopping loose U.S. fiscal policy. A combination of loose U.S. fiscal and monetary policy implies negative U.S. long-term real yields and a weaker U.S. dollar. This scenario could increase the risk of a 1970s-style U.S. inflationary spiral with the U.S. dollar losing its reserve currency status.

But the budget deficit as it stands today, given the muted impact on the current account, should not be a major threat to the value of the U.S. dollar.

The value of fixed income securities may be affected by changing interest rates and changes in credit ratings of the securities.

Unlike mutual fund shares, investments in U.S. Treasuries are guaranteed by the U.S. government as to the payment of principal and interest.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

-

Economic Indicators

-

Demographics & Culture

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Jens Søndergaard

Jens Søndergaard