Market Volatility

Chart in Focus

Here’s a recent event that would have been almost unthinkable a few years ago: China’s President Xi Jinping and top party leaders hosted a meeting with the country’s most prominent entrepreneurs. The message: It’s time for the private sector to make its mark.

The meeting came soon after China startup DeepSeek shocked global markets with its artificial intelligence (AI) training model, shifting the narrative away from the U.S. leading the AI race.

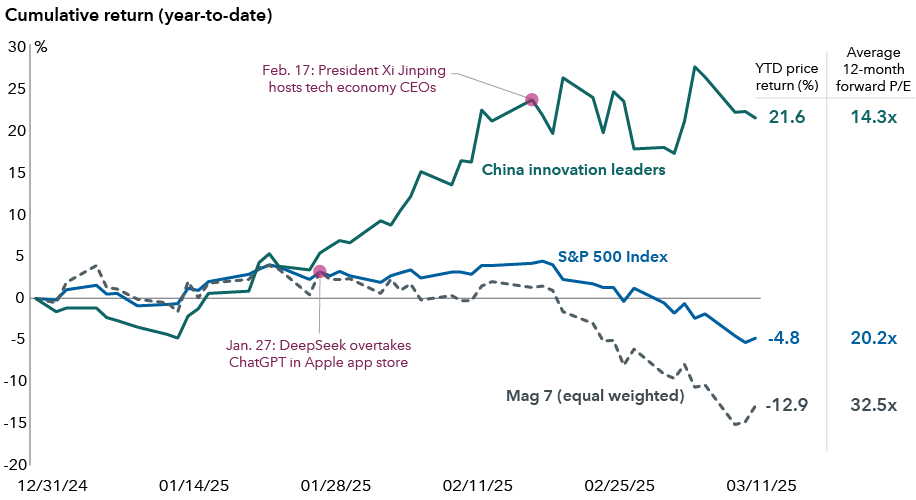

The MSCI China Index has led major global equity benchmarks this year, rallying 18% as of March 12, fueled by gains in information technology and consumer discretionary sectors. As the chart shows, China’s innovators have outpaced their Magnificent 7 (Mag 7) counterparts and the broader S&P 500 Index.

China's tech leaders pull away from the Mag 7

Source: FactSet. P/E = price-to-earnings. Mag 7 = Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. China innovation leaders = Alibaba, BYD, JD.com, Meituan, NetEase, PDD Holdings and Trip.com. Data from December 31, 2024, to March 12, 2025. P/E ratios for Mag 7 and China innovation leaders reflect average P/E ratios across listed companies. The P/E ratio for the S&P 500 Index is market-cap weighted.

Will the gains hold? It’s uncertain given China’s historically volatile stock market. Recent developments underscore China’s policy cycle is moving in a more positive direction. The government has become more vocal in its support of innovative private companies. That’s a shift from late 2020 to 2021, when the private sector faced regulatory scrutiny, sparking a broad sell-off and a crisis of confidence among entrepreneurs, domestic consumers and investors.

The sharp move up for the MSCI China Index is also reminder that innovation is global and select growth opportunities can be discovered in non-U.S. markets.

Going forward, potential gains for China’s equity market are likely to be more differentiated, as investors gauge which companies will see greater earnings revisions. Our investment analysts, for instance, don’t think certain internet platform companies are expensive, even after the rally, due to the potential for better margins and re-accelerating revenue.

Consensus expects 8% earnings growth for the MSCI China Index in 2025, led by areas within technology and consumer industries, based on FactSet estimates as of March 6. The risk is that profit projections get revised lower — a pattern we’ve seen in recent years due to China’s economic slowdown and lack of big-bang stimulus the market has hoped for.

There are also downside risks to economic growth. Fresh U.S. tariffs on Chinese goods and technology-related sanctions could weigh on certain companies. Domestic consumption also remains subdued. And while home sales in large cities picked up in January and February, the ailing property market is far from healed.

Past results are not predictive of results in future periods.

The S&P 500 Index is a market-capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).

Don't miss our latest insights.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Kent Chan

Kent Chan