Macro Brief

- Some companies should now have a better chance at lowering their tax rates through aggressive tax strategies, as U.S. government agencies will be less empowered to interpret and enforce the law.

- Companies with open tax cases should have a better chance of winning.

- More tax cases will likely get caught up in court, and resolutions will be delayed.

- Some companies may reduce unrecognized tax benefits currently recorded as liabilities.

The U.S. Supreme Court’s recent decision overturning the Chevron doctrine is set to disrupt the regulatory state. As the impact of the ruling begins to take shape, investors will want to keep a keen eye on its implications for tax strategy. I believe some companies should now have a better chance at lowering their tax rates through aggressive tax strategies, as U.S. government agencies will be less empowered to interpret and enforce the law.

The 1984 Chevron case, for which the doctrine was named, allowed U.S. government agencies to interpret ambiguous rules and laws enacted by Congress, and the courts would follow their decisions. This meant the Internal Revenue Service (IRS) could make its own determinations on issues related to tax law.

With that overturned, if Congress does not explicitly delegate authority to the IRS in a tax law, judges can interpret cases themselves, rather than deferring to agency interpretations or administrative cases. While courts could still align with the IRS, especially if a case pertains to parts of the tax code with solid legislative history, a judge’s interpretation will no longer need to agree with the agency’s interpretation.

As such, agencies will lose some of the flexibility they currently have to regulate issues within their jurisdiction. For any major new issue, Congress will have to act first. As a result, I believe companies are now more likely to engage in lengthy litigation and have a better chance at prevailing in court in tax challenges brought by the IRS.

The three most significant potential tax outcomes to watch are:

- Companies with open tax cases should have a better chance of winning, in areas where IRS regulations go further than Congressional statutes or case law. One such case to watch is the transfer pricing case involving Coca-Cola. The company must currently pay $6 billion for the 2007 through 2009 open tax years, which the IRS has examined so far. However, the ruling makes it possible for the company to get a refund and avoid owing the remainder of the estimated $17 billion of its potential overall liability.

- At a minimum, I expect more tax cases will get caught up in court, and resolutions will be delayed, as companies challenge agency authorities more frequently. This development will likely result in companies becoming more innovative in their approach to tax planning. Judges will have an increased responsibility to become familiar with industry-specific tax issues.

- Some companies may reduce their liabilities recorded for unrecognized tax benefits. Unrecognized tax benefits are benefits or deductions taken on a tax return but left unrecognized and booked as a liability on financial statements, because the company (and its auditors) believe they have a less than 50% chance of surviving an audit by a tax authority. Under the new Supreme Court decision, companies may no longer be compelled to presume the IRS is correct in its interpretation of tax law written by Congress. I expect some companies to reverse portions of their liabilities for aggressive tax positions.

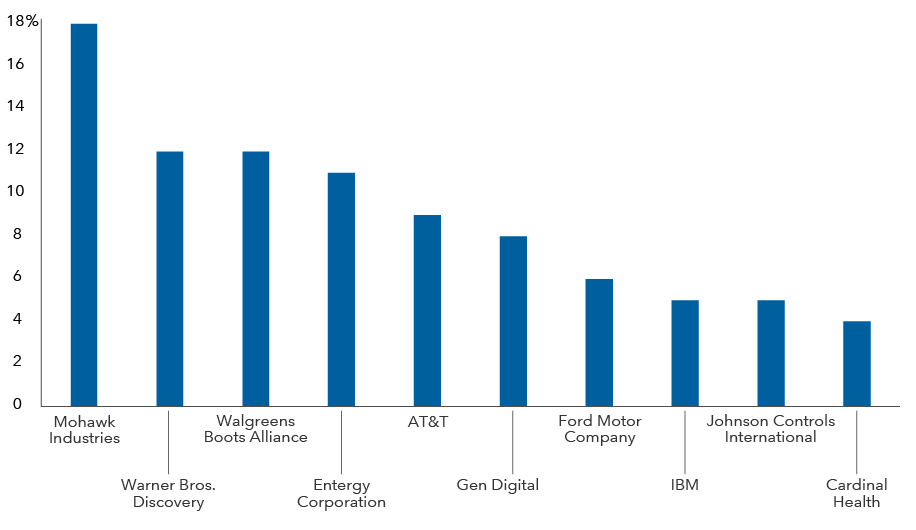

Companies with aggressive tax positions could benefit from Supreme Court ruling

Source: CapitalIQ. Data as of 6/30/2024. The bar chart displays S&P 500 Index companies with the highest unrecognized tax benefits as a percentage of total market cap.

Overall, the U.S. Supreme Court's decision to overturn the Chevron doctrine will likely have wide-reaching consequences beyond tax law. In addition to the IRS, the Securities and Exchange Commission, the Environmental Protection Agency and other regulators will be similarly impacted. Limiting the deference shown to government agencies, could result in broadly looser regulatory standards, which may benefit companies’ bottom lines and investors’ portfolios.

S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely held common stocks.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Demographics & Culture

-

Regulation & Legislation

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Elizabeth Mooney

Elizabeth Mooney