U.S. Equities

Investment Menu

Well-designed restaurant menus help diners navigate potentially overwhelming options to choose the right meal for them. Similarly, retirement plan investment menus can help guide participants to choose their investments wisely. The science behind restaurant menus can offer insight into how.

The science of menu engineering

Hospitality industry research shows restaurants how to organize menus toward a goal. That goal may be profitability or even conscientious or healthy eating. With subtle choices such as iconography, placement, font and daily specials, restaurants can help steer diners toward particular items, guided by science.

For instance, a 2018 eye-tracking study, “Optimization of menu-labeling formats to drive healthy dining,” found that when presenting a visual label (i.e., a physical activity-based labeling and a color-coded labeling), customers spend more time viewing menu labels associated with their final choices.

Examples of menu engineering

Menu engineering also applies to the number of options diners have. “More than seven is too many, five is optimal and three is magical,” according to menu engineer Gregg Rapp.

Streamlined menus make it easier for diners to choose — and they take less time to read.

We can learn something from this in the retirement plan industry.

72% of 401(k) plan assets are invested outside of target date funds*

Despite the popularity of target date funds as plans’ default investment option, many defined contribution (DC) participants are still “do-it-yourself” investors who pick funds off the investment menu.

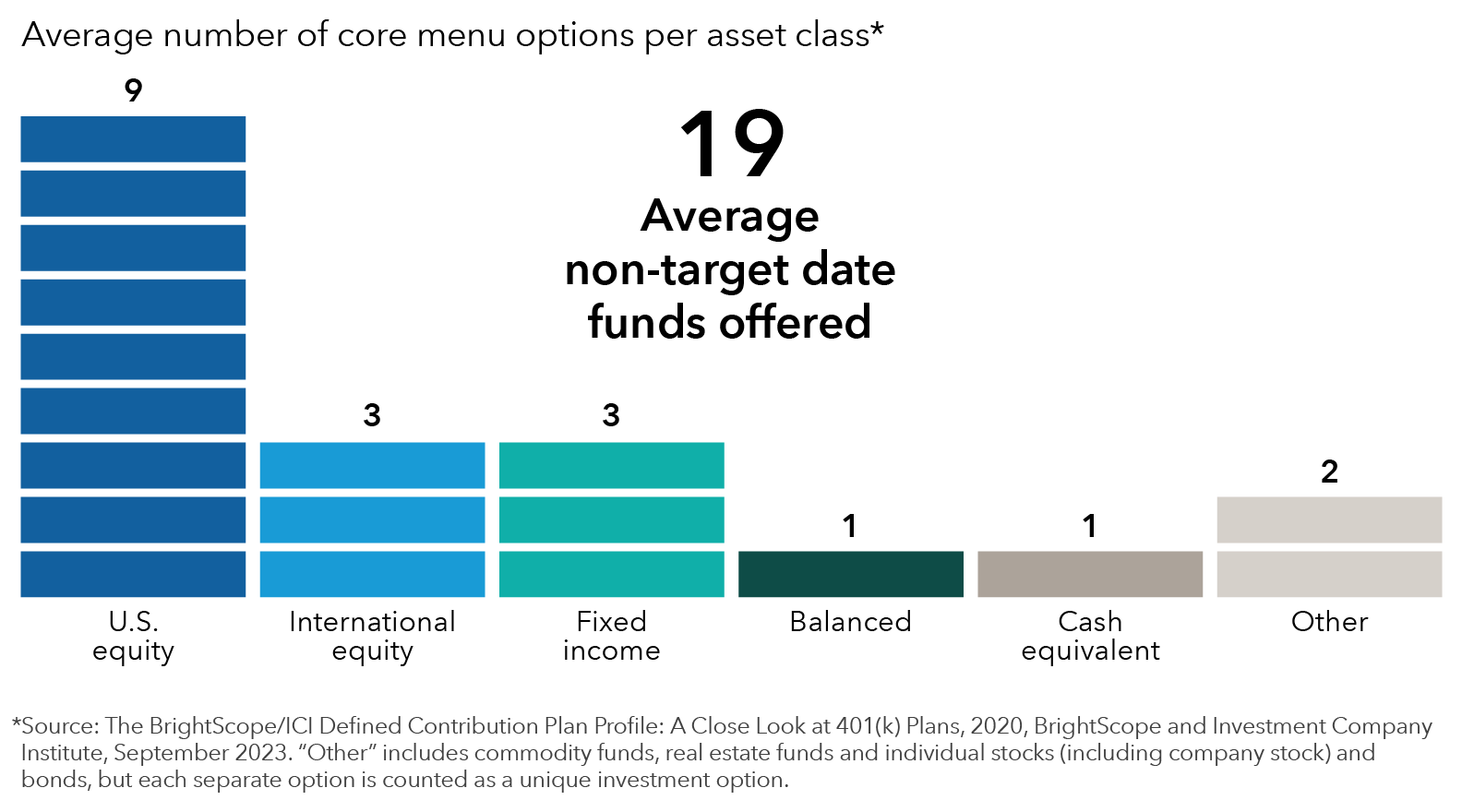

With 20 fund options on an average plan’s menu, including the target date fund, this may be too much choice, and can lead to indecision.

How did DC menus get so big? The Morningstar style box, which was originally intended to be a descriptive evaluation of a managers’ investment style, has turned into something prescriptive — as building blocks for portfolios.

Some suggested action steps for reducing plan menu size:

U.S. equity

Checking all the style boxes is no substitute for offering a small number of well-thought-out U.S. equity menu options.

- Beware too many entrees — Make participants’ decisions easier by limiting U.S. equity menu options to three or four funds with clear and distinct investment objectives.

- Fusion outside the style box — Select funds that capture a broader range of styles, market capitalizations and sectors to make it easier for participants to digest.

- Consider participants’ appetite for risk — Look to pure growth funds for younger participants and to more dividend-oriented “blue chip” equities for those nearing retirement.

International/global

Funds with broad geographic flexibility may be used as core international/global menu offerings to simplify and direct participant choices.

- “It’s good for you” — Treat non-U.S. equities in participant education efforts as the vegetables participants may not want to eat but don’t get enough of. Many participants are “home biased,” preferring more familiar U.S. companies to less-familiar foreign names.

- The global smoothie — Make non-U.S. exposure easier to stomach by offering global funds, which combine unfamiliar non-U.S. firms (think Taiwan Semiconductor) with more familiar, multinational companies (think Apple).

- Don’t attempt the exotic at home — Let portfolio managers, not participants, strike the right balance between developed and emerging markets exposure. Choose an international equity fund with flexibility to invest meaningfully in emerging markets.

Fixed income

One core fixed income menu option that does what it’s supposed to do without unpleasant surprises can go a long way toward providing balance in a retirement plan.

- Balance the meal — Use bond funds to help balance portfolio volatility in four ways: diversification from equities, capital preservation, income and inflation protection.

- Don’t get fancy — Emphasize core bond funds that stay true to their role by not reaching for yield at the expense of too much credit or duration risk.

- Taste before appearance — Evaluate how fixed income actually behaved in real-market conditions instead of just relying on benchmark or category to approximate risk and return levels.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Although target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors' retirement goals will be met.

Our latest insights

-

-

Global Equities

-

Economic Indicators

-

-

RELATED INSIGHTS

-

Liability-Driven Investing

-

Defined Benefit

-

Regulation & Legislation

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Jennifer Miller

Jennifer Miller