Target Date

- We are seeing more retirement plan participants remaining in a defined contribution (DC) plan after leaving the workforce. DC plans must evolve to help these workers translate their savings into sustainable retirement income.

- Plans need to provide retirees with flexible withdrawal options, such as lump sum, systematic and ad hoc withdrawals. Some recordkeeping systems already offer these.

- Sponsors are adding investment options designed to support retirement income, as part of an “in-retirement tier” in the DC investment menu. This tier could include options such as annuities and investment strategies that can generate sustainable retirement income.

- Such strategies can live alongside a target date series providing additional options to meet various objectives.

Forty years ago, DC plans were created as supplemental savings plans. Today, they are an important source of retirement income for many retirees and future retirees.

As their importance grows, DC plans must continue evolving to ultimately develop into a truly effective retirement solution. DC systems need to enable employees to save money throughout their career and then help them convert those savings into a “retirement paycheck.” Employers may need to rethink their plans to help facilitate retirees’ distributions. This goal will become even more important if – as we are seeing – an increasing number of retirees choose to remain in the DC plan after leaving the workforce.

The ability to stay in the DC plan can benefit both employee and sponsor

The ability to continue in a DC plan after retirement, instead of rolling out, for example, into an Individual Retirement Account (IRA), can be a meaningful benefit for an employee. The advantages may include continued employer fiduciary oversight over investment options, access to institutionally priced investments and low-fee administration.

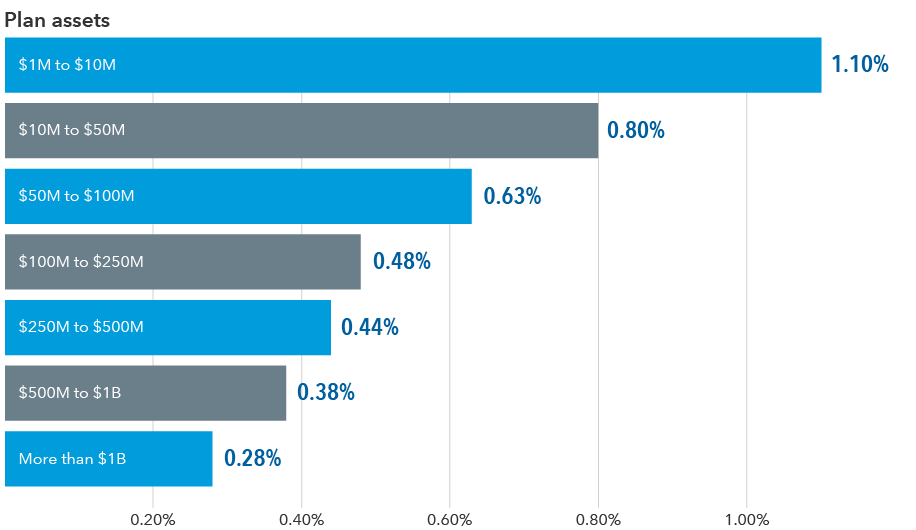

For the employer, encouraging retirees to stay in plan is a competitive and valuable benefit, as retirees typically have greater assets. By keeping those assets in plan, employers can create economies of scale that could help lower plan expenses, as shown in the chart below.

Plan expenses decline as assets grow

Total plan cost as a percentage of assets

Source: The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2017. BrightScope and Investment Company Institute, August 2020. Data were plan weighted.

Access to distribution and recordkeeping options gives retirees flexibility

When DC plans were supplemental savings plans, they would often only allow for a lump-sum withdrawal, usually upon termination or retirement. This has changed and many plans today offer withdrawal options that include lump sum, ad hoc and systematic.

This type of flexibility makes the DC plan work for retirees who may use their savings in different ways at various points in retirement. Key to this success is ensuring that fees to take withdrawals are reasonable so they don't deter participants from taking ad-hoc or systematic distributions.

Recordkeeping systems, while originally designed for the accumulation phase of an employee’s retirement plan, are now more flexible than ever.

Attitudes and systems have evolved rapidly, leading to flexible distribution strategies designed to meet the needs of today’s retiree without adding burdensome costs to the process.

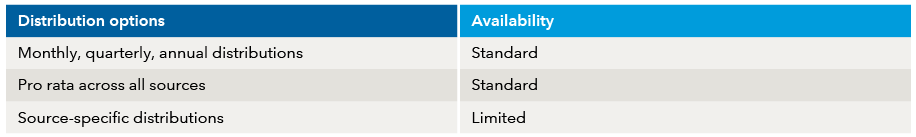

The tables below provide general information about distribution option flexibility and pricing, based on our survey of recordkeepers in the marketplace.

Availability of distribution options

Fees for typical distribution services

*Recordkeeping arrangements vary. Examples of additional fees: Plan A: $60 for periodic distribution setup and $15 for each periodic installment. Plan B: $50 for full or partial withdrawals, but no fee on periodic installments. Source: Capital Group.

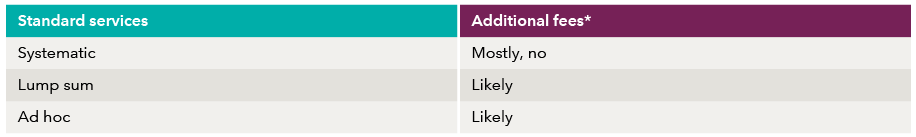

Add a retirement tier to the investment menu

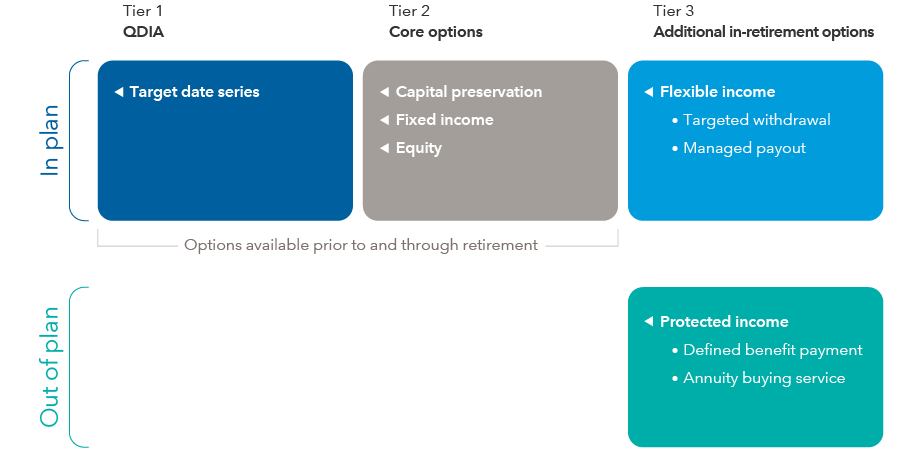

Many DC plans today offer a tiered investment menu, generally consisting of Tier 1 with the qualified default investment alternative (typically a target date series) and Tier 2 with investment options for participants to create their own portfolio. In Tier 1, a “through” target date fund (managed for a number of years after the retirement date) can help participants retire successfully by gradually reducing risk over time and providing income options in retirement.

Moreover, we suggest considering adding a Tier 3 – an in-retirement tier – that would include options specifically designed to provide additional options for income in retirement.

In our framework, we divide Tier 3 options in two ways:

- Flexible income sources (from investments whose value may fluctuate)

- Protected income sources (defined benefits or annuities that come with more certainty)

We also classify options as being offered within the DC plan and outside of the DC plan.

Within the DC plan, an in-retirement tier could offer targeted withdrawal or managed payout funds, which seek to provide regular withdrawals from a portfolio of equities and bonds. These products are classified as “flexible income” options because they don’t come with guarantees.

Outside of the DC plan, an in-retirement tier could offer protected income sources such as a defined benefit payment or an annuity-buying service. The Setting Every Community Up for Retirement Enhancement (SECURE) Act provided plan sponsors with clarification on the selection of lifetime income solutions, which include protected retirement income. However, employers can likely offer more options to retirees by placing these options outside the plan.

The graphic below shows an example of how the investment structure prior to retirement, through retirement and in retirement could be organized and communicated.

Source: Capital Group

Source: Capital Group

Case studies

Below are examples of companies offering different DC plan options to retirees.

Materials firm

- Proactively encourages participants to remain in the plan after they retire

- Offers four income-oriented options — not specifically targeted to retirees

- Institutional annuity platform available — outside the plan

- Worked with recordkeeper to create total flexibility on distribution options without additional user fees

- Of the 150,000+ plan participants, approximately 15% are retired and represent 25% of total plan assets

Manufacturing firm

- Neutral on whether retirees stay in the plan

- Addresses the needs of retirees in the plan through investment options, distribution flexibility and communication

- Income-oriented investment options available as part of the general investment structure

- Of 125,000+ participants, approximately 40% (including retirees) are inactive

Conclusion

DC plans must evolve to effectively meet the needs of current and future retirees by helping workers translate their savings into sustainable retirement income. Sponsors can do this by offering in-retirement menu options, facilitating flexible distribution strategies and offering a “through” target date fund. These moves could benefit both participants and sponsors in their quest for a successful retirement plan designed for the long term.

-

-

-

Asset Allocation

-

-

Market Volatility

RELATED INSIGHTS

-

Target Date

-

Investment Menu

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

John Doyle

John Doyle

Toni Brown, CFA

Toni Brown, CFA