Market Volatility

Asset Allocation

- Investors should consider shifting a higher percentage of their assets to international stocks.

- Going outside the U.S. provides a broader opportunity set and potential currency benefits.

- Try combining a dedicated international strategy with a more flexible approach.

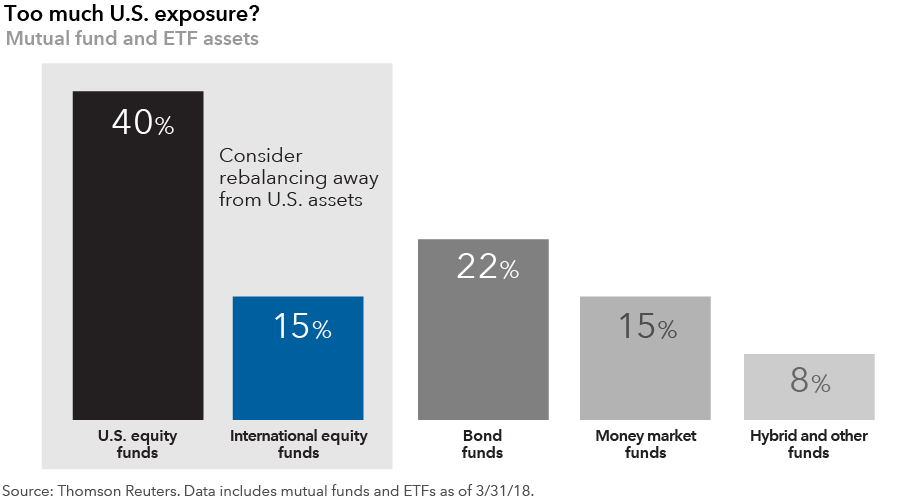

Investing in international equities can be compared to a daily exercise routine: Most people agree it’s a good idea, but quite a few don’t follow through on the concept. Thus, at a time when international equity markets account for roughly 50% of the investable universe, many U.S. investors remain woefully under-exposed to non-U.S. assets, including European, Asian and emerging markets equities.

Additionally, investors who have not dutifully rebalanced portfolios during a long bull market in U.S. equities may also find themselves inadvertently concentrated. Strong U.S. returns have encouraged that trend. This type of home-market bias can be tempting when U.S. markets are rallying, but it robs investors of a broader opportunity set that may be more rewarding over the long term.

So, when it comes to answering the question “How much international equity do you need?” — the detailed answer will vary by individual circumstance, but for many investors, the simple answer may be: “More.”

Why consider international stocks?

With U.S. equity markets reaching record highs in January 2018, valuations appear to be more attractive in non-U.S. markets. Currency tailwinds are also building as the dollar has since weakened significantly from its peak in early 2017. Capital Group currency analyst Jens Søndergaard believes this dollar-weakening trend will continue for at least the next two years, providing a nice tailwind for U.S.-based investors in international stocks.

But the most important reason to invest internationally is that many dominant, innovative companies don’t call America home. For example, some of the most successful companies in the computer-chip industry are found in Europe and Asia — including chip-equipment maker ASML and Taiwan Semiconductor Manufacturing, a key supplier for Apple and Samsung smartphones. Samsung itself is headquartered in South Korea.

The world’s largest food company, Nestlé, is based in Switzerland. High-end luxury goods are dominated by European conglomerates such as LVMH, Kering and Richemont while Japan is renowned for its cutting-edge robotics firms, including Fanuc and Yaskawa. Broadening the definition to include emerging markets, three of the world’s biggest internet companies — Alibaba, Baidu and Tencent — are located in China. In the dirt-and-shovels sector, Brazilian mining company Vale is the largest producer of iron ore in the world. These types of global champions are making international borders less important from an investment perspective.

How much international equity?

Returning to the initial question: how much international equity do you need? There is, of course, no simple or universal answer. Individual circumstances — including risk tolerance, investment objectives and time horizon — should determine the answer, ideally in consultation with a financial advisor.

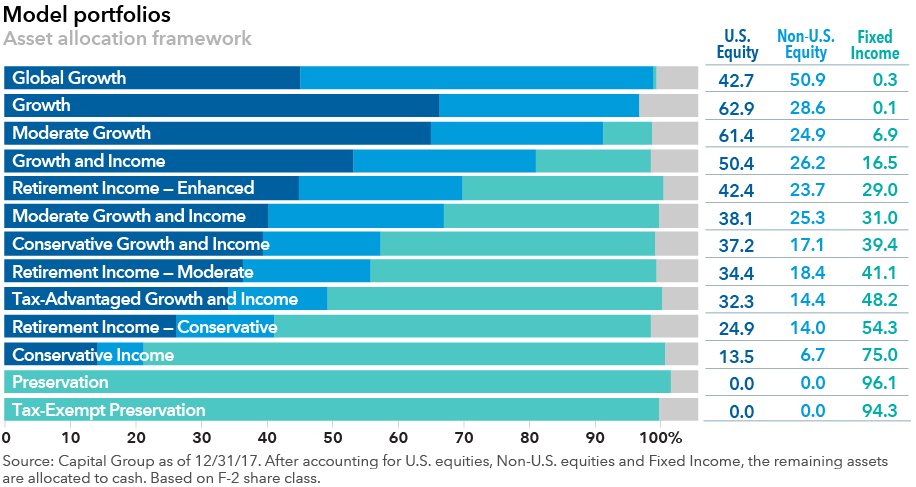

An objective-based approach to portfolio construction can help. At Capital Group, we developed 13 objective-based model portfolios covering a range of investment goals. These models are built by our Portfolio Oversight Committee, a team of seven veteran portfolio managers on a number of equity, fixed income and multi-asset funds. Almost half of the model portfolios have an international allocation of 25% or higher — significantly more than the 14% of overall assets in international funds and ETFs.

What kind of international equity?

Once the amount of international equity exposure is determined, it’s time to develop a framework for that portion of the portfolio. Again, it depends on individual circumstances, but one effective approach is to combine a dedicated international allocation with a more flexible global strategy. A key difference between the two is indicated by the primary benchmark used to measure investment results.

Ten years ago, it was common practice to use MSCI EAFE as the primary international benchmark. But as markets and companies have become more global and with the rise of emerging markets, it may be more effective to use the MSCI All Country World ex USA Index, which reflects the returns of more than 40 developed and developing country stock markets.

Once the core allocation is set, consider adding exposure to a more flexible strategy — for example, a global fund that can ramp up or down international exposure, depending on the managers’ outlook and bottom-up fundamental research. The benchmark here would be the MSCI World Index, which is heavily weighted toward developed-market stocks, or the MSCI All Country World Index, which is similar but also includes some exposure to emerging markets.

The combination of a dedicated core international fund with a portion allotted to a more flexible global strategy can be an effective way to gain exposure to opportunities outside the U.S. while helping investors pursue their long-term goals.

For more information about the risks associated with each fund or underlying fund, go to its detailed fund information page or read the prospectus.

Investment allocations may not achieve objectives and actual underlying fund allocations may vary. There are expenses associated with the underlying funds in addition to any fees charged by the intermediary. Additionally, the intermediary may include cash allocations, which are not reflected here. Risks are directly related to the risks of the underlying funds as described herein.

Content contained herein is not intended to serve as impartial investment or fiduciary advice. The content has been developed by Capital Group, which receives fees for managing, distributing and/or servicing its investments.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Steve Caruthers

Steve Caruthers