Market Volatility

Global Equities

- Traditional diversification is not what it used to be.

- There are increasingly greater correlations between U.S. and non-U.S. equities.

- Diversification today comes through a broader opportunity set.

- Investors might reconsider rigid geographic allocations in favor of flexible global mandates.

Globalization and an increase in open trade are having a significant impact on the universe of investment opportunities, meaning that many companies headquartered in Europe, Japan and the United States don’t necessarily generate most of their revenue in their home country like they once used to.

In our view, this change in the landscape of investment opportunities forces a re-evaluation of whether investment portfolios should be built along strict regional lines or a corporation’s place of domicile.

Diversification benefits have changed amid tighter correlations

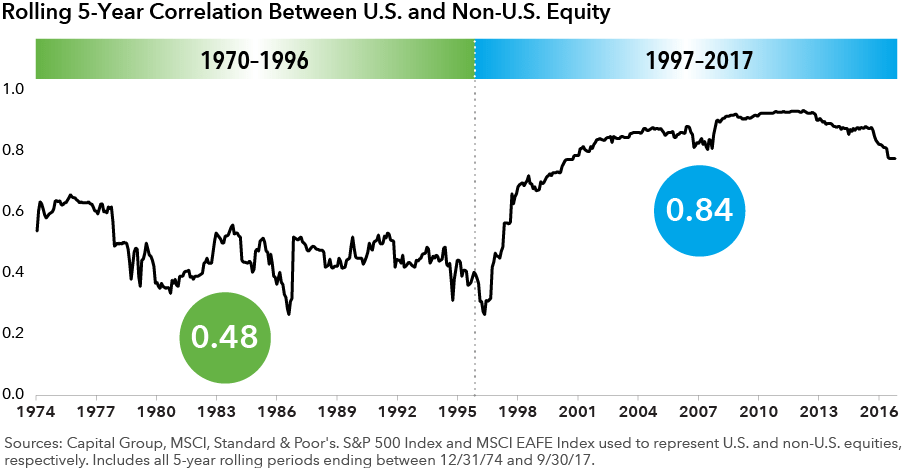

International investing has traditionally been seen as a source of diversification and risk mitigation for U.S. investors. But over the last 20 years, correlations have become less differentiated between U.S. and non-U.S. equities, and this development is challenging previously-held notions about the role of international equities in portfolio construction.

For example, the monthly correlation between the S&P 500 Index for U.S. equities and the MSCI EAFE Index for non-U.S. equities was only 0.48 from 1970 to 1996. However, global equity markets have become increasingly interconnected, and we have seen correlations steadily creep up since the mid-1990s. In fact, monthly return correlations have almost doubled to 0.84 over the last 20 years.

The changing pattern of global equity correlations has important implications for investors.

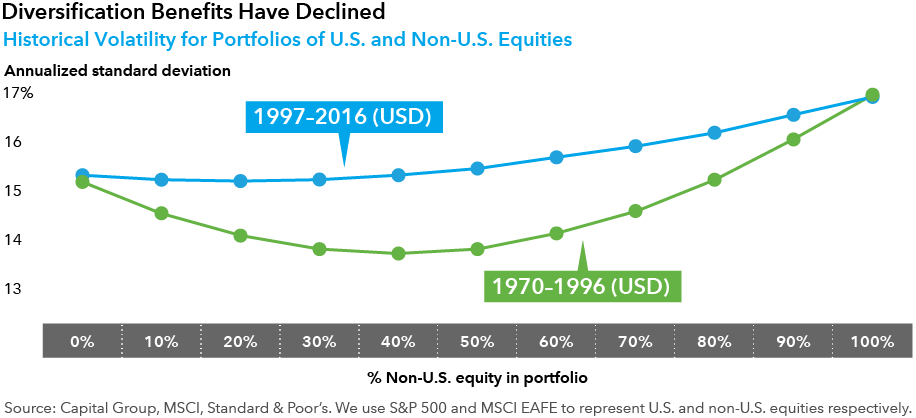

Historically U.S. investors could simply reduce the risk of the portfolios by allocating a slice of their portfolio to companies domiciled outside the U.S. For example, a portfolio with 40% non-US equities had approximately 1.5% lower volatility than an all U.S.-equity portfolio, and lower losses in down months.

As correlations have increased, the automatic risk reduction from including international equities has greatly weakened. Over the last 20 years, portfolios with allocations to international equities have had similar, and often higher volatility.

So if correlations between U.S. and non-U.S. equities remain more tightly linked in a more globalized world, should investors forget international investments altogether?

No, but they should re-think what global investing means for their portfolios. As diversification and risk benefits have become less pronounced, international equities can be seen as a means for stock pickers to pursue a broader opportunity set by homing in on individual companies.

History shows companies can transcend indexes

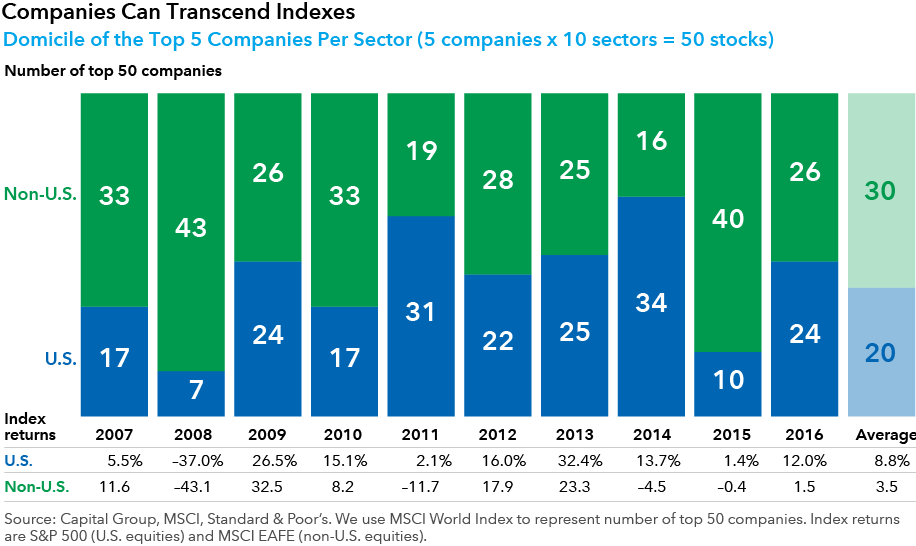

While market-weighted indexes are good barometers for aggregate results, they can mask the opportunity set at the company level.

Over the last 10 years, U.S. equities have staged a massive run to trade at record highs, with the S&P 500 besting the MSCI EAFE Index by an annual average of more than 500 basis points, or 5.3%. (MSCI EAFE tracks large and mid-cap stocks in 21 developed markets, excluding U.S. and Canada).

But this result doesn’t tell the whole story.

We examined equity returns during this 10-year period, breaking down the results of 10 sectors in the MSCI World Index, a gauge of stocks in 23 developed markets. For each year, we selected the five top gainers by sector, resulting in a universe of 50 stocks.

The result: On average, close to 60% of the top-returning companies were domiciled outside the United States. Take 2010: In that year, U.S. equity markets produced almost double the return of non-U.S. markets — yet more than two-thirds of the best-returning stocks were those of foreign companies.

This analysis illustrates how international equities can help improve the depth of investment opportunities for skillful managers, while also presenting a challenge for investment decisions that are made purely along rigid geographic lines.

Global equities improve breadth of investment opportunities

In constructing an equity portfolio, the ability to break free of regional borders and the capacity to implement a flexible approach in terms of asset allocation can be beneficial. It will open the door to a wider pool of companies that otherwise may be constrained by a country-level bias.

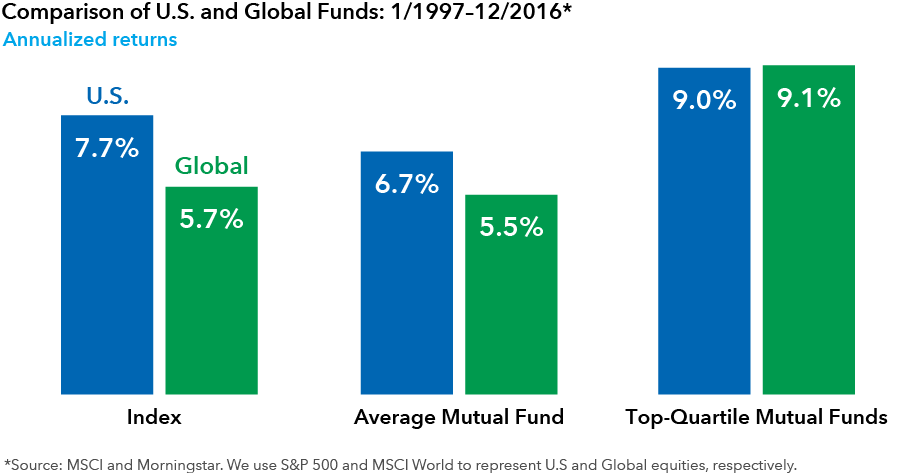

Global managers have used greater investment flexibility to generate better results.

The top quartile global funds tracked by Morningstar exceeded the average annualized return of the S&P 500 by 140 basis points and the MSCI World Index by 340 basis points for the 20-year period ended December 31, 2016. Not only that, they also matched (and slightly outpaced) the returns of the top quartile U.S.-equity funds, despite significant headwinds to international equities in aggregate, demonstrating that above-average stock pickers who use a bottom-up style may be able to capture the value of global opportunities.

Furthermore, given the wide dispersion of potential results, now may be an appropriate time to re-consider global equities as part of a well-diversified portfolio. While the specific mix of U.S. and non-U.S. equities may depend on a range of factors such as spending needs, time horizons and investor preferences, flexible allocations can help a portfolio adapt to different market environments.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Michelle J. Black

Michelle J. Black

Sunder Ramkumar

Sunder Ramkumar