Inflation

If you filled up your gas tank recently, you probably weren’t thrilled with the bill. Prices are up — and not just at the pump. Across many goods and services, they are rising at the fastest pace in decades. While this increases the cost of living, it also has investment implications.

How do you shield a portfolio from rising inflation? There’s no silver bullet, but depending on your investment goals, a few strategies might help.

Key inflation question: How high for how long?

Supply shortages and other pandemic-related factors first triggered the rise of inflation. Demand for many goods began to outpace supply, which boosted prices. Towards the end of 2021, however, the trend began to look less temporary and more lasting. The Consumer Price Index (CPI), a favored broad level of inflation by many economists, increased to 7% by year-end, the highest in nearly 40 years.

The Federal Reserve has taken notice. It is moving to tighten monetary policy much more aggressively than markets expected a year ago. We should see the first interest rate hike as soon as March. And, while the most recent hiking cycle saw quarterly rate moves of a quarter of a percentage point per hike, this cycle could be more rapid given the current inflation dynamics.

“High inflation is likely to persist,” says Ritchie Tuazon, portfolio manager with American Funds Strategic Bond Fund℠. “Our interest rates team estimates that inflation will continue to be firm in 2022, with our forecast a little above market consensus. In coming quarters, we project inflation well above the Fed’s 2% target.”

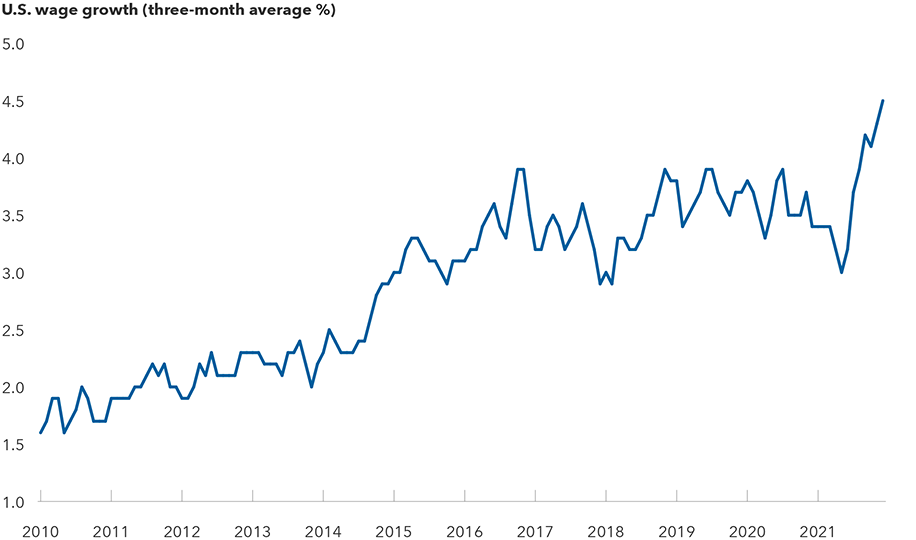

“The inflationary impulses we’re seeing today are strong and signal that inflation will remain elevated for some time,” says Tim Ng, a portfolio manager with American Funds Inflation Linked Bond Fund®. “Businesses are indicating rising input costs, low inventories and a backlog of orders. Supply chain bottlenecks remain. Labor markets are tight, employers are having difficulty finding workers and wages are rising. All these factors are contributing to the strongest inflationary dynamics in over 20 years.”

Wage growth began rising sharply in 2021

Source: Federal Reserve Bank of Atlanta. Data shown from 1/1/2010 to 12/31/21.

TIPS provide direct inflation protection

Many of today’s investors have never had to worry about high inflation. Protecting against rising prices can be important: Inflation erodes purchasing power over time. However, several assets have some indirect inflation hedging potential built in. Some stocks may benefit from rising prices as companies may see their nominal earnings rise with inflation. Many commodities are an input into production and a source of rising prices. So, having some commodity exposures in a portfolio may help hedge against rising prices. Gold is often seen as a safe-haven asset during inflationary periods.

CPI is not directly linked to any of these. Consequently, these assets can only do an imperfect job of hedging broad-based purchasing power erosion. For example, if you pick the wrong stocks and inflation affects those companies’ labor costs more than is compensated for by their rising prices, those shares could decline. If you pick the wrong commodities, they could see less value appreciation than others driving the broader trend. Gold, too, is influenced by a variety of factors and market forces that don’t always correlate directly to actual inflation.

You've discovered one of Capital Group's 10 investment themes for 2022

A Treasury Inflation-Protected Security (TIPS) is a U.S. Treasury bond that pays additional compensation when inflation rises, linked to CPI. Due to that link, it is arguably the most direct hedge to the sort of broad inflation of goods and services that affect a consumer’s purchasing power.

Are TIPS a slam dunk?

Given that direct link, should every investor pile into TIPS right now? Unfortunately, nothing in investing is quite so simple. Every asset is influenced by a set of risks, and TIPS are no exception.

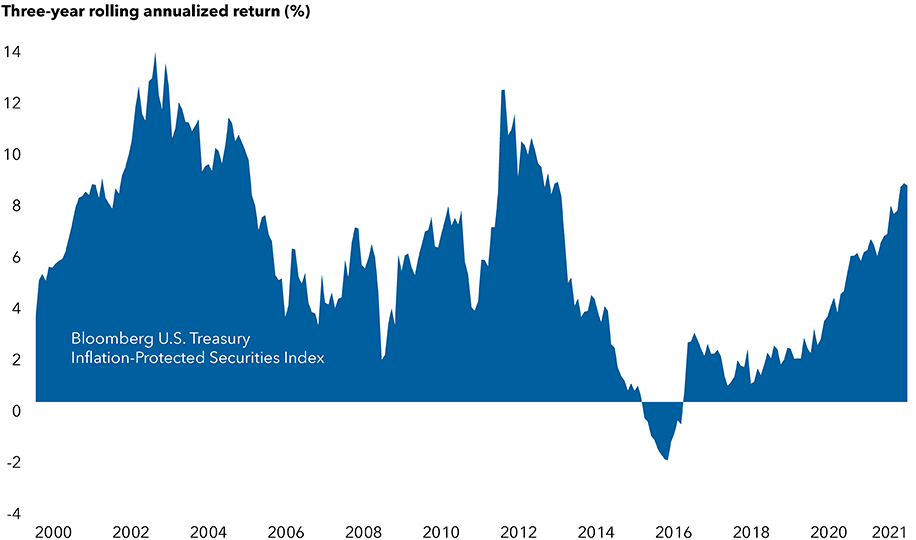

“At the end of the day, TIPS are bonds and therefore have interest rate risk,” Ng says. “And as most investors have seen, yields have risen recently. So, while inflation has remained elevated, the Bloomberg U.S. Treasury-Inflation Protected Securities Index (TIPS Index) had a negative return in January due to the broad rise in bond yields.”

However, one tough month does not make an investment a poor choice in every month. To help manage the complexities of buying individual TIPS, investors can consider an actively managed inflation-linked bond fund that seeks to outpace its benchmark index. In contrast, passive index funds seek to replicate, not beat, their benchmarks.

“We can target certain maturities within the TIPS Index that may benefit the most from near-term inflationary dynamics and are less exposed to a general rise in interest rates,” Ng explains.

Conviction about how investors are thinking about inflation also plays a part. “TIPS market values are based more on expectations than actual inflation,” Ng adds. “That means if the market decides it was wrong about the severity of inflation, prices could fall. The flip side, of course, is that as expectations rise so do TIPS values. Breakeven rates capture these expectations. These are rates of inflation that the market expects over a given period.”

TIPS breakeven rates have risen notably since 2020

Source: Bloomberg. As of 1/31/22. TIPS are Treasury Inflation-Protected Securities.

“We will be watching TIPS values closely over the next several months as the Fed’s tightening ramps up,” Ng says. “In particular, if the Fed begins reducing its balance sheet growth, it could have a negative impact on these bonds. Fed purchases are responsible for roughly 20% of TIPS demand.”

Owning a TIPS fund as a longer term strategy for preserving purchasing power might be a reasonable choice for some investors. Consider even a medium-term time horizon: The TIPS Index has only seen one period of modest negative three-year annualized returns since the inception of TIPS in 1997.

TIPS have notched positive returns over most three-year periods

Source: Morningstar. Monthly rolling returns shown for the Bloomberg U.S. Treasury Inflation-Protected Securities Index between 2/29/2000 and 12/31/21 (from when TIPS were first created in 1997).

A TIPS fund may also be worth considering prior to retirement. At this point in a person’s investing cycle, purchasing power becomes extremely relevant as investors nearing or entering the distribution phase begin relying on their investments to contribute to income.

Core and core-plus bond funds are another option

But what if an investor is neither nearing retirement nor feels the need for a long-term TIPS exposure, but still worries about inflation’s impact on their portfolio? Some actively managed core and core-plus bond funds — the sort that aim to provide ballast to a diversified portfolio — seek to provide some exposure to TIPS as well.

The core benchmark, the Bloomberg U.S. Aggregate Index, does not contain these inflation-protected securities. So, passive index funds seeking to replicate the Bloomberg U.S. Aggregate Index do not own TIPS either. When active fund managers maintain exposure to TIPS, they are taking a view on inflation expectations indicated by breakeven rates. TIPS have the potential to be additive to fund results relative to the benchmark if they outpace that core index — even if the TIPS Index return is negative.

TIPS can be a useful tool for core fund managers. “For starters, we can purchase TIPS in a broader context,” Tuazon explains. “For example, TIPS can sometimes incur losses when yields are rising due to their interest rate exposure. If we have conviction that inflation will rise along with rates a hedge could be put in place to seek to mitigate that interest rate risk while still benefiting from the inflation protection.”

Like in a TIPS fund, actively managed core and core-plus funds can invest in specific inflation-linked bonds where research suggests more upside potential. As managers see inflation receding, exposure to TIPS can be reduced. This prevents the need for individual investors to attempt to time markets by getting in or out of direct investments in TIPS.

Inflation is likely to stick around for a while until central bankers get it under control. But investors have tools that can seek to limit its negative impact on their portfolios.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. While not directly correlated to changes in interest rates, the values of inflation linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) Index consists of investment-grade, fixed-rate, publicly placed, dollar-denominated and non-convertible inflation-protected securities issued by the U.S. Treasury that have at least one year remaining to maturity and have at least $250 million par amount outstanding.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

American Funds Strategic Bond Fund may engage in frequent and active trading of its portfolio securities, which may involve correspondingly greater transaction costs, adversely affecting the fund’s results.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

©2022 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Ritchie Tuazon

Ritchie Tuazon

Timothy Ng

Timothy Ng