Europe

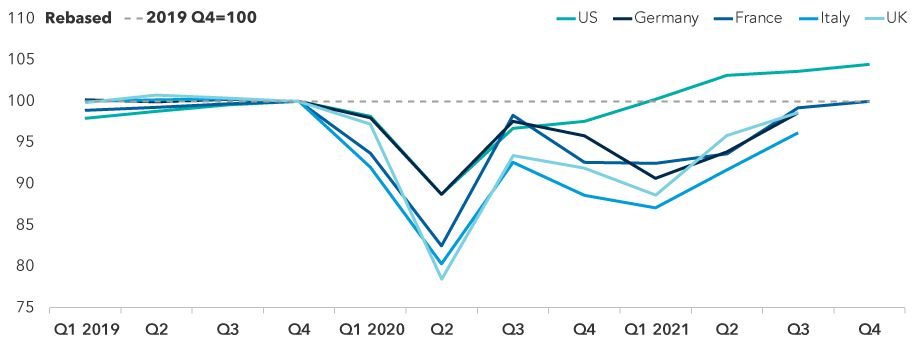

European consumer spending rebounded in 2021, but it lagged the much stronger recovery in the United States. In 2022, I expect that gap to close. Despite numerous headwinds, like soaring energy prices and falling consumer confidence, I believe Europeans will be saving less of their income this year and that there is enough pent-up demand to propel robust consumption growth.

Energy squeeze presents a challenge

In the near term, there are some obstacles for European consumer spending. Consumer confidence has dropped in all four major economies (Germany, France, Italy and the United Kingdom) for two main reasons. First, the spread of the Omicron variant late in 2021 and early in 2022 has affected consumer behavior. In the eurozone, governments implemented some tightening of restrictions, which undermined activity.

Second, European consumers have faced an intense squeeze on real incomes as inflation has jumped over the past six months. Headline CPI inflation rates have now risen well above official 2% targets in all four economies. Notably, Germany, Italy and the United Kingdom have seen inflation rates rise above 5%.

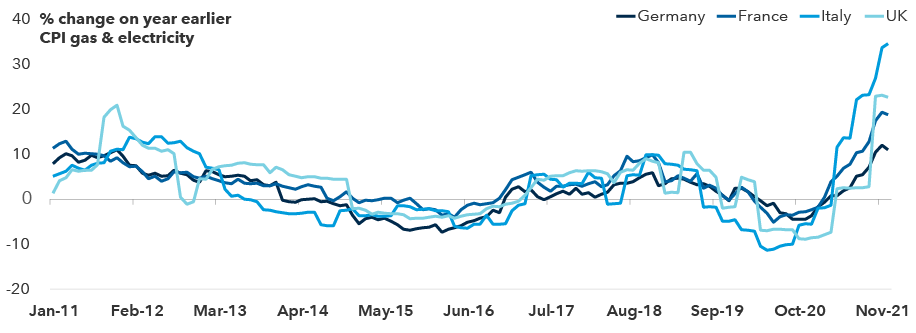

There are many factors underpinning this rise in inflation. In Germany’s case, tax changes have pushed up the inflation rate. But there are common influences in all four economies. The largest factor across the board is that European consumers are absorbing a huge increase in energy prices.

European energy costs shoot skyward

Sources: Eurostat, ONS

The outlook for energy prices is likely to be critical in determining the profile of inflation through the course of 2022. Following the December spike, wholesale gas and electricity prices have dropped back, though they remain well above where they were in late summer 2021. In their inflation projections, the European Central Bank and the Bank of England assume that energy prices will fall further. On this basis, headline inflation rates should drop in 2022, alleviating the squeeze on real incomes.

In the eurozone’s major economies, headline inflation appears close to a peak, meaning relief for consumers could be coming soon. In the U.K., headline inflation likely will continue to rise early in 2022 as higher energy prices feed through to consumers. Currently, it looks like U.K. inflation could peak at around 6%–7% in the spring, which implies an intense real income squeeze on households.

But clearly there is considerable uncertainty around these energy price assumptions, especially given developments on the Russia–Ukraine border. Colder weather over the next few months could also increase energy demand and prices.

Fiscal support and surging labor markets offer relief

Should energy prices remain high, there are two mitigating factors that could shield consumers. First, governments are acting directly to alleviate the impact of higher energy prices. The French and Italian governments have been particularly active in protecting household incomes. The new German government also appears to be considering ways of helping households. And there is growing speculation the U.K. government will offer more fiscal support, particularly to low-income households.

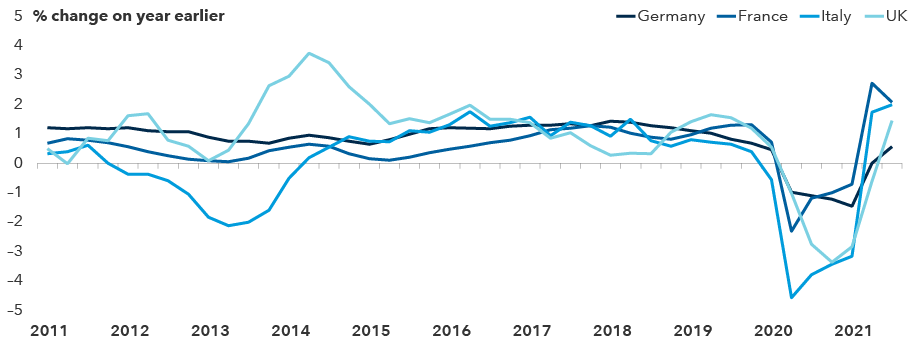

Another reason I’m confident that spending will rebound is that Europe’s labor markets are now recovering strongly, which should underpin household incomes. During the pandemic, European governments implemented furlough and short-time working schemes. These schemes were primarily designed to protect household incomes and jobs, which was in stark contrast to the U.S. fiscal stimulus that gave substantial direct cash grants to households. This helps to explain the gap between U.S. and European consumer spending over the past two years. But it also means the European labor market has been able to recover quickly as economies have reopened.

Household consumption in Europe is rebounding and closing the gap with the U.S.

Sources: BEA, Bundesbank, INSEE, ISTAT, ONS

The rebound in employment has been particularly notable in France and Italy. Strong growth in employment has tightened labor markets. In the eurozone, there are some tentative signs this is now encouraging a pick-up in labor supply. And I also expect to see a recovery in wage growth in 2022, which should support household incomes, particularly in France and Germany.

In the U.K., the labor market is even tighter. In the aftermath of the pandemic and Brexit, the U.K.’s labor supply is still around a half-million workers below its pre-pandemic level. There is no evidence of any recovery in labor supply, and I believe the Brexit labor supply shock will likely prove permanent, which could push up wage growth and boost household incomes. However, higher-for-longer inflation and tax increases are likely to depress real incomes substantially. U.K. households face another income squeeze beginning in April, when the government implements its increase in national insurance rates (effectively a tax on employment). This will likely exacerbate the impact of higher energy prices on U.K. household real disposable incomes.

Employment rates have begun rebounding

Sources: Federal Labour Office, INSEE, ISTAT, ONS

Lower savings ratios release pent-up demand

In most economies, the growth in consumer spending tends to track the growth in household disposable incomes. But even with the impact of higher inflation threatening to offset robust growth in nominal disposable incomes in Germany, France and Italy, I’m optimistic that consumer spending will continue to grow.

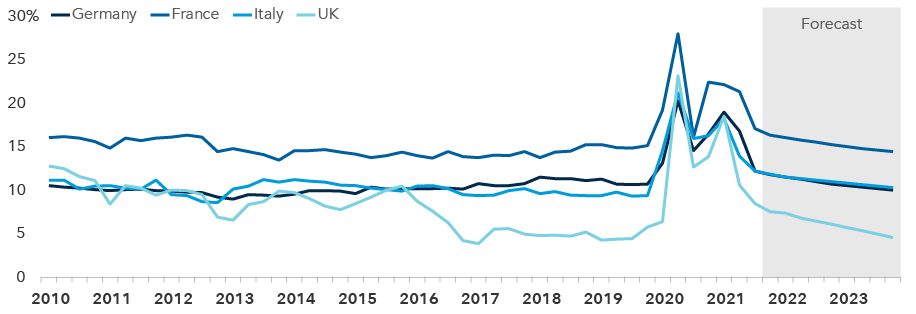

Household savings ratios are headed downward

Sources: Bundesbank, INSEE, ISTAT, ONS, Capital Group forecasts

While governments protected household incomes, consumer spending fell significantly. Consumers increased their spending on goods, but lower spending on services depressed total consumption. Savings ratios have now dropped significantly, though they are still above their pre-pandemic levels. Crucially, I expect household savings ratios to return to their pre-pandemic levels over the next two years, which should enable households to maintain strong consumption growth even in the face of weaker real incomes. In all four economies, I expect real consumption growth to outpace real income growth over the next two years. In Germany and France, real consumption could grow around 4%–4.5% in 2022. In Italy and the U.K., consumption could grow by around 3%.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

Stay informed with our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Economic Indicators

-

Currencies

-

World Markets Review

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Robert Lind

Robert Lind