Market Volatility

Bonds

As the risk of recession looms large over financial markets, how will securitized credit fare? It’s a growing area of bond markets that has become an important anchor of some actively managed fixed income portfolios. Portfolio manager Xavier Goss, who manages securitized credit in American Funds® Multi-Sector Income Fund and American Funds® Strategic Bond Fund, discusses the reasons he remains optimistic on several areas of this market despite some near-term challenges.

The economic outlook is mixed

The U.S. Federal Reserve is obviously looking to bring inflation under control, which means we will likely see the economy slow down and unemployment go back up. But while tightening financial conditions should be a headwind, consumers have remained strong because of wage inflation and low unemployment, as well as the subsidies they received directly from the government. Therefore, even if we head into a recession, consumers are starting from a much better position than they were in the lead-up to the global financial crisis.

Overall, it is not a bad time to be looking at fixed income broadly. With the backdrop of rising unemployment and slower growth, I do expect defaults to increase from current low levels, but relatively tight underwriting standards and a stronger consumer should help mitigate downside risk. Additionally, the excess yields available from investment-grade (BBB/Baa and above) and high-yield corporate bonds are beginning to attract “crossover” investors who are dipping their toes into fixed income. There is a lot of cash in the system and new issuance is low. This could provide a nice backstop for the securitized market.

1. Asset-backed securities provide income, diversification

Securitized credit today is a large and diversified sector. At one end of the spectrum, you have asset-backed securities (ABS), comprising consumer credit such as student loans and auto loans. At the other end, you have commercial mortgage-backed securities (CMBS), backed by loans on a variety of assets such as industrial warehouses, office buildings and retail malls. The securities are segmented into different credit ratings, depending on the level of collateralization (i.e., the value of the assets backing the loan) and/or their position in the capital structure.

Today in the portfolios I manage, the largest relative exposure in securitized credit is to asset-backed securities backed by consumer loans. I am optimistic about the continued strength of consumers’ balance sheets. Given where we are in the financial cycle, I prefer taking shorter duration credit risk in consumer loan sectors as opposed to longer duration commercial assets. ABS look attractive in this rising rate environment as they tend to have significantly shorter duration (meaning they are less vulnerable to interest rate fluctuations). These assets have tended to be good diversifiers and income generators for portfolios.

Consumers remain strong despite economic headwinds

.png)

Sources: New York Fed Consumer Credit Panel, Equifax. Data from 1/1/2003 through 6/30/2022.

In the coming years, I expect there will be significant divergence in performance across sectors. This should increase the opportunity to generate alpha through security selection. Bonds backed by subprime auto loans are a good example of asset-backed securities that have shorter duration and increased credit risk, depending on the originator of the loans. This is an area where credit research can add substantial value.

Private student loans are another example. Credit risk on these loans has come down marginally because of President Joe Biden’s move to provide debt relief to educational loan borrowers, though the program is being challenged in court. Private student loans are, of course, not being forgiven by the government, but it is common for students to have both a federal loan and a private loan. However, the debt relief on the federal loans should lighten the overall debt load, thus the credit risk on private loans should be lower. If the program receives approval to go ahead, it would likely provide a further catalyst for the sector.

Overall, the portfolios I manage are about a year-and-a-half to two years short spread duration versus their benchmarks. (Spread duration is a measure of how the price of an asset moves in relation to its credit spread.) I believe financial conditions will tighten further, and as a result, structured credit spreads need to widen from current levels. I try to keep the investment portfolios I manage balanced between income generation and total return. So, while the market is tilting toward a risk-off stance, I want to own a decent amount of assets that provide a strong revenue stream.

Even with the Fed tightening aggressively, I do not expect unemployment to spike significantly in the next 12 to 18 months. So, if I am buying a bond that matures in two to three years, I am comfortable going down in credit quality given the shorter maturities.

2. Select opportunities in CMBS despite retail headwinds

Commercial mortgage-backed securities are a different story from consumer ABS. These assets are longer duration in nature and closely tied to gross domestic product (GDP) growth and corporate profits. I currently favor the more senior part of the capital structure in CMBS. In a slowing economy, I don't really want to own long-duration intermediate-risk (mezzanine) tranches as they tend to be more vulnerable to slowing GDP growth.

While I remain cautious on CMBS overall, there are some corners of the market that still look attractive. In terms of the underlying collateral of these bonds, warehouses for companies like Amazon and other large retailers, data centers and industrial buildings have held up better, but there is still a lot of uncertainty in the office and retail sectors. Some companies are bringing their employees back to the office five days a week, which should be positive for CMBS. But it is impossible to project what the office sector will look like in the coming years. Lower office attendance has also meant less foot traffic in commercial city centers, which can be a headwind for retail. But even if the reopening brings more people into stores, the retail sector is still facing the same challenge it has faced for years with people shopping more online.

I see better opportunities in commercial mortgages in single-asset, single-borrower (SASB) deals, where instead of the bonds being backed by a broad portfolio of commercial real estate, it's just one asset or a small handful of assets. The majority of the total volume of deals coming to market this year have been SASBs. This is representative of a shift in investor preferences. Single-asset borrower deals are also easier to analyze than a traditional CMBS that contains multiple underlying assets. Currently, in portfolios I manage, the CMBS sleeves are almost equally split between SASBs and more traditional conduit deals backed by multiple properties.

Single-asset CMBS have gained significant market share

.png)

Sources: Capital Group, Bloomberg. Data as of 10/13/22.

3. Managing risk in non-agency residential mortgages

In non-agency residential mortgage-backed securities (RMBS) assets, I currently prefer credit risk transfer securities, which are government-originated loans that have been offloaded to the private sector. I think the biggest potential headwinds in this sector are extension risk and a moderate increase in delinquencies as unemployment increases. With rising interest rates, borrowers are likely to extend their mortgages. Borrowers who received loans or refinanced their existing mortgages during the pandemic when rates were below 3% are unlikely to prepay any time soon. Relative to asset-backed securities, mortgage-backed securities need much greater management of duration and convexity risk.

I am also starting to look out for deteriorating underwriting standards. Broad market underwriting standards appear to have returned to pre-COVID-19 levels as certain lenders look to increase origination volumes to meet loan demand. However, as financial conditions tighten, I expect we will see significant bifurcation in terms of what loan originators will do.

Savvy originators are likely to tighten their underwriting standards, or at least keep them consistent and be willing to let their origination volume go down as a result. On every call that our analysts and I have with originators, we ask about their underwriting standards and their origination volumes. If their volumes are up in the last year, it is an immediate red flag.

Originators that have steady backing from long-term investors tend to accept that their origination volumes can decline 20% or more given current financial conditions. I expect any weakening of standards to first appear in private equity-funded issuers since many commercial banks have maintained a more conservative stance.

Given this backdrop, I strongly believe that security selection will be a key driver of results in the coming years. We have a team of analysts that aims to sort the good originators from the bad ones.

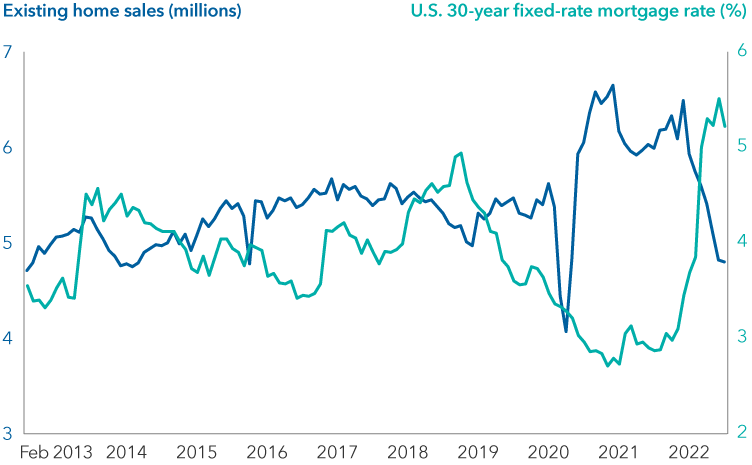

U.S. home sales have declined amid rising mortgage rates

Source: Refinitiv Datastream. Data as of 9/15/2022.

4. Highly selective on CLOs

One of the key benefits of having securitized credit in a diversified fixed income portfolio is that it has a lower correlation with corporate credit. You can generate similar returns while getting decent diversification. Right now, I’m looking for relative value opportunities along the same lines I mentioned before: shorter duration credit in consumer loan sectors.

That's manifested itself in the portfolios I manage in an overweight position in consumer ABS. I am also looking to build a position in collateralized loan obligations (CLOs), although I am highly selective and opportunistic when investing in these securities. I think there is going to be an opportunity in CLOs, but for now there are a lot of technical headwinds. Valuations are relatively high and there are a significant number of loans sitting on dealer warehouse lines, which have not yet been securitized. U.S. and Japanese banks, which have historically been large investors in CLOs, are also dramatically reducing their demand due to recent changes in the regulatory environment for U.S. banks. Meanwhile, a strong U.S. dollar is reducing demand from Japanese banks. That leads me to believe spreads are likely to grind wider in the coming months. Given the above technical backdrop, potential purchases in the future will be very slow and deliberate.

5. Fundamentals are supportive of securitized credit

While an economic slowdown always increases risk, I am less worried about forced selling by leveraged investors than I have been in past cycles. Many securitized credit investors have been cautious on the market since the start of 2022 and are holding significant cash positions.

It is probably one reason credit spreads have held up relatively well despite the recent selloff in equities. Another factor supporting structured securities is that there is just not a lot of supply coming to market. New issuance in the corporate sector is down around 30% year over year; structured products supply is lower by around 50% relative to the prior year.

While the risks emanating from a weakening economy cannot be ignored, the securitized credit market appears to be in a pretty good spot overall from a fundamental perspective. I expect overall credit fundamentals to weaken, but security selection will be the key to alpha generation in the coming years. There will be ample opportunities to utilize our deep credit analysis to add value for clients.

Credit spreads refer to the difference in yield between securities with different credit quality and the same maturity.

Subprime loans are loans offered to borrowers with lower credit quality.

Convexity measures how a bond’s duration changes as interest rates fluctuate.

Our latest insights

-

-

Market Volatility

-

-

Artificial Intelligence

-

Interest Rates

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Xavier Goss

Xavier Goss