Market Volatility

Bonds

- Internet commerce continues to shake up retailers.

- Discount retailers are coping better than larger brands.

- With bonds pricing at rich levels, we remain selective.

Brick-and-mortar retail stores are under pressure like never before. Although the trend began two decades ago, internet commerce has changed the retail landscape in a profound way and at unprecedented speed.

Retailers have navigated a history of cyclical pressures ranging from soft economies, swings in real estate valuations, supply chain disruptions and evolving consumer behavior. However, the current environment is different, creating structural fissures that have shuttered many stores and forced them to rethink their business models.

The challenges retailers face

Not all retailers face gloom and doom, but many continue to struggle. The explosion in internet commerce has forced many brick-and-mortar retailers into shrinking their physical footprints and/or trying to shift more business online. Across many developed markets in recent years there have been other unwelcome factors, such as:

- Anemic wage growth

- Altered consumer behavior since the Great Recession (e.g., consumers hooked on discounts or promotions)

- The growing impact of millennials with both diminished brand loyalty and new consumption patterns

E-commerce has brought two clear structural changes, impacting balance sheets, credit profiles, ratings and bond valuations of such companies. First, greater price transparency has put pressure on the margins of many brick-and-mortar retailers since they have a relatively higher fixed-cost base than their online peers. Hence, adjusted profit margins are unlikely to return to historical levels anytime soon.

Second, traditional business models are shifting. Most large retailers have been actively managing their real estate with a view to closing underperforming (but sometimes still profitable) stores. They are maximizing investments in good locations while adjusting or investing in distribution and warehouse capabilities. Nevertheless, many companies are still in the early stages of a longer term effort to grow their online businesses, while strategically repurposing physical stores to support an omni-channel sales approach.

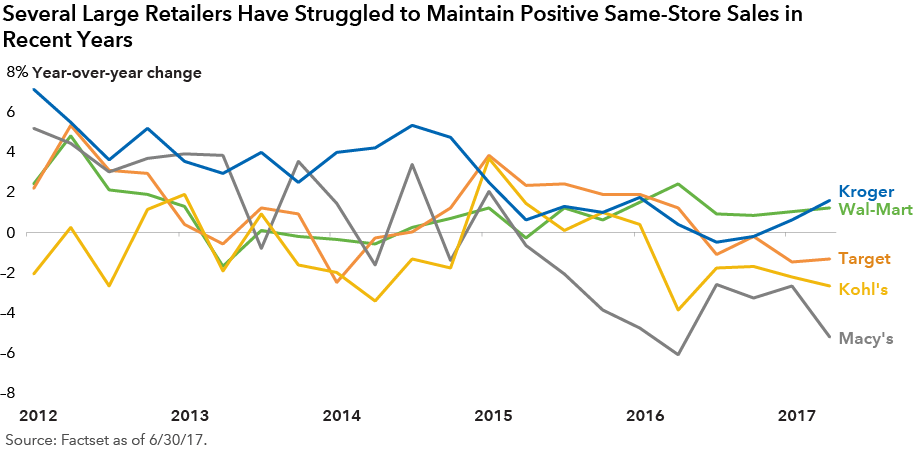

Discerning the winners from the losers

Across the retail sector, the impact is uneven. The least affected retailers thus far are deep discounters, such as Dollar General and T.J. Maxx. Other less impacted subsectors include large home improvement retailers, such as Home Depot and Lowe’s, and aftermarket auto parts stores like AutoZone.

Meanwhile, the retail grocery segment also is changing rapidly. Amazon is one of many competitors, with most large grocers (including Wal-Mart as the largest) attempting to develop effective online platforms while trying to address changing consumer preferences. Office supply and department stores have been the worst hit by the e-commerce storm, experiencing meaningful deterioration in financial performance and credit ratings.

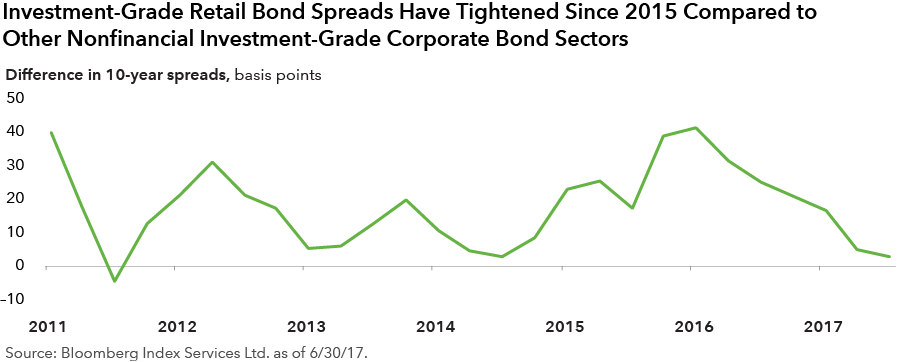

In summary, structural transformation and heightened credit risks persist for many investment-grade retailers as many bonds are approaching historically rich valuations. Within the context of a market landscape characterized by low interest rates and relatively tight bond spreads to Treasuries and in the absence of adequate compensation to bond holders for the spectrum of risks, we continue to take a cautious approach to investing in this evolving retail universe.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

Market Volatility

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Steve Lotwin

Steve Lotwin