U.S. Equities

Bonds

This article was originally published on May 23, 2018. It has been updated to reflect market conditions.

With stock markets showing increased volatility in the past year, building resilient and balanced portfolios should be a priority for investors. After all, today’s backdrop of simmering trade tensions, moderating growth and tighter central bank policy all add uncertainty to the outlook. Volatility isn’t going away anytime soon.

With that in mind, now’s a perfect time to revisit the question: Why fixed income? Fixed income serves four key roles in a portfolio: Diversification from equities, capital preservation, income and inflation protection. Many investors would benefit from evaluating whether their bond holdings are meeting these goals.

Capital Group regularly meets with thousands of advisors to evaluate their portfolios and offer our perspectives on potential enhancements. Common problems often surface. Some funds have too much risk embedded in bond allocations. Others develop high correlations to equities due to reaching for yield beyond what may be prudent.

In fact, according to Morningstar’s best-fit index methodology, which uses a quantitative method to determine which index a fund most closely resembles, roughly 88% of the intermediate-term bond category did not behave like a true core fund. Instead, for the three years ended December 31, 2018, most of these funds behaved more like a credit index, according to Morningstar data.

Style drift like this, in addition to other pitfalls, can be addressed by refocusing on the four roles that fixed income is designed to play in a portfolio.

What goals can fixed income help you pursue in your portfolio?

We believe bonds can serve four central roles in a balanced portfolio. These roles can aid in pursuing retirement goals or simply help stabilize a portfolio to be more resilient when economic shocks hit markets.

1. Diversification from equities

Your bonds shouldn’t behave like stocks when volatility hits.

If the stock market always rose, then many investors might not bother with bonds. But unfortunately, equity markets often experience volatility and corrections. When this happens, it’s important to have investments within a portfolio that are designed to provide resilience. That is the essence of why investors should seek balanced, diversified portfolios. When one part of a portfolio struggles, another part can pick up the slack.

Many bond allocations may not be ideally positioned to weather a stock market decline. They hold potential “hidden” risks in the form of high correlations between the fixed income and equity portions of the portfolio. For instance, they may hold funds with an outsized allocation to higher yielding bonds, which historically have had a high correlation to equities and tend to decline in value when stock markets decline. In contrast, fixed income sectors such as Treasuries and agency mortgage-backed securities have tended to provide good diversification from equities.

For that reason, investors should seek to upgrade their portfolio with funds that provide diversification from equities. These can be good building blocks to help dampen volatility and create durable portfolios. These strategies often have had a low correlation to equities because they invest in higher quality bonds that tend to hold up well when stocks suffer losses. This stability can help enable an investor to rebalance when equities are priced more attractively and to take advantage of market cycles. This approach can help investors achieve long-term investment and savings goals.

2. Capital preservation

A durable portfolio needs a strong foundation.

If equities decline sharply, and a portfolio only contains equities, the portfolio could lose a substantial amount of capital. That’s a particularly serious situation for investors who are nearing retirement, and underscores another important role of fixed income: To help preserve capital.

Unlike equities, high-quality fixed income securities can serve as an all-weather foundation for a portfolio. This advantage can be seen even when looking at medium-term rolling returns for bonds or bond funds with capital preservation as their chief objective.

Although losses can occur over short-term time horizons, history shows that high-quality fixed income investments can offer a measure of stability over time. Historically, they have demonstrated a very strong track record of protecting capital. Short-term periods of losses have tended to be minor in comparison with declines in equities or a bond sector like high yield.

Bonds issued or guaranteed by stable governments or corporations with good business models and solid balance sheets can be key building blocks for a capital preservation strategy. Bonds structured to be backed by strong collateral also can achieve very high quality ratings. Many of these securities have credit ratings at the upper end of the investment-grade spectrum. That said, ratings are only one of many metrics we use to establish the capital preservation aspect of securities. The more risk-averse an investor is, the larger the capital preservation component of their portfolio is likely to be.

3. Income

It’s called fixed income for a reason.

Another way fixed income fundamentally differs from equity is its explicit income component. Although some common and preferred stocks pay dividends, these income streams can fluctuate or disappear at a company’s discretion. Bonds carry more explicit and predictable income streams in the form of coupons, so long as the issuer remains solvent. While the yield will fluctuate with the price, coupons on fixed rate bonds typically do not change.

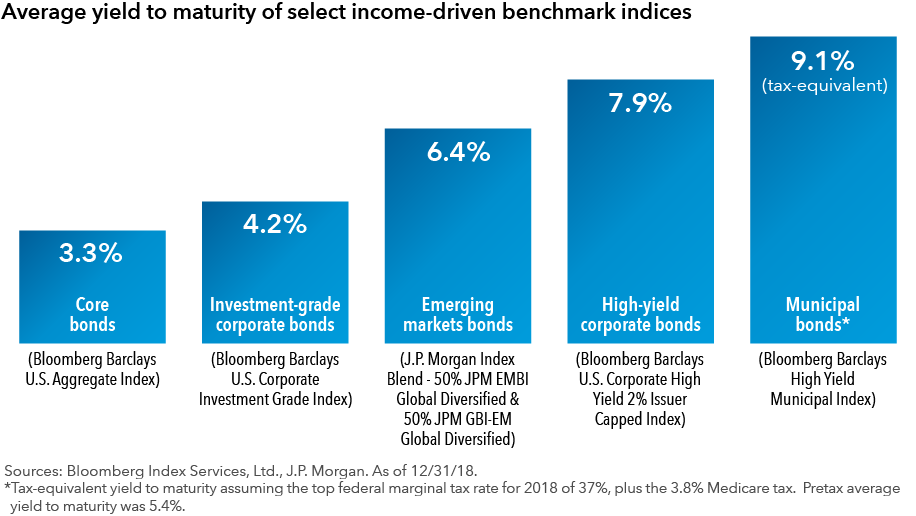

For this reason, bond funds typically provide some income, with higher yielding bonds generally associated with additional risk. This steady source of investment income can play an important role for many investors, such as retirees who may rely on it for monthly living expenses.

However, years of rock-bottom interest rates have resulted in some style drift by select bond funds that now are holding riskier bonds to augment their yield. This added risk is especially prevalent in some of the top-performing funds, even in categories that traditionally have focused on capital preservation.

While income should be a component of any diversified portfolio, it is prudent to monitor the portion of a fixed income allocation dedicated to higher yielding bonds. Specifically, these holdings should not be regarded as a key source of capital preservation or diversification from equities — they may not perform those roles well.

In a market environment where credit valuations are still arguably high in historical terms, caution is advisable. Investors may potentially take on too much equity-like risk by allowing high-yield corporates to dominate their bond allocations. In a classic 60-40 portfolio, for example, allocating up to a quarter of the 40% fixed income to income might be considered reasonable for some investors. That said, investors should work with their advisors to determine the appropriate allocations for them.

4. Inflation protection

Even modest inflation can erode wealth over time.

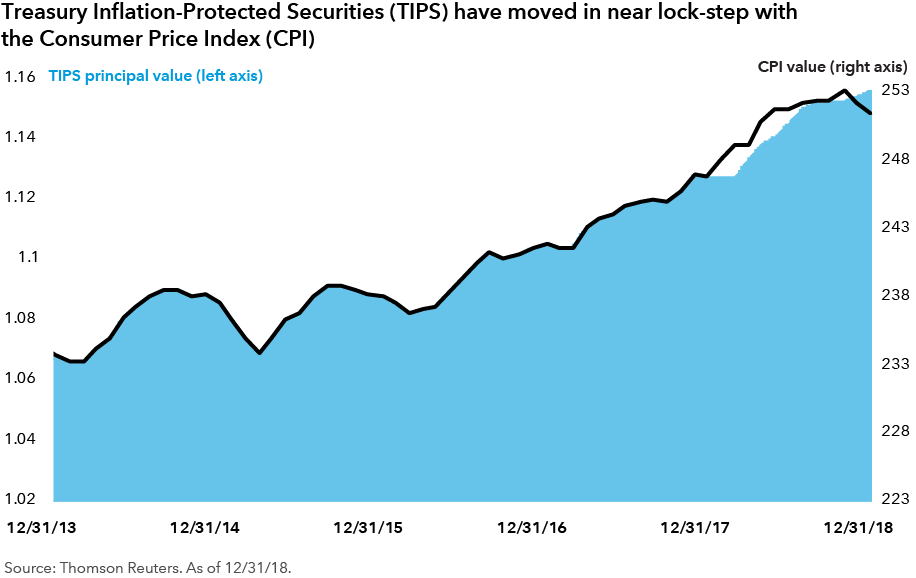

Inflation has ebbed and flowed lately. The core Consumer Price Index (CPI) — the inflation measure that strips out volatile food and energy prices — moderated, dropping from 2.4% in mid-2018 to 2.2% in December 2018. A drop in fuel prices also prompted headline inflation to fall.

That said, economic growth and a tight labor market should be supportive of inflation over time. Even if inflation were to remain stuck near the Federal Reserve’s modest 2% target for a decade, that reduces a portfolio’s purchasing power by 18% over those 10 years.

While some investment vehicles can provide indirect protection against inflation, an inflation-linked bond fund can more explicitly preserve purchasing power. This goal can be achieved by owning funds that invest in bonds whose valuations have an explicit link to the CPI, such as Treasury Inflation-Protected Securities (TIPS). The principal value of TIPS adjusts with changes in CPI so that as inflation rises, the principal value increases to preserve purchasing power. Inflation-linked funds can provide more precise protection for purchasing power, especially when inflation is unexpectedly strong.

The bottom line

For long-term investing, balance is key. Investors who seek a balanced portfolio should ensure that their fixed income allocation serves all four roles. Now may be a good time for investors to run a checkup on their fixed income portfolios and consider making the following adjustments:

- Upgrade your core bond allocation to help provide elements of all four roles of fixed income — including diversification from equities.

- Diversify portfolio income by considering emerging market debt or high-income municipal bonds strategies to complement high-yield corporate bonds.

- Look to munis for more than just tax-free income. Municipal bonds can offer attractive after-tax yields for investors in higher income tax brackets, as well as diversification from equities.

Want to learn more? Explore the investment implications of our fixed income outlook. Remember: No matter how market conditions may evolve, bond allocations that provide elements of all four key roles can bring balance to portfolios and help investors achieve better long-term outcomes.

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg Barclays Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

Bloomberg Barclays U.S. Government/Credit 1-7 Years ex BBB Index is a market-value weighted index that tracks the total return results of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to seven years, excluding BBB-rated securities

Bloomberg Barclays Municipal Short-Intermediate 1-10 Years Index is a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years.

Bloomberg Barclays U.S. Corporate Investment Grade Index represents the universe of investment grade, publically issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements.

Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

Bloomberg Barclays High Yield Municipal Bond Index is a market-value-weighted index composed of municipal bonds rated below BBB/Baa.

These indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Our latest insights

-

-

-

Global Equities

-

Economic Indicators

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Kelly Campbell

Kelly Campbell