Market Volatility

China

Since 1973, New Perspective Fund® (NPF) has sought to take advantage of changing global trade patterns. Today, the winds of change are stirring as the U.S. seeks to dramatically alter its trading relationship with China through steel tariffs and other punitive measures. Just last week, U.S. trade officials vowed to increase the pressure by imposing additional tariffs and seeking to block China’s technology-related investments in the United States.

Steve Watson is an NPF portfolio manager with 12 years of experience on the fund and 30 years in the investment industry. For the past 18 years, Watson has lived and worked in Hong Kong, where he’s had an up-close view of the changes taking place in China. Watson sat down to discuss his view of increasingly tense U.S.-China trade relations, his outlook on Chinese and global equities, and his flexible approach to guiding NPF through periods of volatile markets and geopolitical turmoil.

Q: Do the recent headlines focusing on U.S.-China trade disputes affect your view on the outlook for China-based investment opportunities?

A: We need to watch the situation carefully because it is a serious dispute and it does have the potential to grow into something very ugly and very disruptive. But if I step back and consider the long-term outlook, I remain enthusiastic about China from an investment perspective. China’s economy is growing at an annual rate of roughly 6.5%. We may see that growth decline a bit, but it’s worth keeping in mind that China had been growing at a rate north of 10% a few years ago. We’ve seen it cool down to this level, which I think is appropriate as the economy matures. I think China’s economy will continue to grow at a healthy pace and we should be able to find attractive investment opportunities there for many years to come.

Q: How do you think China’s leaders will react to the latest round of tough talk from the United States?

A: The Chinese focus much more on action than on rhetoric. So far, they have responded with some tough talk and significant tariff proposals of their own, but they’ve also mixed in some conciliatory messages and what seems like a genuine desire to avoid a full-blown trade war. Let's hope the situation doesn’t get out of hand but, for now, it looks containable.

One thing worth remembering is that the really important trade flows today involve data and capital. That kind of international trade is much more difficult to restrict. While I hope we don’t see a clampdown on the flow of physical goods around the world, I do take some comfort in the fact that the most important flows — data and capital — are likely to continue moving around the world relatively unimpeded.

Q: Illegal subsidies and intellectual property misappropriation also have been cited by the U.S. as major areas of contention. What approach do you think China will take on those issues?

A: I suspect the Chinese have been surprised in recent years that we haven't pushed back harder on these issues. My guess is, they've been expecting it. I think it would be appropriate for China to pursue reforms in these areas, particularly as its economy matures and China develops its own intellectual property that it wants to protect. I would like to think that China will be open to becoming more like other developed nations in this regard. Let’s hope that pragmatism reigns.

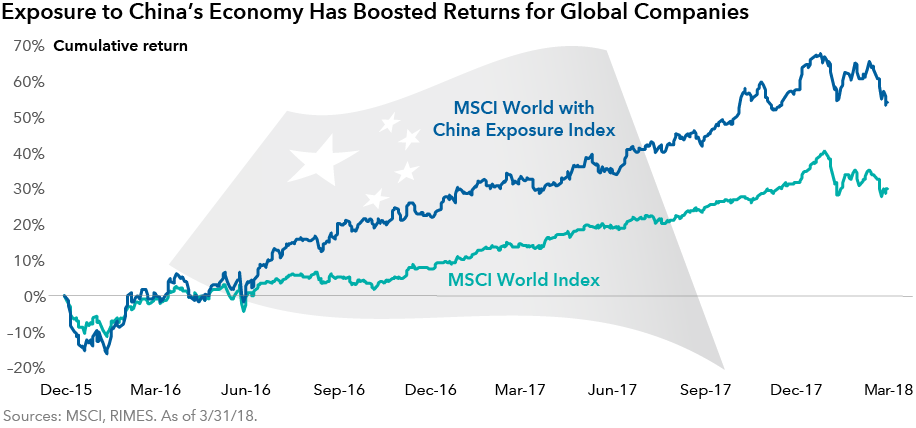

Q: Chinese stocks posted impressive gains in 2017. What explains those strong results in your view?

A: 2017 was an interesting year. There was a “wall of worry” that had to be climbed, particularly by Western investors. The “coming collapse of China” was a phrase you heard repeated a lot. There was a strong feeling that China was going to experience a property market collapse, or a debt crisis, or some other kind of large dislocation. As those fears began to fade in 2016, the market was able to rebound and climb that wall of worry. I think we are now in a place where investors are able to take a more rational look at the Chinese economy and Chinese investments, without so much hysteria in the background.

Q: Emerging markets also did well last year. Do you think there is more room to run?

A: The recent strong showing from emerging markets comes on the heels of a long dry spell when it didn’t go quite as well. Now, in 2018, we find ourselves in a world characterized by synchronized global growth and a relatively weak U.S. dollar. Those two elements, historically speaking, have been good for emerging markets investing.

I think those conditions will continue for a while and so, yes, I am enthusiastic about emerging markets with the disclaimer that it’s more difficult today to think of emerging markets as a single category. It’s a very diverse asset class with unique characteristics in each country and each company. Just think about how different China is from Brazil. That’s why it’s so important to look at each potential investment on a fundamental, company-by-company basis.

Q: How would you describe your investment style?

A: I am a contrarian, value-oriented investor. I look for excesses of enthusiasm and I try to avoid those areas. I look for excesses of pessimism and I try to find value in those areas. So, essentially, I find myself avoiding happy places and seeking out unhappy places.

I’ll give you an example – a Brazilian mining company called Vale. I became interested in Vale about three years ago when Brazil was in political turmoil, the economy was in recession, and Vale itself was immersed in scandal. Meanwhile, the iron ore that Vale sells to the world had collapsed in price. So my natural response was, that sounds very interesting. And, after a lot of pain and uncertainty, the company was able to right the ship. (Vale is held in the NPF portfolio at a weighting of 1.1% of assets, as of March 31, 2018.)

Q: NPF focuses on multinational companies that can take advantage of changing global trade patterns. Given that approach, are you concerned about the rise of protectionism around the world?

A: There is risk associated with the trade in physical goods around the world, but not all of the multinational companies that we invest in are directly involved in shipping goods around the world. When you look at some of our major personal-care investments, for example, these are companies that have multiple subsidiaries around the world doing business as though they are local companies.

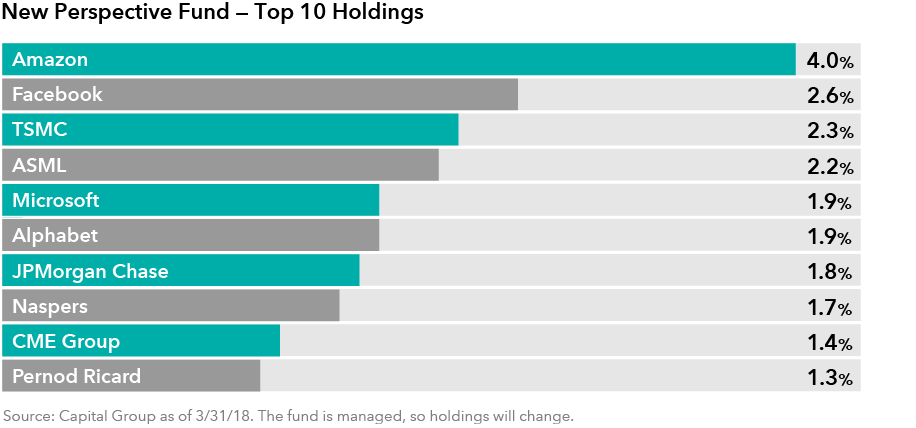

While a clampdown on the flow of physical goods could potentially be impactful for a shipping company, it would not necessarily impact some of the other strong, multinational companies that are held in the NPF portfolio. As I noted earlier, it might be less impactful for companies engaged in data or capital flows, which you will also find in the NPF portfolio — companies such as Alphabet, Microsoft and JPMorgan Chase.

Q: In your view, where does NPF fit in an overall, diversified portfolio of mutual funds?

A: NPF provides investors with exposure to growth-oriented, multinational companies that tend to do well in up markets while also demonstrating the resilience, flexibility and balance sheet strength needed to ride out down markets, oftentimes better than companies that operate in a single, domestic market. NPF can add global flexibility to the core of a portfolio. We’ve long advocated the approach of including some truly global exposure to portfolios, rather than strictly dividing them into regional slices.

NPF is contained in several of Capital Group’s model portfolios. In one example, the American Funds Global Growth Model Portfolio allocates 20% of its assets to NPF, with the remainder spread out among five other funds. In a more conservative approach, NPF makes up 10% of the American Funds Moderate Growth and Income Model Portfolio.

Content contained herein is not intended to serve as impartial investment or fiduciary advice. The content has been developed by Capital Group, which receives fees for managing, distributing and/or servicing its investments.

For more information about the risks associated with each fund, go to its detailed fund information page or read the prospectus.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Steve Watson

Steve Watson