Market Volatility

Trade

Global trade tensions are on the rise. And while much of the attention has centered on a series of retaliatory tariffs between the United States and China, trade disputes with European and North American allies also have strained traditionally friendly relationships.

Investors should avoid putting too much emphasis on the short-term noise of daily trade rhetoric, but the eventual outcome likely will have economic, investment and political implications across the globe. To provide guidance on a complicated and rapidly changing situation, Capital Group’s investment team selected six charts that highlight a key takeaway for the current state of global trade.

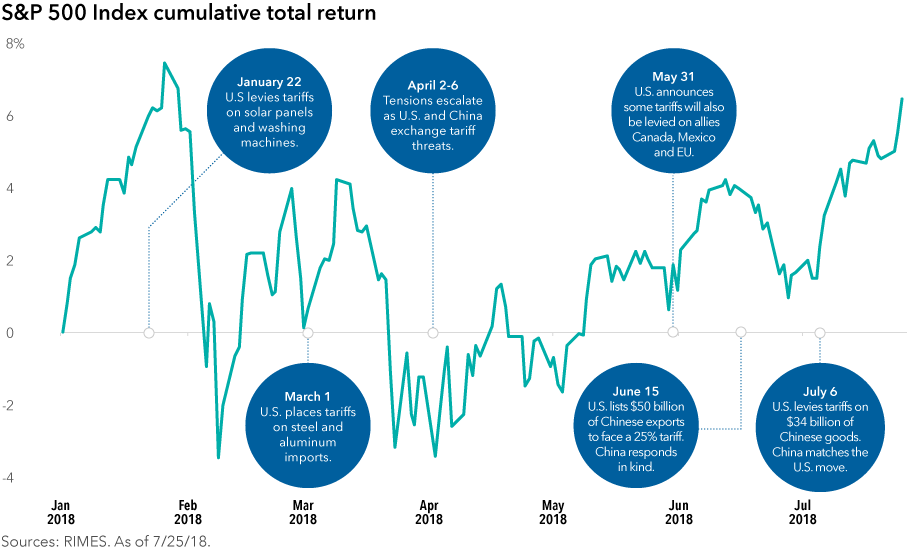

1. Concerns over a possible trade war with China have unsettled markets.

Markets were calm in 2017, but that changed early this year. With equity valuations near historic highs, external factors are having a greater influence in unsettling markets. And while regulatory scrutiny of tech companies and threats of higher inflation also have contributed to market jitters, the looming shadow of global trade has overshadowed most other issues.

The initial announcement of U.S. tariffs — on solar panels and washing machines in late January — preceded the country’s first market correction since 2016. Since then, equities often have moved in step with global trade headlines. Markets bounced around wildly when the first week of April saw a volley of escalating threats between the U.S. and China. As trade talk diminished, investors felt more comfortable returning to riskier assets. Markets drifted upward until late June, when the U.S. threatened $200 billion in tariffs on Chinese goods and sent markets downward once again.

The situation remains in flux. In just the last week, the U.S. went from suggesting automobile tariffs could be on the way to issuing a joint statement with the European Commission chief announcing an intention to work toward “zero tariffs, zero non-tariff barriers, and zero subsidies.”

2. So far, it’s more talk than action.

Much of the volatility has been a result of investors trying to interpret to what extent the threats would come to fruition. So far it has been a small portion, although the situation remains fluid. Recently the U.S. threatened tariffs on an additional $400 billion of Chinese exports — a figure that far exceeds China’s imports from the U.S. Capital Group political economist Matt Miller believes this imbalance raises the risk that Beijing will retaliate with nontariff measures, such as consumer boycotts or heightened enforcement of regulations on American businesses operating in China.

“Even as the battle heats up, one shouldn’t assume that President Trump’s unusual and aggressive negotiating style is a prelude to an all-out trade war, which would hurt both sides,” Miller said. “As each side feels the other out and tests the other’s mettle and ultimate goals, it seems likely that we’re in for an unsettling period of tit for tat that may rattle markets and companies caught in the crossfire.

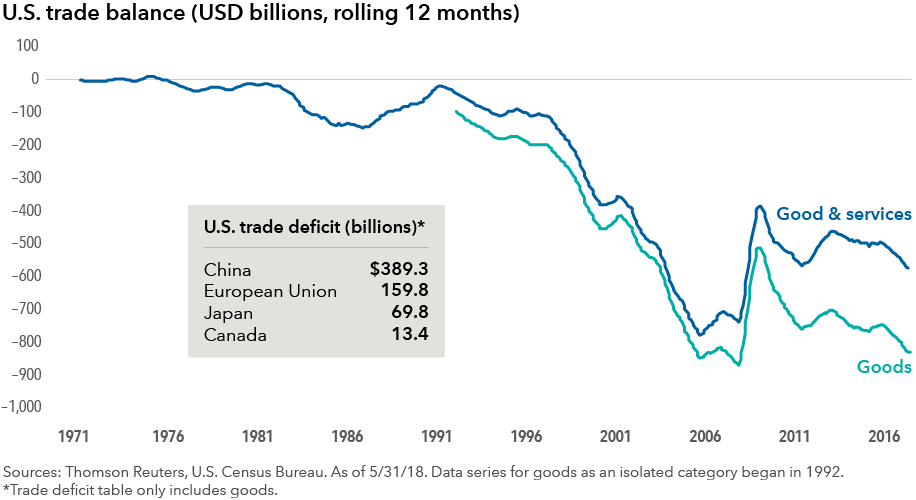

3. Tipping point: U.S. trade imbalances have deteriorated for years.

The U.S. trade deficit has increased dramatically over the last 25 years, prompting the new administration to try to reverse the trend. Capital Group Vice Chairman and portfolio manager Rob Lovelace noted this approach has been a long time coming.

“President Trump has talked about his issues with trade deficits for decades,” Lovelace said. “It features in many of his public comments throughout his business career. He has stated the U.S. needs better balance in trade accounts with all other countries. In line with this view, the administration wants a dramatically reduced trade deficit in physical goods.”

4. China is in the spotlight after reaching record trade deficit.

Although Trump would like to reduce the deficit with all countries, his biggest target has been China. The U.S. trade deficit with China was $376 billion in 2017, with exports at $130 billion and imports at $506 billion. In addition to tariffs, the administration has considered blocking Chinese firms from buying U.S. companies with industrially significant technology. But even then, it backtracked on some of the toughest restrictions initially proposed.

.png)

Hong Kong-based portfolio manager Steve Watson notes that although risks have increased, he remains optimistic about the future of Chinese stocks. “If I step back and consider the long-term outlook, I remain enthusiastic about China from an investment perspective,” Watson said. “I think China’s economy will continue to grow at a healthy pace, and we should be able to find attractive investment opportunities there for many years to come.”

5. Digital trade is skyrocketing — and tariffs shouldn’t stop that.

Most of the uncertainty has centered on the trade of physical goods. A possible silver lining is that an increasing share of transactions now involves digital assets and ideas rather than tangible products. Cross-border digital traffic surged in the last decade and its growth is projected to accelerate over the next several years. Many aspects of the digital economy cannot be easily dictated by governments, so the impact of trade negotiations is likely to be less severe for technology companies than manufacturers.

“While I hope we don’t see a clampdown on the flow of physical goods around the world, I do take some comfort in the fact that the most important flows — data and capital — are likely to continue moving around the world relatively unimpeded,” Watson explained in a recent Capital Ideas podcast. “That kind of international trade is much more difficult to restrict.”

6. Despite the uncertainty, investors should still think globally.

Over the past several years, the rise of globalization has supported corporate growth and investment returns. And that doesn’t need to change now. Despite the potential headwinds, many of our investment professionals still find global exposure — whether it is achieved through investing in multinationals or non-U.S. domiciled companies — a good long-term strategy.

“Of course, not all global companies will thrive in this environment,” said portfolio manager Jody Jonsson. “Fundamental research will be key to identifying potential winners. Having invested in global companies for nearly three decades, I have found that successful multinational companies typically have innovative management teams, diverse sources of revenue and resilient balance sheets. These are the attributes I will be looking for as globalization enters a new era.”

Rob Lovelace agrees. “Shifts in economic and trade regimes and turning points in markets provide managers like us the opportunity to capitalize on short-term distortions in asset prices and to invest in companies that we view to be winners in the long term,” he said.

Any reference to a company, product or service does not constitute endorsement or recommendation for purchase and should not be considered investment advice.

American Funds are intended only for persons eligible to purchase U.S.-registered mutual funds.

Past results are not predictive of results in future periods.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Rob Lovelace

Rob Lovelace

Matt Miller

Matt Miller

Steve Watson

Steve Watson