Monetary Policy

- The Fed raised rates by 25 basis points at Wednesday’s meeting.

- Easy financial conditions could spur two more hikes in 2017.

- We think rates could rise more slowly if conditions tighten.

Why the Fed hiked rates

1. Financial conditions have eased since late last year. Financial conditions are financial variables, including asset prices, that can influence economic behavior and thereby the future state of the economy. The broad dollar index is roughly unchanged, 10-year Treasury yields are slightly lower, credit spreads are tighter and the S&P 500 Index is up nearly 5% since the Fed raised rates in December.

2. The economy has continued to make progress toward the Fed’s mandated goals of full employment and price stability. The labor market continues to be strong, with the economy adding an average of 180,000 jobs per month over the past six months. This has kept the unemployment rate steady below 5%, which is already equivalent to the Fed’s long-run forecast for the non-accelerating inflation rate of unemployment, or NAIRU.

On price stability, inflation is gradually rising toward the Fed’s 2% target. The January reading of the annual change in the core personal consumption expenditures (PCE) price index rose to 1.74%, ahead of the Fed’s end-of-2017 forecast of 1.7% provided by its December projections.

3. In recent weeks, several Fed officials had strongly hinted at raising rates at the March meeting. That includes core members such as Chair Janet Yellen and New York Fed President William Dudley. In prepared remarks given last Friday, Chair Yellen said, “At our meeting later this month, the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate.”

In a recent interview, Dudley advised, “The case for monetary policy tightening has become a lot more compelling,” adding that a rate rise could come “in the relatively near future.” By hiking rates at this meeting, Fed officials gave themselves more flexibility to adjust policy for the remainder of this year and reduced the likelihood of “falling behind the curve” down the road, a concern that several officials have mentioned in the past.

Aggressive rate hikes face headwinds

The Fed may soon be joined in monetary tightening by the European Central Bank. President Mario Draghi, at a press conference last week, emphasized the euro zone’s “firming and broadening expansion.” This put upward pressure on rates globally as markets begin to look ahead to positive policy rates and an eventual end to European quantitative easing.

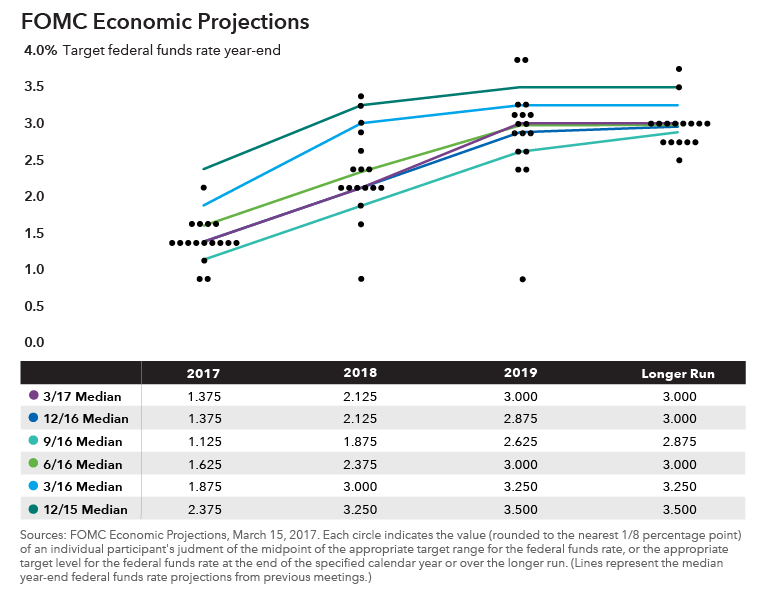

Looking ahead, additional Fed rate hikes will depend on the evolution of financial conditions and continued progress toward the Fed’s goals. On the one hand, if financial conditions remain easy and the economy evolves in a manner that exceeds the Fed’s expectations, then there may be two additional hikes this year.

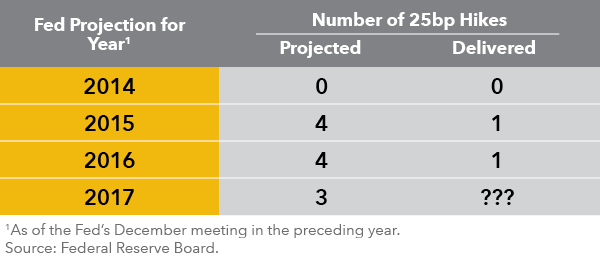

However, we think it is more likely that financial conditions will tighten once the market anticipates a faster pace of rate increases, which will then allow the Fed to hike more slowly. To illustrate this point, financial conditions tightened significantly after the Fed raised the fed funds rate in December 2015 and surprised the market by forecasting four hikes for 2016. In the end, the Fed was only able to hike once in 2016 as tighter financial conditions led the Fed to be more cautious about further removing monetary accommodation.

How did we get here?

- 2008: To cope with the global financial crisis and ensuing deep recession, the Fed took a number of aggressive monetary policy measures, including cutting short-term interest rates to near zero and implementing three rounds of quantitative easing in the years that followed.

- October 2014: The Fed ended its quantitative easing program.

- December 2015: The Fed raised rates for the first time since 2006, by 25 basis points.

- December 2016: The Fed raised rates by another 25 basis points. It also projected three hikes for 2017 at that time.

Past results are not predictive of results in future periods.

Our latest insights

-

-

-

Asset Allocation

-

-

Market Volatility

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Ritchie Tuazon

Ritchie Tuazon

Timothy Ng

Timothy Ng