Bonds

- Investors on the hunt for income may be in a strong position as inflation dips and the Federal Reserve (Fed) considers rate cuts.

- Even if rates stay elevated into 2025, we think U.S. investment-grade corporates, U.S. high-yield corporates, emerging markets bonds and U.S. securitized credit can potentially deliver strong total returns.

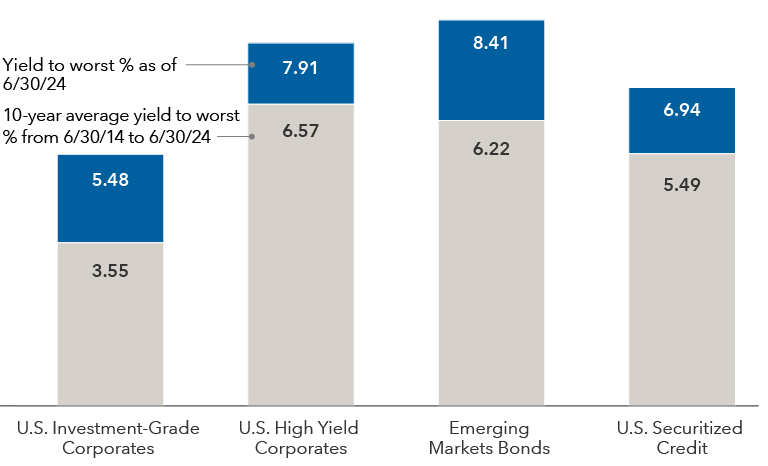

- In fact, the current yield to worst among these sectors is sharply higher than its 10-year average.

Investors on the hunt for income may be in a strong position as inflation dips and the Federal Reserve (Fed) considers rate cuts. Even if rates stay elevated into 2025, we think U.S. investment-grade corporates (BBB and Baa and above), U.S. high-yield corporates, emerging markets bonds and U.S. securitized credit can potentially deliver strong total returns. In fact, the current yield to worst (in this case, the lowest possible yield that a bond portfolio can generate if the underlying issuers fulfill all their payment obligations) among these sectors is sharply higher than its 10-year average.

Yield to worst (%) exceeds historical average among income-oriented sectors

Sources: Bloomberg and Morgan Markets. Sectors in chart represented by the following indexes: U.S. Investment-Grade Corporates: Bloomberg U.S. Corporate Total Return Value Index; U.S. High-Yield Corporates: Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index; Emerging Markets Bonds: JPM EMBI Global Diversified Index; U.S. Securitized Credit: a 50%/50% weighting of the Bloomberg U.S. CMBS Non-Agency Ex-AAA Index and the Bloomberg U.S. ABS Ex-AAA Index.

In this environment, high interest rates could represent an unexpected opportunity for income investors. And if the Fed starts cutting rates later this year, we anticipate that current fixed income investments will generally benefit from their interest rate exposure and higher coupon rates. Ultimately, we think select income-oriented sectors can provide investors with a strong combination of coupon income and upside potential in prices.

Inflation slows amid economic growth

The U.S. economy has produced some contradictory signals. On one hand, economic growth appears resilient, and GDP has been above 2% for six consecutive quarters as of June 30, 2024. In addition, the unemployment rate has remained in the 4.0% range for more than two years, while the S&P 500 and NASDAQ Composite Indexes have hit multiple record highs over the past six months. With these and other data points in mind, Capital Group economists expect U.S. corporate profits to grow throughout 2024, indicating continued economic expansion.

On the other hand, inflation was more persistent than many market participants expected early in 2024, while the two-to-10-year Treasury yield curve has been inverted since July 2022. Meanwhile, The Conference Board’s Consumer Expectations Index (which measures consumers’ outlook for U.S. economic conditions) has remained below 80 for five consecutive months as of June 30, 2024, a level that often precedes a recession.

Against this backdrop, inflation has trended closer to the Fed’s 2% target over the past few months as the labor market has shown signs of weakening. These and other factors may convince the Fed to cut rates later this year, which may in turn motivate investors to take some of the record $6.4 trillion in money market accounts off the sidelines (as of June 7, 2024, according to the Federal Reserve Bank of St. Louis).

Investment-grade corporates: Where we see opportunity

By most fundamental metrics, including underlying corporate earnings and balance sheets, U.S. credit markets appear to be in good shape. At the same time, we don’t view valuations as particularly cheap. And while major fixed income sectors can offer attractive risk-adjusted returns over the long run, each market cycle can produce markedly different returns across sectors. On that basis, a disciplined approach to sector and security selection can help investors build flexible portfolios based on relative value.

While the investment-grade corporate bond sector is fairly expensive on the whole, we believe it still offers some reasonably attractive valuations. For example, in recent months, several large-scale pharmaceuticals have announced acquisitions of smaller companies that appear to be developing promising medications, and many of these buyers have used leverage to facilitate these transactions. In our view, demand for medications is stable, and the pharmaceutical business is not especially economically sensitive. We expect that these buyers will generate free cash flow in the next few years, and that they’ll use that income to reduce leverage. As such, we think these bonds offer attractive relative value.

We’re also finding some opportunities in utilities, and particularly in utilities in California, Oregon and Colorado that have heightened wildfire risk. Over the past few years, spreads have widened to reflect the risk of wildfire liabilities. As a result, certain utilities are taking steps to make their distribution systems safer, such as burying transmission lines or shutting off power during periods of high winds. As these investments take effect, we expect spreads to recover and provide attractive returns.

High-yield credit quality has increased

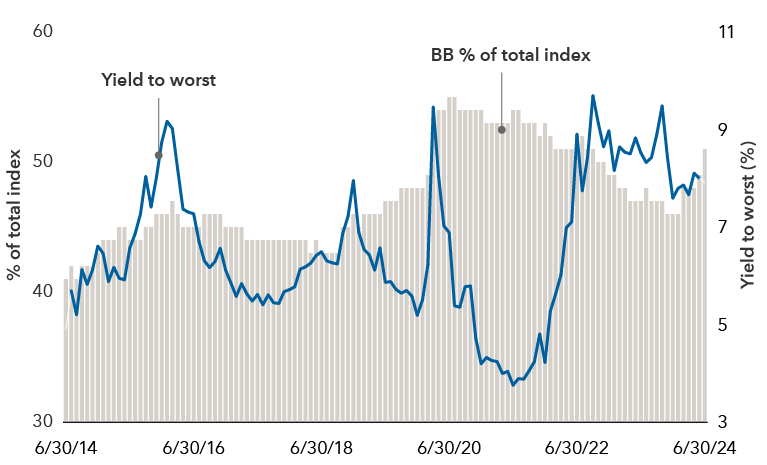

On a historical basis, median high-yield spreads are tight to investment-grade corporates. Still, we believe there are positive reasons for this tightening to have developed over the past few years. For example, credit quality within the high-yield sector has moved up substantially, with the average high-yield issue now rated BB. In addition, durations (in this case, a bond portfolio’s sensitivity to interest rates) have generally shortened within the sector, thereby decreasing investors’ interest rate risk. Meanwhile, companies rated CCC are at the low end of their historical range as a percentage of the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index. With these and other factors combined, the sector is currently within the top quartile of its historical range for both credit quality and yield to worst—a rare occurrence.

Over the past decade, yields and credit quality have risen

Source: Bloomberg. The index referenced in the chart is the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index.

We think this environment makes high yield an attractive long-term investment despite recent spread tightening. For example, the sector’s yield to worst stands at nearly 8.0%, above its long-term average and significantly above investment-grade corporate yields. In particular, we’ve found idiosyncratic opportunities in energy, communications and healthcare.

Within energy, we believe fundamental dynamics are supportive as global demand remains strong and supply growth continues to be constrained. In communications, fundamentals are more challenged. However, some bond prices appear oversold as investors have become extremely cautious on the sector. Meanwhile, the healthcare sector appears to offer multiple attractive opportunities, especially in pharmaceuticals and healthcare services. In addition, given that demand for healthcare is stable, we believe the sector is somewhat more insulated from broad economic trends than other sectors may be.

Securitized credit: Focusing on CMBS and subprime ABS

As compared to U.S. high yield, the securitized credit sector tells an opposite story: Spreads are currently wider than they’ve been on a historical basis. While some of these wider spreads are certainly justified, we think the market has mispriced other issues in the sector. In our view, security selection will likely be the major source of alpha generation over the near term. One example of this is in asset-backed securities (ABS), especially in certain ABS subsectors like subprime auto and credit card ABS. Despite market hesitancy and recent weakness in credit performance by subprime consumers, we take comfort in the automatic deleveraging built into certain structures and view the market’s hesitancy as an attractive investment opportunity.

Prior to investing, we spend a significant amount of time evaluating management teams and focus our investments on a select group of issuers in the space. Given market pessimism around the subprime sector, spreads have lagged and remain relatively wide. We think these spreads may tighten going forward.

We’re also finding opportunities among single-asset, single-borrower bonds within commercial mortgage-backed securities – or CMBS where a single borrower (or a related group of borrowers) uses a single commercial property (or a related group of properties) as collateral to secure the bond(s) that they issue. We believe commercial real estate will continue to experience challenges in the coming years, but not all bonds within the sector will encounter difficulties.

Emerging markets yields favorable as local rates fall

Having raised rates early in the COVID-19 pandemic to address rising inflation, many emerging markets (EM) central banks are now pivoting to interest rate cuts, which could support price appreciation for EM bonds denominated in local currencies. Meanwhile, yields remain favorable across both local currency bonds and those denominated in major currencies such as the U.S. dollar or euro (i.e., hard currency bonds). We’re finding attractive yields in lower rated hard currency sovereign markets; these tend to be more idiosyncratic credit opportunities in Africa and Latin America. We’re also finding diversification benefits and attractive yields in EM corporates, where investors can potentially achieve better yields than similarly rated U.S. investment-grade corporates. Inflation-adjusted yields remain favorable across many local currency markets.

More broadly, we think including EM bonds in a portfolio can help investors generate a similar income profile as U.S. high-yield corporates while increasing both credit quality and geographic diversification. Allocations to EM may also help investors decrease their fixed income portfolios’ correlation to equities.

Active diversification to manage risk

As we’ve noted, income potential across the U.S. investment-grade corporate, U.S. high-yield corporate, emerging markets and U.S. securitized sectors remains high. Over the near- to moderate-term, we believe that idiosyncratic credit selection will be the key to attractive risk-adjusted returns across all sectors. Accordingly, we believe fixed income investors might consider an active, diversified approach to portfolio construction. For those willing to take on more risk, investors might consider a multisector approach where active managers have the flexibility to adjust their allocations based on the relative value among sectors, subsectors and individual issues—especially within the income-oriented sectors discussed above.

Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Investing for short periods makes losses more likely. Share prices and returns will vary, so investors may lose money.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

The NASDAQ Composite Index tracks the performance of more than 3,000 stocks listed on the NASDAQ and is often viewed as an indicator for the newer sectors of the economy.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, a security will be considered to have received the highest of those ratings, consistent with applicable investment policies.

The J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report. J.P. Morgan disclaimer: https://www.jpmm.com/research/disclosures

The Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

The Bloomberg U.S. Corporate Total Return Value Index measures the investment-grade, fixed-rate, taxable corporate bond market. It includes U.S. dollar-denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

The Bloomberg U.S. CMBS Non-Agency Ex-AAA Index measures the U.S. commercial mortgage-backed, non-agency fixed income market, excluding AAA-rated issues.

The Bloomberg U.S. ABS Ex-AAA Index measures the U.S. asset-backed fixed income market, excluding AAA-rated issues. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Indexes are unmanaged and therefore have no expenses. Investors cannot invest directly in an index.

Duration is a measure of a bond or bond portfolio’s sensitivity to interest rates.

More insights

-

-

Economic Indicators

RELATED INSIGHTS

-

-

Global Equities

-

Economic Indicators

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Xavier Goss

Xavier Goss

Damien McCann

Damien McCann

Shannon Ward

Shannon Ward