Market Volatility

Media

- Gaming is the fastest growing segment of the media and entertainment industry.

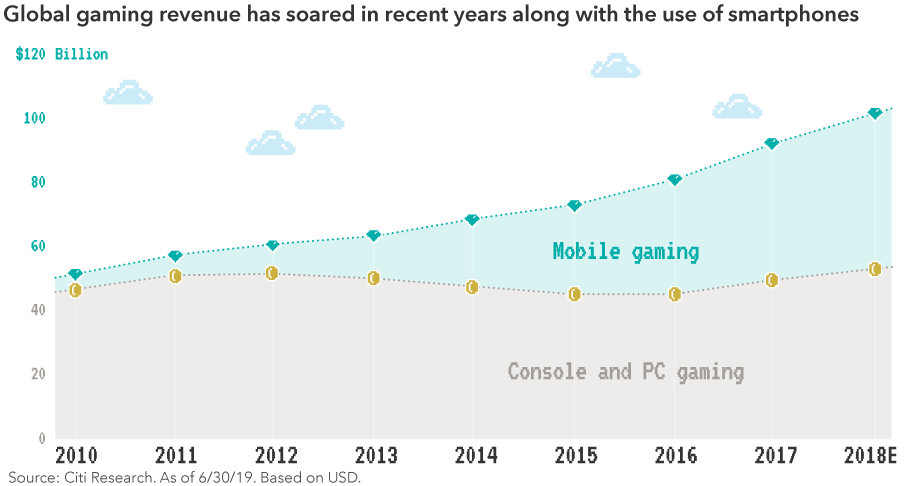

- Smartphones are enabling a new generation of gamers around the world.

- Leading companies are putting a focus on internet streaming and free-to-play games.

As a kid growing up in Bettendorf, Iowa, Capital Group equity analyst Nathan Meyer had two passions: sports and video games. “There wasn’t much else to do in Bettendorf,” he says of the small, rural town about 170 miles west of Chicago.

Fast forward a few years and Meyer is now covering the video game industry as part of the broader media and entertainment landscape, tracking its rapid growth and the trends driving it.

“Video games make up the fastest growing segment of the $1.5 trillion global media industry,” Meyer explains. “Worldwide gaming revenue rose by an estimated 11% last year and, in my view, that kind of healthy growth trajectory should continue as interactive gaming becomes a more and more popular form of mainstream entertainment.”

Mobile drives growth

Indeed, gaming is rapidly moving into the mainstream as a wide variety of games become available on mobile devices. Even some graphics-intensive games can now be played on the latest smartphones, allowing users to enjoy the experience with or without an expensive gaming console or PC. In addition, the popularity of internet-streaming games and free-to-play games has opened the market to more gamers than ever before.

“It’s no longer just 15-year-old boys playing video games in their parents’ basement,” Meyer says. “This is a big business, and it’s attracting many types of players all over the world.”

Need more data? Consider these stats:

- More than 164 million adults play video games in the U.S., according to a recent report by the Entertainment Software Association, and they spent about $43 billion on game-related purchases. The average age of a U.S. gamer is 33; 54% are male and 46% are female.

- China is the world’s fastest growing video game market, with sales rising about 14% a year. China has 598 million gamers and roughly 95% of them play on mobile devices, according to a study by research firm Niko Partners.

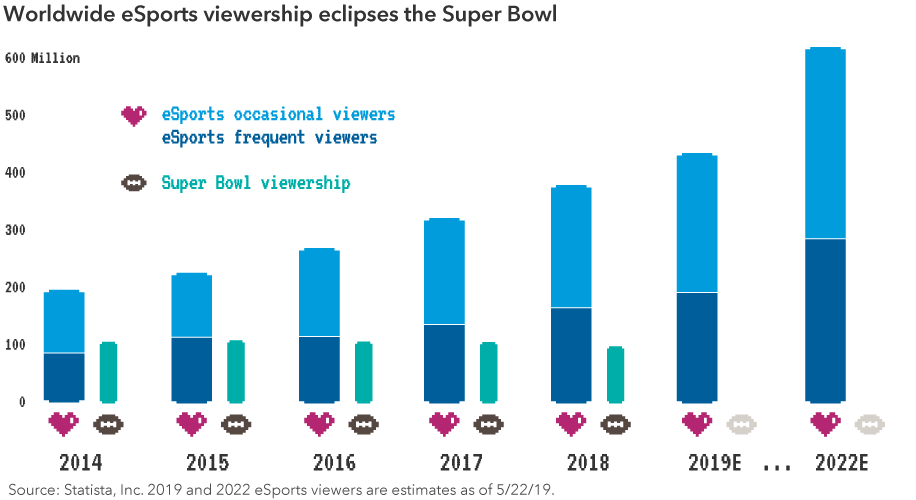

- There are far more people around the world watching eSports events — online and in-person video game tournaments — than watching the Super Bowl, according to data gathered by Statistica. And much like professional athletes, contestants in eSports events can earn millions in prize money and endorsements.

Grand theft market share

In another sign of the times, the most popular video games are generating far more revenue than individual movies, books and music. Earlier this year, the video game Grand Theft Auto V became the highest-grossing entertainment product of all time. GTA V, which is routinely among the top selling titles each year, has sold more than 90 million copies since it launched six years ago, and it has generated about $6 billion in revenue.

By contrast, the highest grossing movie of all time, “Avengers: Endgame,” has earned roughly $2.79 billion worldwide since it was released in April 2019. Prior to that, 2009’s “Avatar” held the record at slightly less than that amount, or $2.78 billion.

“What fascinates me about video games, as opposed to movies, is the highly interactive nature of the content,” says Alan Wilson, a portfolio manager with Capital Group. “As a player in the game, your participation changes the content, and that makes it a much more immersive experience. It’s a very different experience than passively watching a movie. In some ways, it’s much more powerful.”

You've discovered one of Capital Group's 10 investment themes for 2022

Industry leaders

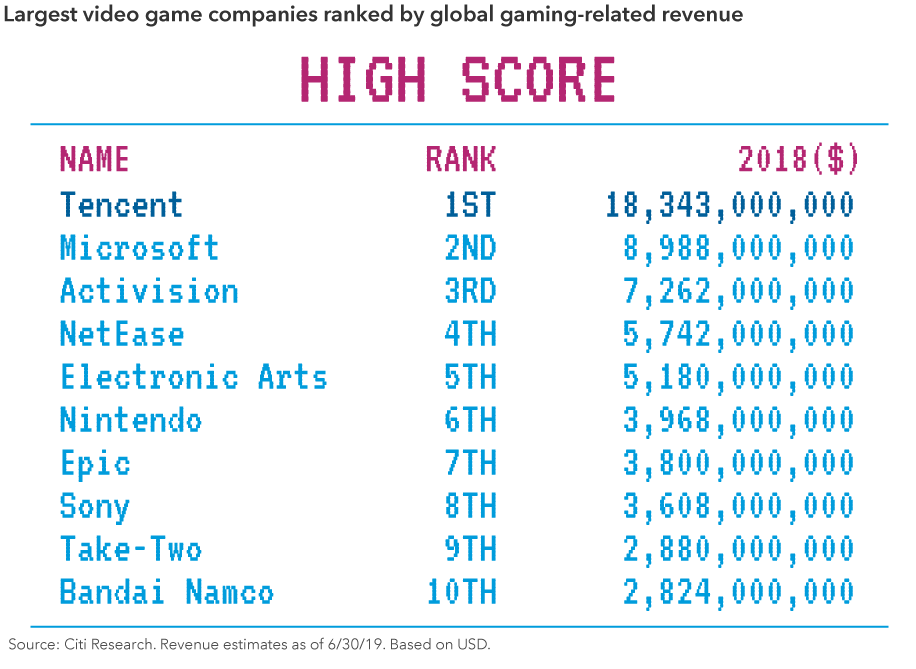

Gaming is a global industry and, as such, the major players can be found throughout the U.S., Europe and Asia. They include game console-makers such as Microsoft (Xbox) and Sony (PlayStation), as well as game developers and publishers such as Activision, Electronic Arts and Take-Two Interactive. Some, like Nintendo, even do both, producing consoles and creating games featuring world-renowned intellectual property.

Here’s a brief look at the three largest companies by gaming revenue:

Tencent — Headquartered in Shenzhen, China, Tencent is a giant technology conglomerate and by far the largest gaming company in the world. It also provides internet, mobile and telecom services, among other operations. Gaming is Tencent’s largest business division, accounting for about 30% of the company’s total revenue. Tencent also has U.S. holdings, including Riot Games, maker of the online free-to-play game League of Legends. It also owns a 40% stake in Epic Games, the maker of free-to-play rival Fortnite.

Microsoft — Redmond, Washington-based Microsoft is the largest gaming company in the U.S., thanks largely to its Xbox console, the main rival to Sony’s PlayStation and Nintendo’s Switch. Gaming accounts for less than 10% of Microsoft’s annual revenue, but it’s a high-profile segment of the business. The company also owns a number of popular games for the Xbox platform, including Halo, Forza and Minecraft. Later this year, Microsoft is planning to launch a cloud-based service dubbed the “Netflix of gaming,” although it will likely face several new competitors in the space, including Amazon and Google.

Activision — Based in Santa Monica, California, Activision Blizzard is one of the world’s largest video game publishers. The company has many iconic titles in its portfolio, including Call of Duty, World of Warcraft and Overwatch, among dozens of others. In the mobile arena, Activision’s King unit is the creator of the wildly popular smartphone game Candy Crush. Activision Blizzard was formed in 2008 through the merger of Activision and Vivendi Games.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Nathan Meyer

Nathan Meyer

Alan Wilson

Alan Wilson