Currencies

Will surging inflation in the United States finally upend a decade-long bull run for the U.S. dollar? It’s a question I’ve been getting from many of my colleagues and several of our clients. My answer remains no.

Even though traditional analysis would suggest that higher inflation is typically a long-run currency headwind, I still think it’s too early to call an end to the U.S. dollar bull run. Higher real interest rates that continue to draw foreign capital flows to the U.S., as well as solid economic growth and the persistence of the dollar’s status as a safe-haven currency in periods of geopolitical stress should continue to support a stronger dollar outlook.

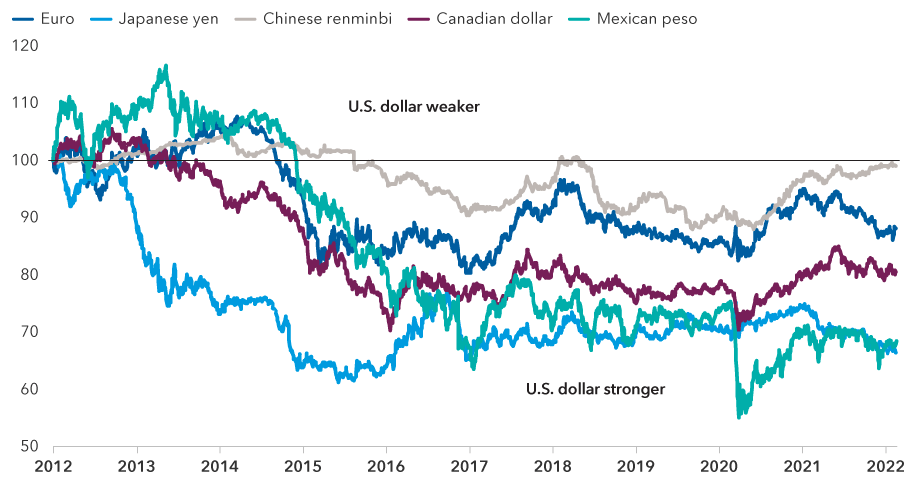

U.S. dollar has outpaced currencies of major trading partners

Source: Bloomberg. As of February 11, 2022. All data indexed to 100 as of December 30, 2011.

Fed’s hawkish stance should be supportive

To assess where the U.S. dollar is headed, it’s important to consider how aggressive different central banks will be in their efforts to tame current high inflation rates. The Federal Reserve is signaling a series of rate hikes beginning in March and discussing ways to shrink its balance sheet. Futures markets are pricing in a federal funds rate of 1.25%–1.50% by year-end, up from 0%–0.25% today. But the market is not expecting much further Fed tightening in 2023 and 2024. I think the Fed is likely to tighten monetary policy in 2023 by more than is currently priced in, which would keep the bullish dollar narrative intact despite elevated inflation in the U.S.

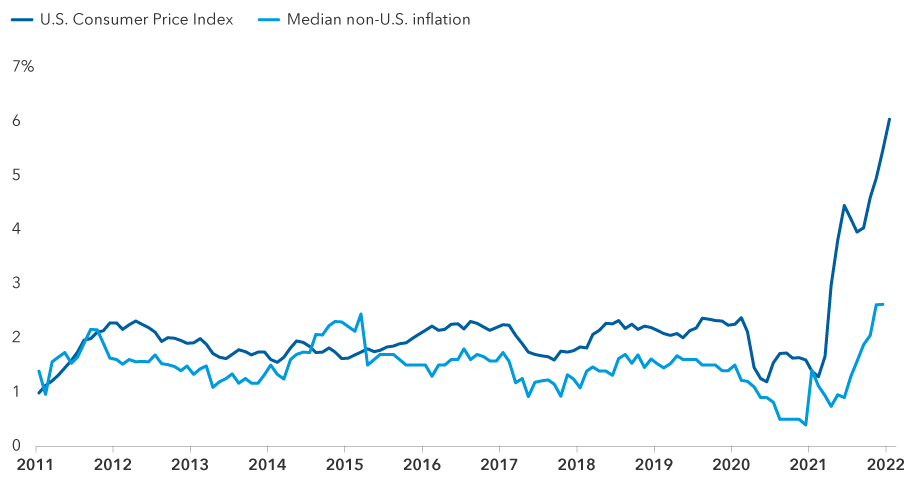

U.S. inflation has outpaced other major economies

Sources: Capital Group; U.S. Bureau of Labor Statistics; National Institute of Statistics and Geography (Mexico); National Bureau of Statistics of China; Statistics Canada; Japanese Statistics Bureau, Ministry of Internal Affairs & Communications; Eurostat. As of January 1, 2022.

Note: Inflation measure is core inflation. Non-U.S. group includes Canada, China, Japan, Mexico and the euro area.

In Europe, monetary policy remains looser. The European Central Bank (ECB) recently joined the hawkish fray by declining to rule out a rate hike this year after euro area inflation reached a record 5.1% in January, but its key deposit rate remains at –0.50% and it indicated that it would start to raise rates only after ending asset purchases.

Still, the ECB’s surprise pivot to a more hawkish stance prompted several market analysts to call for a resurgence of the euro. But I think the euro must overcome high hurdles to gain meaningfully against the dollar and other major currencies. To get substantial euro strength, we would need to see sustained economic growth in the euro area, including Spain and Italy in particular. Such a scenario would also involve sharply higher real yields on German government bonds sufficient to reverse capital outflows from the euro area. I am skeptical that this is imminent.

Meanwhile, among other major central banks, both the United Kingdom and New Zealand have lifted rates several times in recent months. The Bank of England (BOE) raised its key bank rate to 0.50% from 0.10%, and an inflation reading of 5.5% in January — a 30-year high — fed speculation of another BOE rate hike soon. Policymakers in several emerging markets, particularly in Latin America, have been proactively tightening monetary policy for even longer, a notable shift from prior inflationary episodes when they have followed the lead of central banks in advanced economies.

In contrast, the two major Asian central banks are leaning more dovish as inflationary pressures are less pronounced in the region. Last month, the Bank of Japan nudged up its inflation forecast just 20 basis points to 1.1% for the coming fiscal year — its first increase since 2014 — while maintaining its negative target rate. The People’s Bank of China has made a small rate cut and taken other measures to ease monetary conditions amid a slowdown in economic growth and stress in the property sector.

While these moves could shake up the global rates picture, the U.S. dollar remains in a position of strength. As the Fed prepares to tighten, real rates in the U.S. are already well above those in most other advanced economies. Short-term nominal rates have soared, with the two-year U.S. Treasury yield more than doubling so far in 2022. So long as savers and investors in countries like Germany and Japan can continue to earn high rates in the U.S., the dollar should continue to hold up.

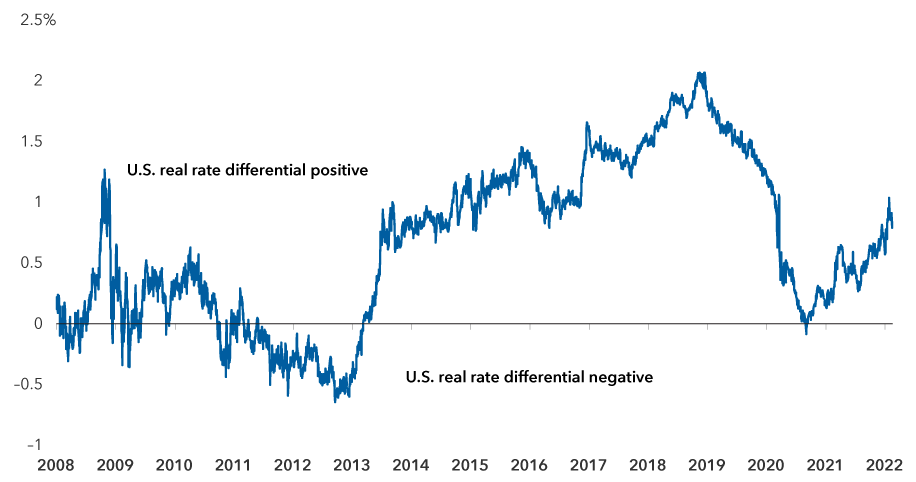

U.S. real rate differential continues to support the dollar

Sources: Capital Group, Macrobond. As of February 14, 2022.

Note: Based on the yield of 10-year U.S. Treasury Inflation-Protected Securities (TIPS) relative to the corresponding yields of inflation-indexed bonds in Germany, Japan and the United Kingdom. A real rate differential is the difference between two interest rates that have both been adjusted for inflation.

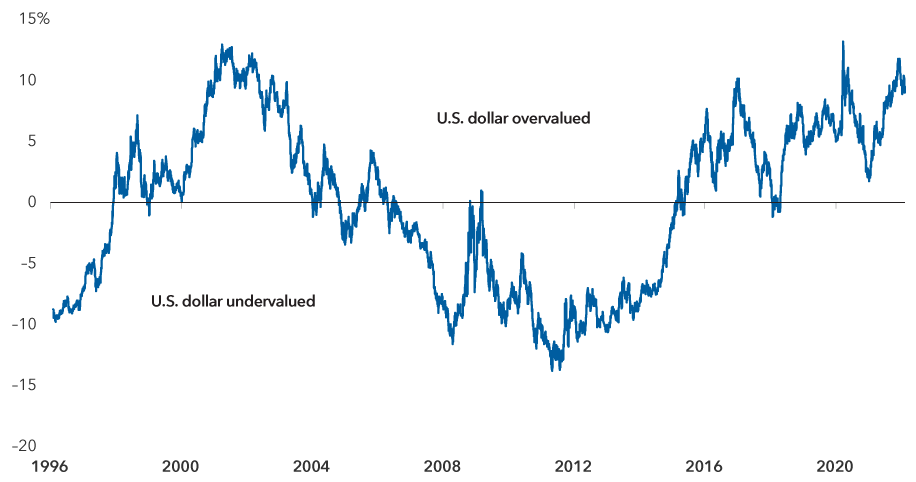

Dollar could remain overvalued

No doubt, the dollar has been overvalued for many years — since 2015, by one measure. While that should correct at some point, I don’t see a catalyst for a near-term drop in the dollar. For the foreseeable future, several cyclical factors are likely to keep it stronger for longer:

- Global growth forecasts for 2022 look optimistic. In my view, the global consensus for economic growth this year has not fully factored in the impact of slowing growth in China and the most recent escalation of the conflict between Russia and Ukraine. Paired with rising inflation around the world, that suggests a coming round of downward revisions to growth expectations. Typically, that tends to benefit safe-haven currencies such as the U.S. dollar and Japanese yen.

- Growth tailwinds are stronger in the U.S. than elsewhere. The U.S. continues to see a stronger post-COVID-19 recovery than the rest of the world, buoyed by a strong U.S. consumer. Trillions of dollars in fiscal and monetary stimulus over the past two years have left consumers flush and household balance sheets in the best shape in decades.

- The differential in global real interest rates continues to support the U.S. dollar. The appeal of higher real rates in the U.S. should attract additional foreign capital flows, which would help finance the U.S. current-account deficit and keep the dollar overvalued.

- A weaker Chinese economy could weigh on emerging markets currencies. These currencies tend to be highly procyclical, so a slowdown in China that drags down global growth could be challenging for them relative to the dollar. At the same time, most emerging markets currencies weakened significantly in 2021, leaving them with cheaper valuations. Some of these currencies enjoyed a bounce in early 2022, but it remains to be seen whether that is the start of an enduring trend. If it is, currency effects could be positive for returns on emerging markets debt.

U.S. dollar remains overvalued

Sources: Capital Group, J.P. Morgan. As of February 10, 2022.

Note: Chart displays the percentage by which the U.S. dollar’s trade-weighted nominal exchange rate is greater than or less than its trade-weighted nominal fair value.

Bottom line

The U.S. dollar has enjoyed a structural bull run for the past decade and it appears overvalued by many metrics. At some point, the currency will shift into a bear cycle. But given the Fed’s intention to wage a campaign of tighter monetary policy to tackle inflation, it is unlikely that a dollar downturn will arrive anytime soon. The dollar’s path will depend in part on how aggressively other central banks fight their own inflation battles.

The question for all central banks will be how to control inflation without short-circuiting economic growth. If they manage to move in lockstep, they could produce a “Goldilocks” scenario where inflation declines in a relatively swift and orderly fashion without pulling the rug out from under the global economy. Declining inflation would leave real rates at more elevated levels. This would argue for investors to be more globally diversified, with broad exposure to a basket of non-U.S. currencies. This positioning would also serve as a possible hedge for the day when the dollar cycle turns bearish.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report. J.P. Morgan disclaimer: https://www.jpmm.com/research/disclosures.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Jens Søndergaard

Jens Søndergaard