Asset Allocation

Chart in Focus

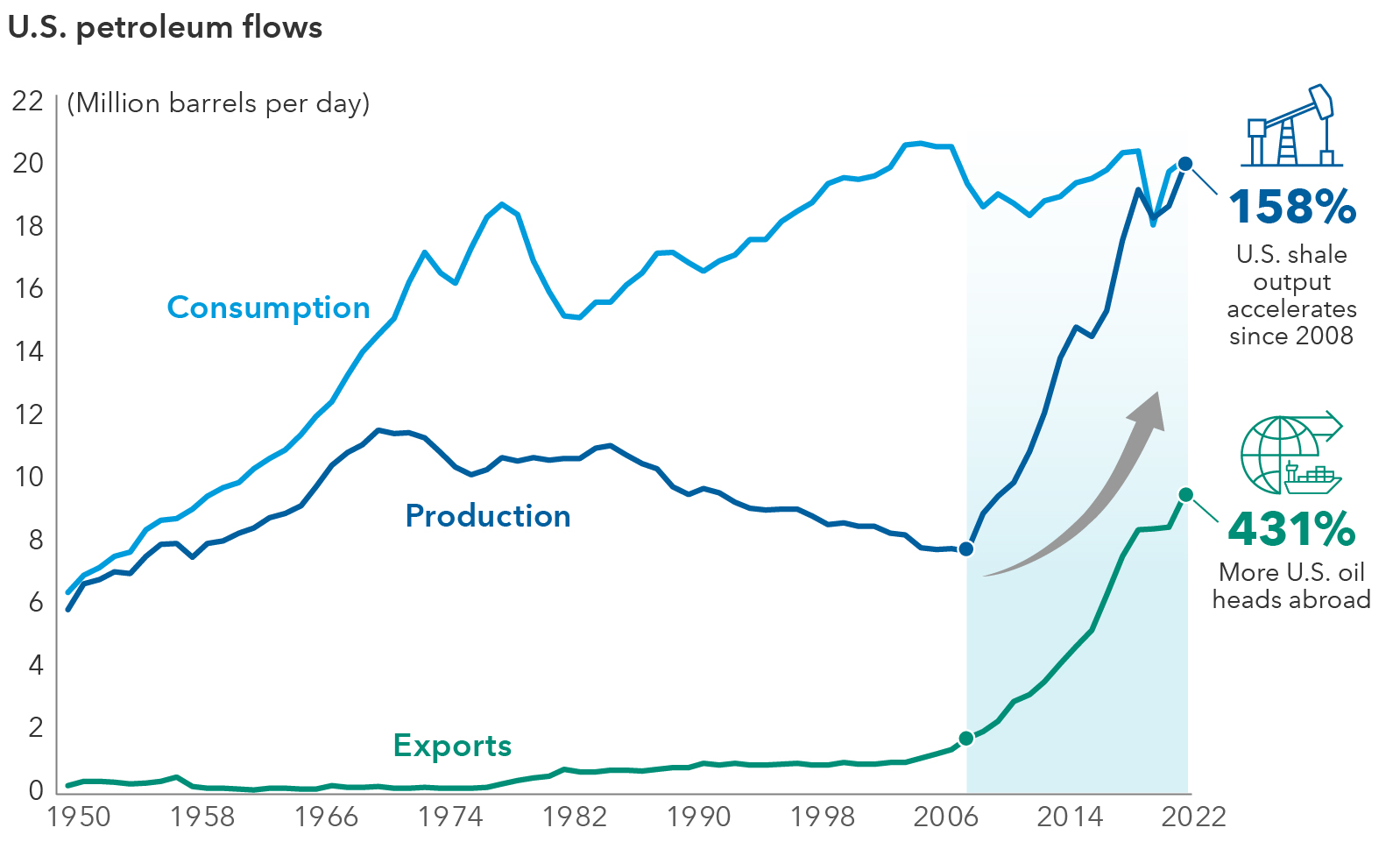

The U.S. is cementing its position as an energy superpower amid expanding geopolitical tension and evolving oil production dynamics. With crude exports soaring to record highs, the U.S. is riding a wave of demand from its European allies while simultaneously capturing Asian market share. The OPEC+ members recently extended their oil production cuts, allowing the U.S. to secure a larger slice of the global market.

More U.S. oil is heading overseas

Source: U.S. Energy Information Administration, Monthly Energy Review, September 2023. Data from 1950 until 2022.

U.S. crude oil exports averaged 4.1 million barrels per day (b/d) in 2023, 13% more than the previous annual record set in 2022, according to the U.S. Energy Information Administration. In addition, crude exports reached an all-time high of 4.8 million b/d in March of this year.

Fallout from the Russia-Ukraine war has placed a spotlight on energy security, allowing the U.S. to fill a global void as European nations pivot from Russian petroleum products. American companies have ramped up domestic production to meet the growing demand, despite their commitment to fiscal discipline and focus on profitability. Meanwhile, shale output is hitting unprecedented levels, thanks to stronger drilling technologies that boost the productivity of oil wells.

Global markets initially shrugged off the breakout of the Israel-Hamas war, though any signs of the conflict broadening and/or extending could impact oil supply. Oil prices could remain elevated in such a scenario. Spot Brent crude oil has gained 17% year to date (as of April 15, 2024), while West Texas Intermediate is up 18%.

Moreover, Saudi Arabia has borne the brunt of OPEC+ production cuts, ceding market share to competitors such as the U.S., Canada and Iran. Saudi Arabia’s willingness to continue may flag as the kingdom could increase production in the latter half of 2024 in a bid to increase revenues and reclaim its market crown.

The S&P 500 Energy Index has surged by almost 14% year to date (as of April 15, 2024), eclipsing the S&P 500 Index’s 6% increase, stemming from oil’s rise of over 20% from its December lows. Despite oil stocks being attractively valued at an average price-to-earnings multiple of 11.3, my colleague, investment analyst Craig Beacock, cautions that further gains could be limited in the near term after the recent strong move.

Still, the energy sector’s weighting of about 4% in the S&P 500 remains below historic levels, suggesting room for expansion as the sector makes gains in the medium term. This is partly why energy remains attractive in the long run. Signs of industry consolidation are occurring at major companies — Chevron announced a plan to buy Hess, and ExxonMobil expects to close a deal this quarter for shale producer Pioneer Natural Resources.

The S&P 500 (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely held common stocks.

The S&P 500 Energy Index comprises those companies included in the S&P 500 that are classified as members of the GICS energy sector.

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organization with an objective to coordinate and unify petroleum policies among member countries. OPEC+ includes non-OPEC member countries that participate in the organization's voluntary supply cuts or policy objectives.

Shale oil is a type of unconventional oil found in shale formations that must be hydraulically fractured for extraction purposes.

Brent and West Texas Intermediate (WTI) are two leading oil benchmarks. Brent is the benchmark used for the light oil market in Europe, Africa, and the Middle East, while West Texas Intermediate is the benchmark for the U.S. light oil market and is sourced from U.S. oil fields.

Don't miss our latest insights.

Our latest insights

-

-

World Markets Review

-

-

Market Volatility

-

Demographics & Culture

RELATED INSIGHTS

-

Global Equities

-

Economic Indicators

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Talha Khan

Talha Khan