U.S. Equities

Monetary Policy

- As expected, the Fed has announced balance sheet tapering.

- Rather than being actively sold, assets will “run-off.”

- This may push 10-year Treasury yields higher over time.

- We estimate that the impact could be 20 to 40 basis points.

- However, long-term yields should remain range-bound.

The Federal Reserve has announced it will begin reducing its balance sheet in October. This unwind of the central bank’s massive quantitative easing programs marks a major policy change that could impact interest rates and markets more broadly.

How this move may affect markets

Long-term interest rates could move higher over the medium term as the Fed starts to shrink its asset holdings. However, the magnitude of the rise may be modest. Our fixed income interest rates team estimates the impact on 10-year Treasury yields could be 20 to 40 basis points over time, which is consistent with projections provided by the Treasury Borrowing Advisory Committee. This estimate is based on the assumption that the broader macroeconomic environment will not shift significantly.

Although higher yields impact bond prices, significant losses can be avoided by most fixed income investors, particularly those who rely on managed bond funds that can benefit from reinvesting in higher yielding securities, as well as from duration management.

A global perspective

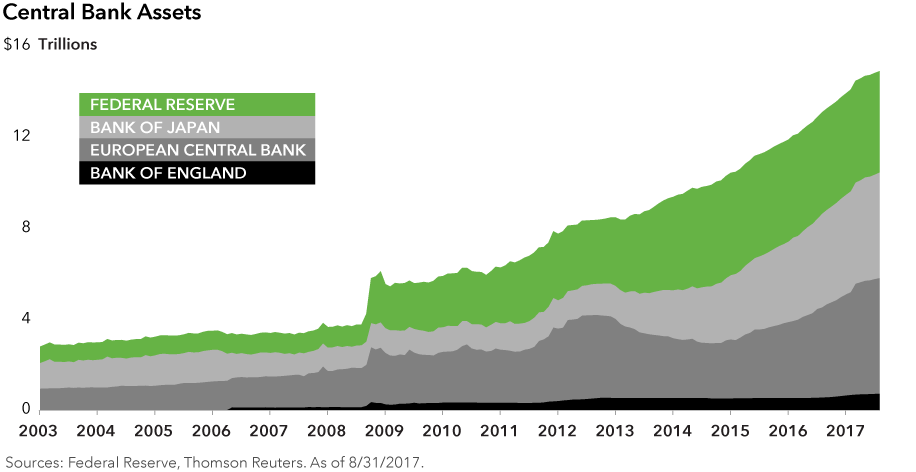

The Fed was the first among the major global central banks to announce an extensive asset purchase program in the wake of the financial crisis of 2007-08. With its September 20th announcement, the Fed also becomes the first central bank to start pulling back on its quantitative easing. Other major central banks have also signaled their intent to wind down these expansive programs that have injected unprecedented liquidity in global financial markets and led to a sharp rise in asset prices and a decline in market volatility.

As monetary authorities withdraw this liquidity, we can expect financial conditions to become less accommodative. Whether this leads to lower asset prices, including those of stocks and credit securities, remains to be seen.

Overall, the U.S. economy continues to hum along, with manufacturing activity picking up, the labor market nearing full employment and consumers showing strength. The global economic backdrop remains supportive, with Europe and Japan showing signs of a pickup in GDP growth, China maintaining a growth rate in the high single digits and emerging markets broadly continuing to grow at a faster rate than developed markets in aggregate.

Looking ahead

Against this backdrop, the market has raised its expectation of the probability of a December Fed rate hike closer to our view of just over 50%. If the rate increase is implemented, it will be the fifth rate hike of this monetary cycle. The Fed has raised its policy rate four times since late 2015. This has boosted the Federal Funds rate to a range of between 1.00 and 1.25%.

Nevertheless, 10-year Treasury yields have remained mostly in the range of between 1.4% and 2.6% over this period and were hovering around 2.25% in late September. We see a handful of factors that could potentially pull these yields in two different directions.

Factors that could raise yields:

- With the Fed scaling back their security holdings by reinvesting fewer of their maturing Treasuries back into the market over time, the private sector will have to absorb an increasing share of Treasuries, causing yields to rise.

- As the policy rate continues to rise, demand could flow to shorter maturity securities and away from longer term yields, driving them higher.

Factors that could lower yields:

- As the Fed shrinks its balance sheet and drains reserves, banks that rely on those reserves to satisfy capital rules may be impacted, which may result in higher demand for Treasuries from banks. We estimate that this could offset as much as half of the decline in Fed demand.

- Quantitative easing by other central banks will likely continue. In the past, this has led to lower yields in those markets, increasing the yield differential with U.S. bonds and leading to higher demand for Treasuries.

These mixed factors, along with relatively tame inflation and a modestly growing economy, leads us to expect long-term interest rates to remain range-bound.

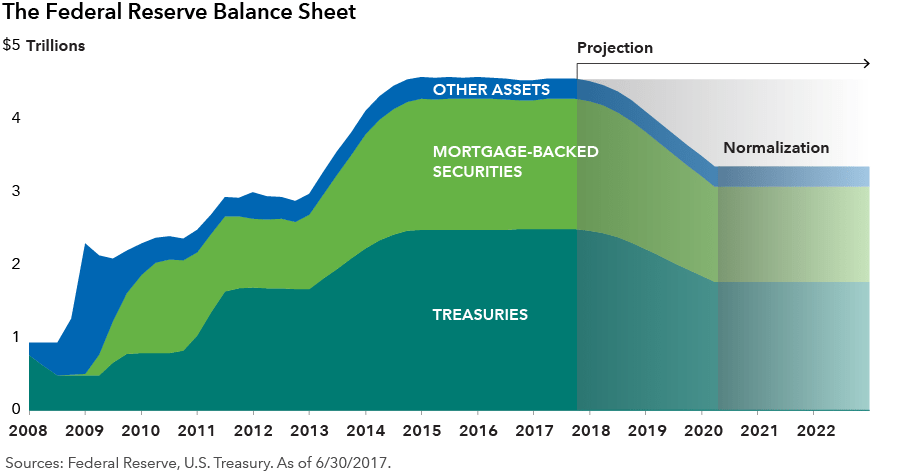

Once initiated, we anticipate asset tapering will operate in the background on autopilot as outlined by the Fed, provided there are no major shocks to the economic recovery. Mortgage-backed securities may be vulnerable to the Fed tapering. Although MBS have already felt some impact given tapering expectations, and having cheapened earlier this year against Treasuries, additional uncertainty on the impact of reduced Fed purchases could weigh on this sector.

How will the Fed reduce its balance sheet?

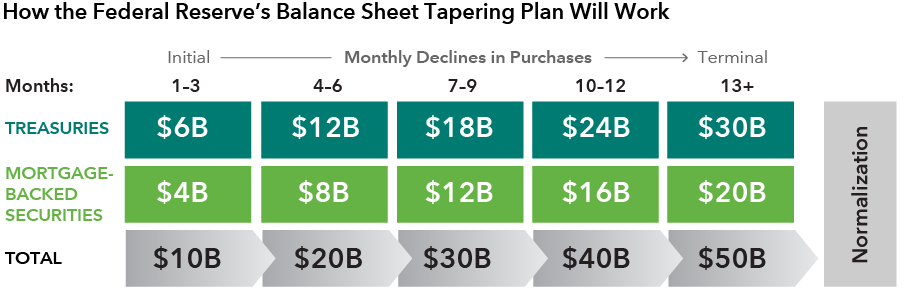

In its September post-meeting statement, the Fed said it was following through with its plans outlined earlier this year, which would commence in October. The Fed will structure its balance sheet reduction by capping the amount of proceeds it reinvests from maturing securities, starting at $10 billion per month, with a 60-40 split of Treasuries and mortgage-backed securities, and gradually increasing the cap over the year to a total of $50 billion. That terminal principal reinvestment reduction will remain in place until the size of the balance sheet is normalized. While unlikely to fall all the way back to its pre-crisis size of $1 trillion, we expect the balance sheet to stabilize at assets of around $3.3 trillion from a high of over $4.5 trillion.

This policy change represents a major step for the Fed. However, with a potentially modest effect on rates over time, investors in well-managed bond funds shouldn’t feel a dramatic impact. While we expect long-term rates to remain range-bound, as financial conditions become less accommodative, credit sectors are vulnerable to spread widening. We remain cautious on credit assets, especially high yield, where yields have declined substantially and may not adequately reflect the embedded risks.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Global Equities

-

Economic Indicators

-

-

RELATED INSIGHTS

-

-

Asset Allocation

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Timothy Ng

Timothy Ng