Market Volatility

Global Equities

- A decade of dominance by U.S. stocks shouldn’t deter you from international investing.

- National borders are no longer an effective way to evaluate and categorize companies.

- Growth opportunities and attractive valuations abound outside the United States.

Since the end of the global financial crisis in June 2009, U.S. stocks have been on a tear, generating returns roughly three times higher than international stocks. Driven by innovative tech and health care companies, this remarkable period of dominance has raised questions about whether it still makes sense for investors to venture outside the United States.

In fact, it makes more sense than ever if you consider how dramatically the world has changed under the influence of free trade, global supply chains and the rapid growth of multinational corporations. In many cases, the location of a company’s headquarters is significant only in terms of regulation and taxation.

“Where a company gets its mail is not a good proxy anymore for where it does business,” explains Rob Lovelace, a portfolio manager with New Perspective Fund®, which invests in companies all over the world. “The debate over U.S. versus non-U.S. stocks made sense at one time. It served us well for 40 or 50 years but the world has changed, and investors need to change their mindset as well.”

“You really should dig into the fundamentals and find out where companies generate their revenue,” Lovelace continues. “For instance, there are many companies based in Europe that have a great deal of exposure to growing markets in the U.S., or China, or Latin America, and that explains their success far better than where they are domiciled.”

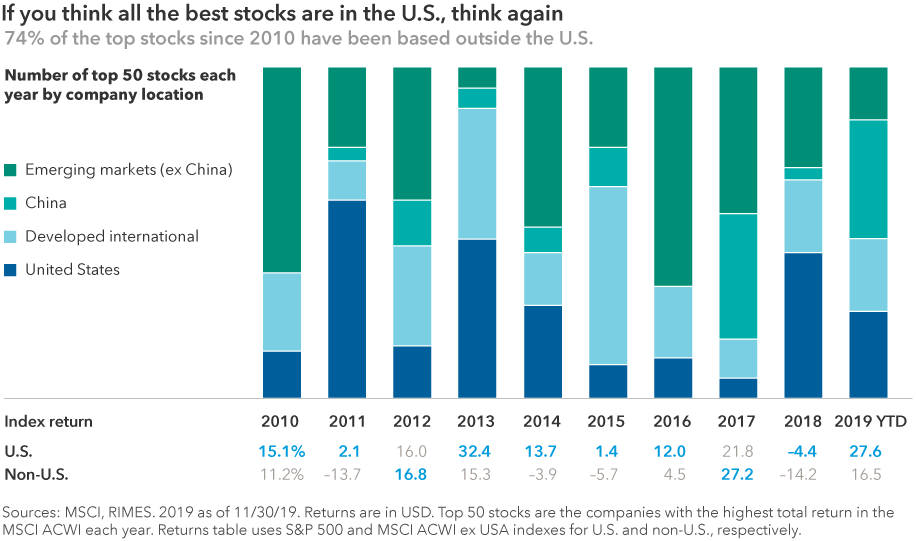

Indeed, if you look at individual companies instead of index returns, you’ll find that the companies with the best annual returns each year were overwhelmingly located outside the U.S. In 2019, 44 of the top 50 stocks were based on foreign soil. Investors who opted not to go outside the U.S. missed a shot at these companies, many of which are small to mid-sized firms that don’t appear in some popular indexes.

In a year when political pressure has weighed on many U.S. health care companies, Japanese pharmaceutical giant Daiichi Sankyo was one of the top returning stocks. Likewise, Kweichow Moutai is far from a household name outside of China, but it became the world's largest spirits company by market value after its stock doubled in 2019 (through October 31).

Why fish in only half the lake?

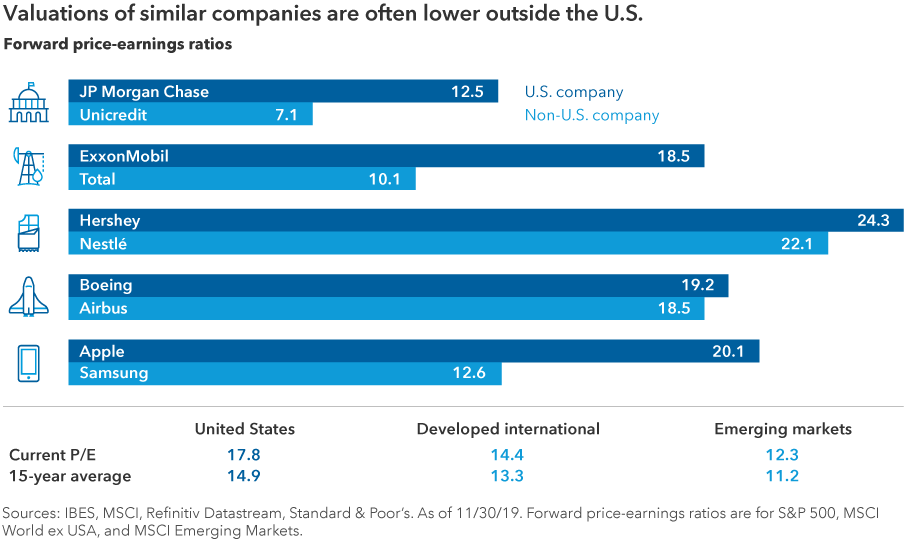

Even among large-cap stocks, the dominant companies in a given industry often have a U.S. and a non-U.S. leader. For instance: Boeing and Airbus, Nike and Adidas, ExxonMobil and Royal Dutch Shell, Intel and Taiwan Semiconductor Manufacturing.

“In the commercial aircraft industry, Boeing and Airbus are essentially a duopoly,” notes Capital Group equity investment director David Polak. “If you only invest in the United States, you've just cut your opportunity set in half.”

In some industries, it’s tough to find a U.S. equivalent. The luxury goods business is dominated by European companies, including LVMH, which owns iconic brands such as Louis Vuitton and Christian Dior. LVMH’s leading position was underscored last month when the French giant offered $16.2 billion to acquire New York-based Tiffany & Co. The largest-ever deal in the luxury sector is expected to close by mid-2020.

Several innovative health care giants also call Europe home: Novartis, AstraZeneca and Novo Nordisk, to name a few. Outside Europe, the story remains valid. Japan is home to many cutting-edge robotics firms, including Murata and Fanuc. And some of the world’s most successful technology companies are based in Asia: Samsung, Taiwan Semiconductor, Tencent and Alibaba, for example.

It’s about companies, not indexes

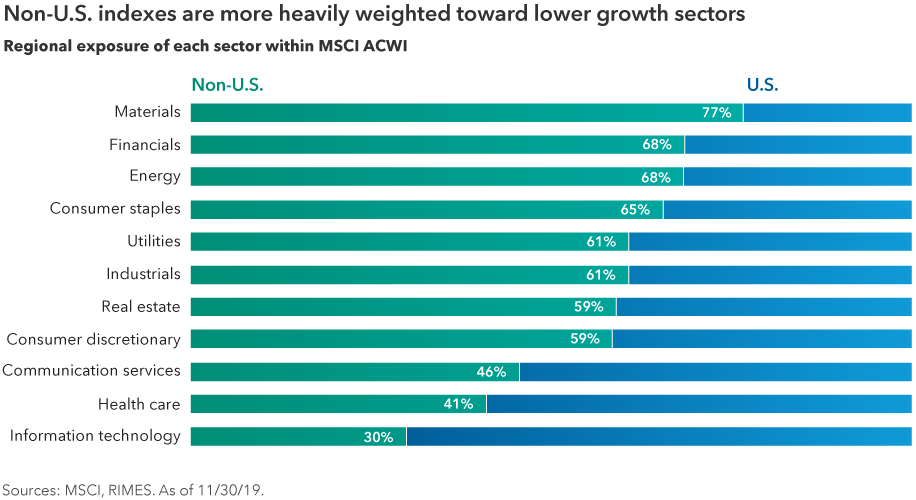

One reason why it’s tough to judge non-U.S. companies by index returns is that regional indexes are skewed toward certain sectors. The most widely used international indexes are heavily influenced by old-economy companies in the materials, financials and energy sectors. Meanwhile, popular U.S. indexes are dominated by a few fast-growing companies.

If you remove the FAANGs — Facebook, Amazon, Apple, Netflix and Google parent Alphabet — U.S. index returns look much less impressive over the past decade. Conversely, there are a handful of technology companies in Europe, such as ASML and Temenos, that have commanded valuations on par with U.S. tech firms.

Additionally, international equities have tended to offer higher average dividend yields and generally lower valuations, compared to similar stocks in the U.S. These are attractive characteristics for investors who prefer to be more defensively positioned in a late-cycle economic environment or ahead of the next recession.

For example, global food giant Nestlé paid a 2.3% dividend, as of October 31, 2019, and it sells products that consumers crave regardless of economic conditions. Moreover, there are more than six times as many non-U.S. stocks that offered a dividend yield above 3%.

Looking ahead

Following a volatile 2019, the outlook for international equity markets remains clouded by trade uncertainty, rising political risk and slowing economic growth in Europe, Asia and elsewhere. Heading into 2020, a challenging investment environment may be further tested by a contentious U.S. presidential election.

However, there are reasons to be optimistic about the prospects for international equity returns. Central banks around the world, including the Federal Reserve and the European Central Bank, have cut interest rates aggressively over the past few months, which should provide some level of support to struggling economies. The U.K.’s long-running Brexit drama could be resolved, one way or another, by a general election on December 12. And even a limited U.S.-China trade agreement could provide a substantial boost to markets, especially in trade-dependent economies such as Europe and Japan.

“The European economy, in particular, should gradually start to improve in 2020 as political risks diminish and as monetary and fiscal policy work their way through the system,” says Robert Lind, a Capital Group economist who covers Europe. “2019 was a tough year for the eurozone, largely due to trade disruption and economic policy uncertainty, but there are signs that the worst is over.”

For more on this topic, read International investing in 2020: Your comprehensive guide.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The market indexes are unmanaged. Investors cannot invest directly in an index.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

MSCI ACWI ex USA is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes.

MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure results of the large- and mid-capitalization segments of more than 20 emerging equity markets.

MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI World ex USA Index is designed to measure equity market results of developed markets. The index consists of more than 20 developed-market country indexes, excluding the United States.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Rob Lovelace

Rob Lovelace

David Polak

David Polak

Robert Lind

Robert Lind