Markets & Economy

Currencies

A rapid shift in the outlook for the global economy — punctuated by soaring inflation, Europe’s deepening woes and increasing fears of a worldwide recession — is having an enormous impact on currency markets.

The U.S. dollar has continued to climb higher, building on its impressive rally during the first half of the year. Both the euro and Japanese yen are trading at multi-decade lows, and the euro recently touched parity with the dollar with a 1-to-1 exchange rate for the first time since 2002.

With global foreign exchange markets changing rapidly, Capital Group currencies analyst Jens Søndergaard shares his outlook on a strong U.S. dollar, a weak euro and a Japanese yen that appears to be running away from its reputation as a safe-haven asset.

Q: What’s driving these recent moves?

Global growth is slowing faster than expected and the inflation picture is a lot worse. Central banks in both developed and developing markets are hiking interest rates aggressively, with the European Central Bank (ECB) surprising markets with its recent 50 basis point hike. Currencies are just reacting to the shift in relative macro fundamentals we are now seeing.

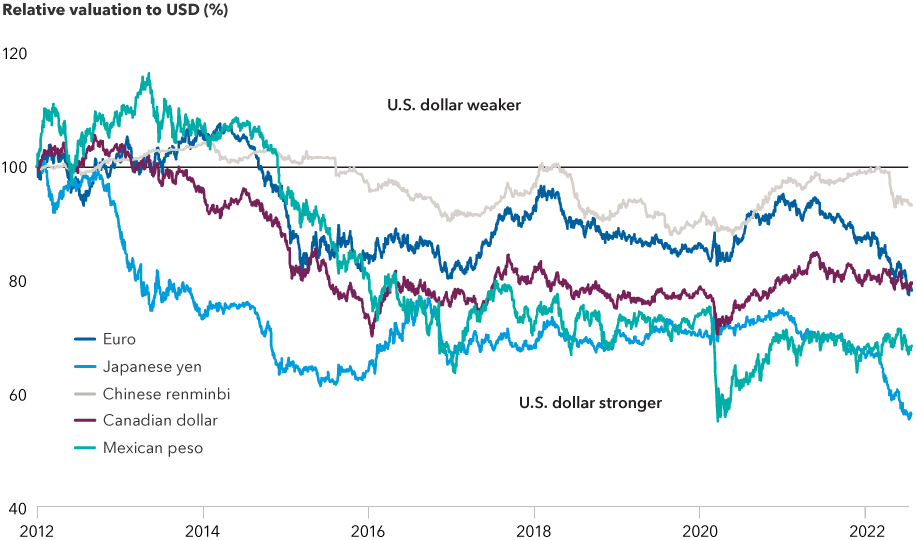

U.S. dollar has outpaced currencies of major trading partners

Source: Bloomberg. As of July 27, 2022. All data indexed to 100 as of December 30, 2011.

Q: How much longer can the U.S. dollar gain on other currencies?

I believe the dollar can continue its ascent for at least another six months. The dollar is rallying for good reasons. The U.S. economy is stronger than that of other major economies, and the U.S. Federal Reserve is aggressively tightening to blunt the impact of inflationary pressures. In most other parts of the world, it’s a very different story. We have lackluster growth, inflation that’s mostly driven by energy prices, severe compression of real wages and central banks that are being forced into what I could characterize as “bad” rate hikes.

It’s this contrast between the United States and the rest of the world that’s been driving these currency moves.

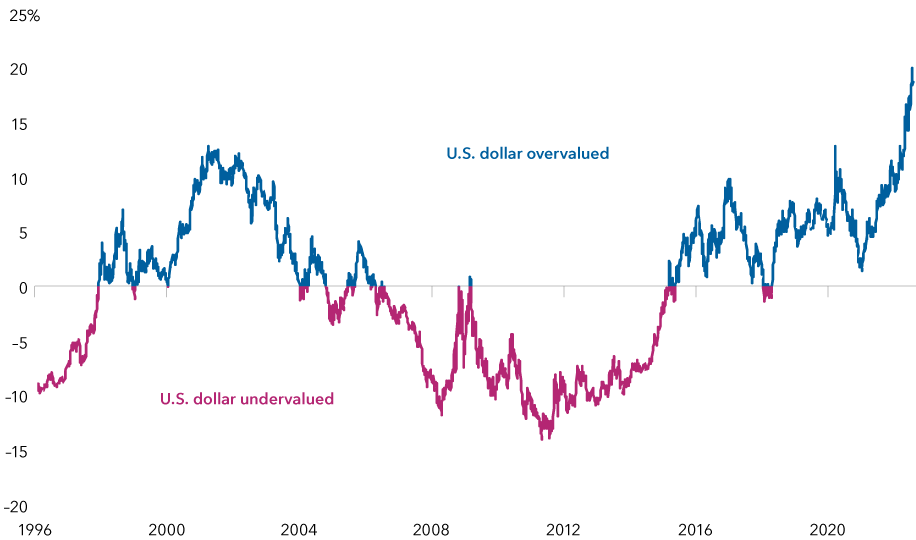

I expect the next six months will be very bumpy in terms of market volatility, mainly driven by recession fears. While the dollar is overvalued by various metrics I track, I don’t see a catalyst for a near-term drop. In a recession, the dollar has been the preferred safe haven for investors. So, I anticipate the dollar will stay strong until we see signs that global growth is stabilizing, along with indications that inflation has peaked around the world.

U.S. dollar remains overvalued

Sources: Capital Group, J.P. Morgan. As of July 26, 2022.

Note: Chart displays the percentage by which the U.S. dollar’s trade-weighted nominal exchange rate is greater than or less than its trade-weighted nominal fair value. Trade-weighted nominal exchange rate and fair value are metrics designed to measure the strength of a country’s currency compared to other currencies weighted by the amount of trade that a country has with other countries.

Q: What's your outlook for the euro and the British pound?

My biggest conviction is a bearish view on the euro. The euro area needs a very cheap exchange rate to offset the macro headwinds from the Ukraine-Russia conflict. In my view, even with the euro and dollar close to parity, it’s not clear the euro is cheap enough.

The euro’s recent depreciation reflects concerns about the euro area macro outlook. We’re seeing a cost-of-living crisis starting to show up in the data: consumer confidence is weakening and Europe’s manufacturing sector — an important growth engine — is slowing. This comes after a post-COVID-19 rebound for the eurozone that wasn’t as strong as in the U.S.

Euro area inflation hit a record high of 8.6% in June. There’s also the lingering risk that Europe won’t get the natural gas supplies it needs from Russia for the next heating season. That would raise the prospect of widespread rationing, which would likely shut down large parts of the European manufacturing sector, and is likely to hit Germany and Italy the hardest.

I am also bearish on the pound. The euro and the pound tend to move in tandem. The United Kingdom is also facing escalating living costs, and political uncertainty is heightened with the recent resignation of British Prime Minister Boris Johnson.

Q: Why is the Japanese yen not behaving as the safe haven it has historically been?

The yen has been moving almost perfectly in tandem with the U.S. 10-year Treasury yield. As Treasury yields have risen, the yen has weakened. It is a textbook example of monetary divergence. The Fed is tightening, and the Bank of Japan (BOJ) is staying fully committed to its zero interest rate policy.

I believe the story will come to an end at some point. It hinges on two questions: When will the Fed pause its rate-hiking cycle, or maybe even reverse it? And, secondly, when will the BOJ abandon its zero rate policy? I'm less sure on the BOJ since Japan is seeing less inflation relative to other developed nations.

But we are now seeing what I would deem “bad” tightening cycles, where the market is forcing a hawkish response from both the BOJ and the ECB against the backdrop of weak global growth. I believe, if that’s the case, the only reason for sticking with the yen is that the currency may do well in a large risk-off scenario and be an ideal recession hedge.

Q: Do any emerging markets currencies look attractive?

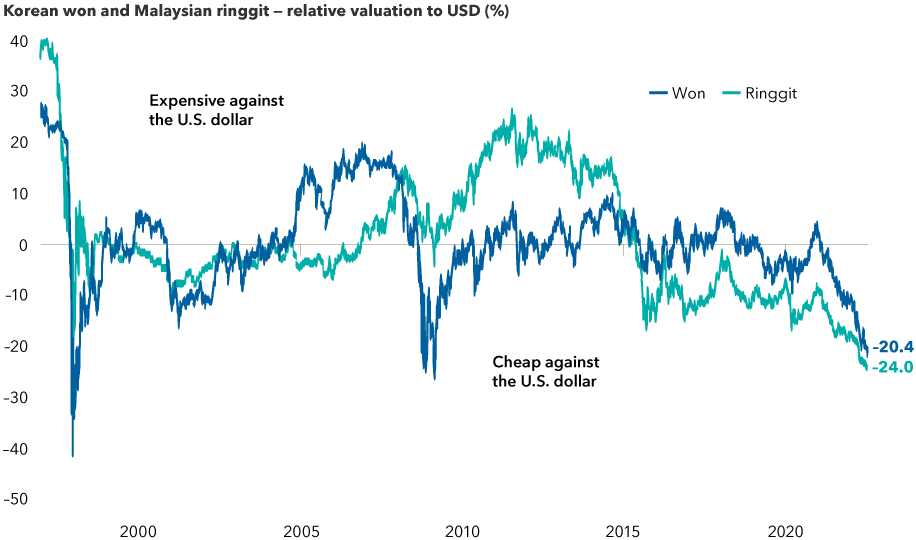

Almost all emerging markets currencies are very cheap based on my long-term valuation framework. Overall, Asian currencies look more attractive than those in Latin America. The fundamentals in Asia are better in terms of current account surpluses, better growth prospects and lower inflation rates.

The Chinese renminbi has been resilient against the dollar, due to its fixed exchange rate ratio. There might be a scenario under which China loosens its “dynamic zero-COVID” policy, pumps more fiscal stimulus into its economy and economic growth picks up after the second-quarter slowdown. If that’s the case, I would expect the renminbi to do well.

The Malaysian ringgit and Korean won may also benefit. I think both countries are better positioned relative to other emerging markets in terms of having current account surpluses and facing less-severe inflation spikes. The Korean won, while very cheap relative to the dollar, has been closely correlated with the global technology cycle and that remains a headwind to consider.

Asian currencies could be better positioned among those in emerging markets

Sources: Capital Group, Bloomberg, Macrobond. Data as of July 26, 2022.

Currencies in Latin America had benefited from strong commodities demand and held their ground against the dollar last year and into part of this year. However, if global growth gets worse over the next six to nine months, pro-cyclical currencies — or those that benefit from an economic upswing — will likely get hit.

Recession risks have driven down prices for copper, oil and industrial metals, sparking a selloff in the Brazilian real, Chilean peso and Colombian peso. Overall, I think there are some longer-term, structural problems in Latin America. Those economies need to cope with deglobalization, re-shoring of supply chains and climate change. The political situation in many countries in the region is also unstable. Therefore, even at current valuations, I do not have a favorable view of Latin American currencies.

Source: BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report. J.P. Morgan disclaimer: https://www.jpmm.com/research/disclosures.

Stay informed with our latest insights.

Our latest insights

RELATED INSIGHTS

-

Treasury market turmoil: How might the Fed react?

-

World Markets Review

Trade war fears jolt markets: Q1 roundup -

Interest Rates

Will economic uncertainty knock the Fed off course?

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Jens Søndergaard

Jens Søndergaard