Global Equities

Currencies

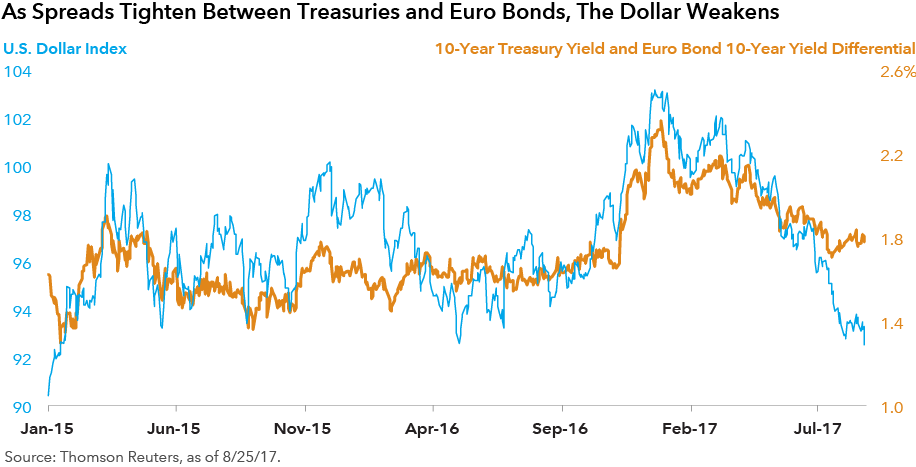

The strength of the U.S. dollar in recent years has been a headwind for some multinational companies’ revenues and earnings. However, a weakening dollar in 2017 has provided a tailwind to corporate sales and profits, which were strong during the second quarter. The improving European economic environment has been one of the catalysts for the dollar’s weakness. The spread between the 10-year U.S. Treasury bond yield and the euro area 10-year bond yield has narrowed as the dollar has weakened, which may signal that businesses and investors alike are seeing risks dissipating in Europe relative to the United States. If Europe’s economic improvement continues, spreads could continue to narrow and the U.S. dollar may further weaken, which would lend additional support to multinational companies’ revenues and earnings.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Economic Indicators

-

-

-

Asset Allocation

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.