Market Volatility

U.S. Equities

Growth stocks took a beating in 2022, no question about that. The crucial question for growth-oriented investors today is: Where do we go from here?

“Last year investors recognized that historically low interest rates produced many excesses, including high-flying stocks without the earnings to support them,” says Carl Kawaja, an equity portfolio manager for EuroPacific Growth Fund®. “That said, the fundamental tenet of buying companies whose return is going to come from generating superior growth over time still makes sense for long-term investors. You just need to be more selective today.”

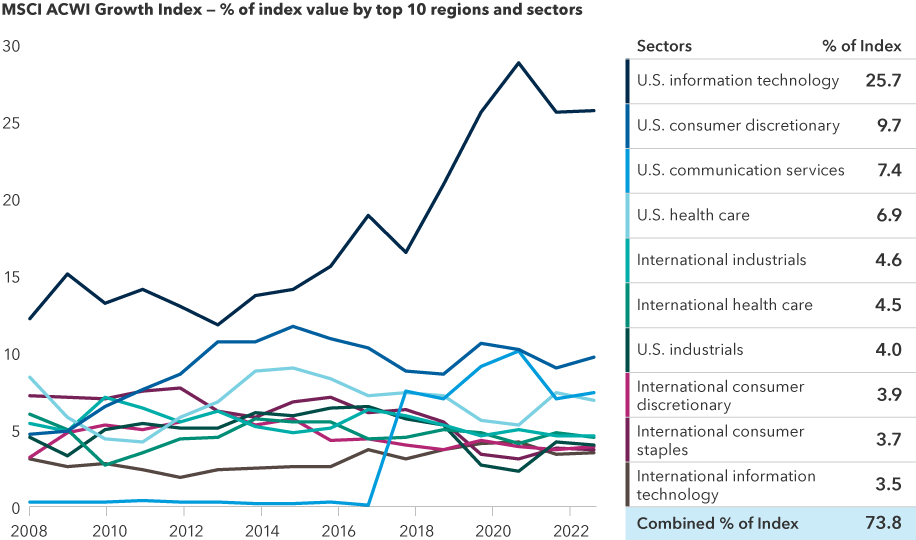

Indeed, many well-known growth companies have been repriced to account for a more expensive cost of capital. Going forward, proven earnings growth will likely be a bigger driver of returns, Kawaja says. The good news is that companies with growth potential will probably come from a broader range of industries and regions — not just U.S. tech and consumer stocks.

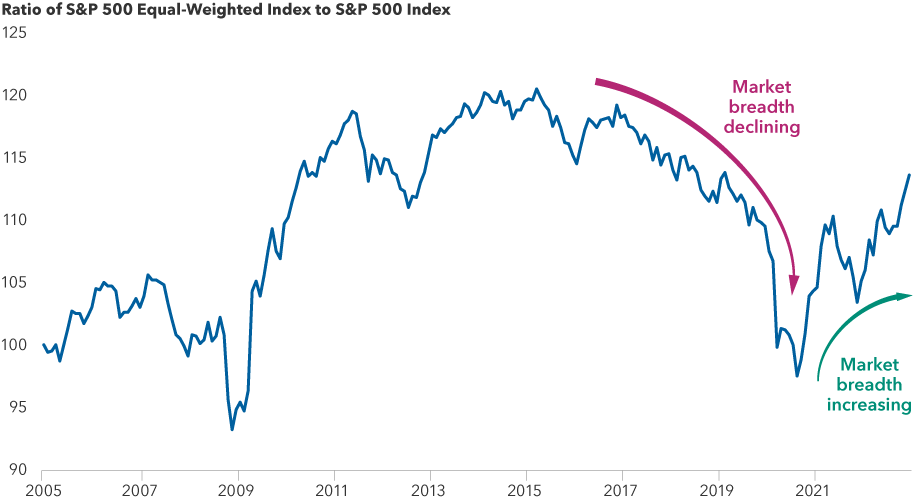

Markets are moving from narrow to broader leadership

Sources: Capital Group, Refinitiv Datastream, Standard & Poor’s. As of 12/31/22. Indexed to 100 as of 1/1/05.

“We're moving from what had been a very binary world — you invested in one sector and avoided others, you invested in the U.S. and avoided non-U.S. — to a more balanced environment with a broader sense of opportunity,” explains Martin Romo, an equity portfolio manager for The Growth Fund of America®.

In the 50 years since The Growth Fund of America began operations — and nearly 40 for EuroPacific Growth Fund — we have witnessed the era of the Nifty Fifty of the 1970s, the tech bubble of the 1990s, the global financial crisis of 2007–2009, and the COVID-19 pandemic. These funds and their generations of portfolio managers have navigated them all.

Here, three of Capital Group’s current generation of growth investors — Romo, Kawaja and Cheryl Frank, an equity portfolio manager for AMCAP Fund® — share their views on how growth investing is evolving, where they are looking for opportunity and how they are preparing for the next bull market.

1. The AI inflection point is here

Martin Romo, 31 years of investment experience

Tech and consumer stocks have been punished, and in many cases that was warranted. But in some cases, I think the market is throwing out the baby with the bathwater. When nearly everyone says that the world has changed and what was true over the last 10 years can’t be true going forward — I think that is a mistake. The market may be overlooking continued strength in some well-positioned companies.

What’s more, the pace of innovation around the world is picking up. Several colleagues and I recently spent a few weeks in Silicon Valley meeting with public companies and venture capital firms, and I came away believing we are at an inflection point with artificial intelligence (AI). Innovative uses of AI are happening all around.

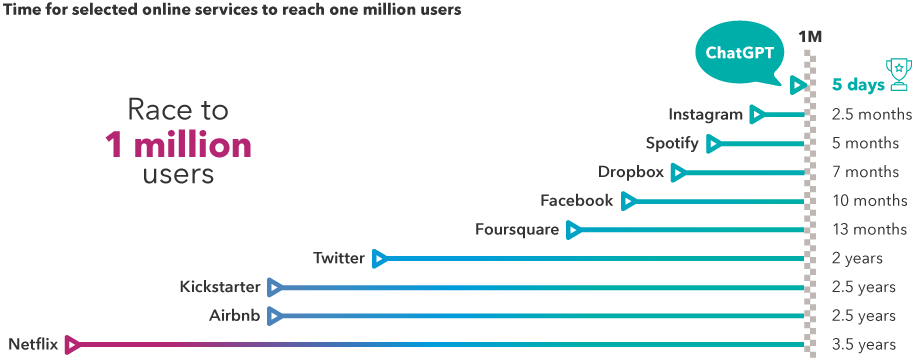

The speed of adoption for new technologies is picking up

Source: Statista. As of 12/31/22. Kickstarter refers to number of backers. Airbnb refers to number of nights booked. Foursquare and Instagram refer to number of downloads.

Companies like Microsoft are using AI technology to help differentiate their offerings and deliver enhanced productivity to customers. Microsoft has already issued a limited test release of its Bing search engine that harnesses ChatGPT, a chatbot developed in partnership with OpenAI. Microsoft has also disclosed plans to include the technology in its widely used Office software suite, its Teams platform and its GitHub code-development service.

Wider adoption of AI technology will require massive computing power, providing tailwinds for cloud services and the semiconductor industry. Nvidia, which develops semiconductors and computing hardware, already uses AI to improve the speed of its own product development and recently disclosed an AI distribution partnership with Microsoft. Semiconductor maker Broadcom, which helped develop AI chips for Google in 2016, has since introduced more advanced AI chips.

The key takeaway for me is that we are very early in the development of this technology. It feels like the early days of mobile and cloud as they entered an era of hyper-charged growth. Right now, there’s a lot of hype surrounding AI and questions about the accuracy of chatbots. Despite a challenging environment, I remain very excited about the long-term investment opportunities on the horizon.

Go deeper:

2. “Picks and shovels” enable growth across industries

Cheryl Frank, 24 years of investment experience

One lesson I’ve learned in my career is to closely track capital floods and droughts. When capital floods into a sector, it usually drives increased investment that can lead to opportunities for suppliers in that industry. These are what I call pick-and-shovel companies. Investors sometimes overlook these businesses, but they often have more stable cash flows and lower risk profiles compared to the companies they service.

Consider how much money has flowed into health care research and development (R&D). This has been going on for a few years, but it was turbocharged during the pandemic. Pharmaceutical companies that successfully developed COVID vaccines and anti-viral treatments, such as Pfizer and Moderna, piled up cash. Much of this capital will be funneled into more R&D.

Pick-and-shovel companies like Danaher and Thermo Fisher Scientific, which provide drugmakers with testing equipment, reagents and diagnostics, could see demand for their services rise as R&D investment grows.

By contrast, in the energy sector we saw a years-long capital drought as energy prices touched levels near zero. Then, as soon as supplies got tight and prices rose, capital flooded back in. Record-breaking cash flow over the last 12 months has left oil producers with some of the strongest balance sheets in history.

Even though energy is not a growth sector, I believe there are opportunities for growth within it. When energy companies profit, they typically expand exploration and production, which requires more machinery and services. This could be a source of growth for companies that provide technology, products and services to the industry.

Tech and consumer sectors aren’t the only sources of growth potential

Sources: Capital Group, MSCI, Refinitiv Datastream. In 2018, the telecommunications sector was expanded and reclassifed by the Global Industry Classification Standard (GICS) as communication services. As a result of the reclassification, Facebook, Netflix and Alphabet became included in communication services sector. Prior to 2018, Facebook and Alphabet had been classified as information technology constituents, and Netflix had been classified within the consumer discretionary sector. Values through 2023 are current as of January 31, 2023.

3. Global champions get stronger as the dollar weakens

Carl Kawaja, 36 years of investment experience

Last year, for the first time in almost a decade, U.S. stocks trailed markets in other major regions of the world. The odds that this trend can continue are reasonably good, in my view, simply because we've been in a long upcycle for U.S. stocks and the U.S. dollar.

For companies outside the U.S., dollar strength tends to be a headwind. At some point, I believe the Federal Reserve will have to cut rates. And when that happens, I think we may see further dollar weakness. So I'm optimistic about the prospects for international investing.

Regardless of whether economies in Europe or Asia do well, there will be great companies in those regions with solid business prospects. I often use a basketball analogy to help describe this dynamic. I'm struck by how international the NBA has become. In a sport that was first championed in the U.S., the NBA now features something like 120 international players from 40 countries, including some of the biggest superstars in the game.

Today I think there are select companies outside the U.S. that have been waking up to their opportunity globally. They are refocusing on generating value for shareholders during a time that is much more beneficial for their currency. In other words, like basketball, the world catches up, and some of the superstar companies are based in other countries.

Consider ASML, the world’s leading provider of manufacturing equipment for the most advanced semiconductors. It just happens to be based in the Netherlands. ASML has developed unique technology for making advanced chips. As its market share grew, it aggressively invested in developing its technological advantage. Right now, many chip stocks are down and the industry is struggling with oversupply. But taking a multi-year view, I think the industry is well positioned for a strong cyclical recovery.

Another example is in drug discovery. We are in the middle of a golden age of health care innovation. Many of the recent advances in treatments for cancer and pathogens like the COVID virus have been developed by U.S. companies. But there is also a Danish pharmaceutical company, Novo Nordisk, that has developed therapies to treat diabetes and obesity. Again, interest in this company has less to do with whether European markets can outpace U.S. markets and more to do with a worldwide increase in diabetes and obesity and the potential to improve patients’ lives.

Why experience matters during volatile markets

All three of these seasoned investors believe the keys to navigating volatile markets are patience, experience and a long-term perspective. “There are lots of questions today about inflation, the Fed and recession,” Romo says, “But if we look over the horizon and focus on durable investment themes over the next few years, then I see lots of opportunity ahead.

“Growth investing is down but not out. Seeking to invest in companies with superior long-term prospects is as relevant today as ever.” Such companies are more likely to survive market downturns and come out stronger on the other side.

That sentiment was nicely echoed years ago by former Capital Group Chairman Jim Rothenberg, who was a member of an earlier generation of portfolio managers on The Growth Fund of America from 1994 to 2014.

When asked for his market prediction, Rothenberg said, “I don’t predict the rain. I help investors build financial arks.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. The index is unmanaged and, therefore, has no expenses.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Equal Weight Index is the equal-weight version of the widely used S&P 500 Index. The S&P 500 Equal Weight Index includes the same constituents as the capitalization weighted S&P 500 Index, but each company in the S&P 500 Equal Weight Index is allocated a fixed weight, or 0.2% of the index total at each quarterly rebalance.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Don't miss our latest insights.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Martin Romo

Martin Romo

Cheryl Frank

Cheryl Frank

Carl Kawaja

Carl Kawaja