Health Care

Amid the storm of market volatility in the first half of 2022, health care was among the few areas that offered investors some shelter.

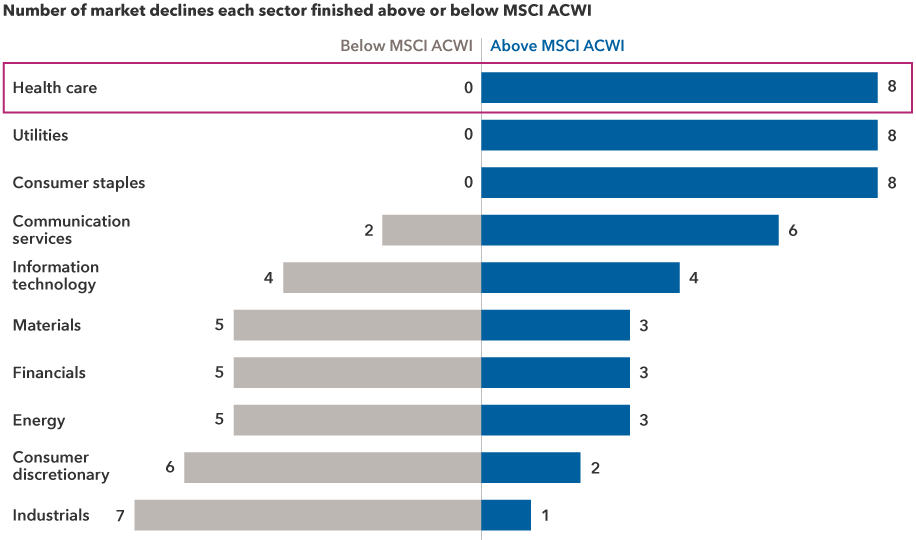

That may not be surprising, considering that demand for services in the sector tend to hold up regardless of market volatility or the economic cycle. In fact, the sector has outpaced the broader global stock market in each of the past eight market declines of 15% or more.

Indeed, prospects for select companies appear to be brightening, and some have the potential to remain compelling investment opportunities for years to come, according to equity analyst Christopher Lee, who covers U.S. pharmaceuticals and biotechnology companies.

“Health care has been a good place to invest since the start of the pandemic for a variety of reasons,” says Lee, who holds a medical degree from Columbia University. “First you had biopharma companies developing vaccines and treatments for COVID. Now you have other companies benefiting from their defensive nature in a time of uncertainty in the markets.”

Health care is among the sectors that have done well in down markets

Sources: Capital Group, FactSet, MSCI. Includes total returns for MSCI ACWI sectors for the last eight periods in which the S&P 500 declined by more than 15% on a total return basis. The 2022 bear market is considered current as of June 30, 2022, and is included in this analysis. The periods included in the analysis above are July 17, 1998–August 31, 1998; March 24, 2000–October 9, 2002; October 9, 2007–March 9, 2009; April 23, 2010–July 2, 2010; April 29, 2011–October 3, 2011; October 3, 2018–December 24, 2018; February 19, 2020–March 23, 2020; and January 3, 2022–June 30, 2022.

“But that’s not the whole story,” Lee adds. “Innovation across drug development, genetic sequencing, data collection and health care service delivery is accelerating. That’s driving growth for nimble companies and generating opportunity for long-term investors.”

This all begs the question: Could the 2020s be the decade when global health care takes a leading role in markets?

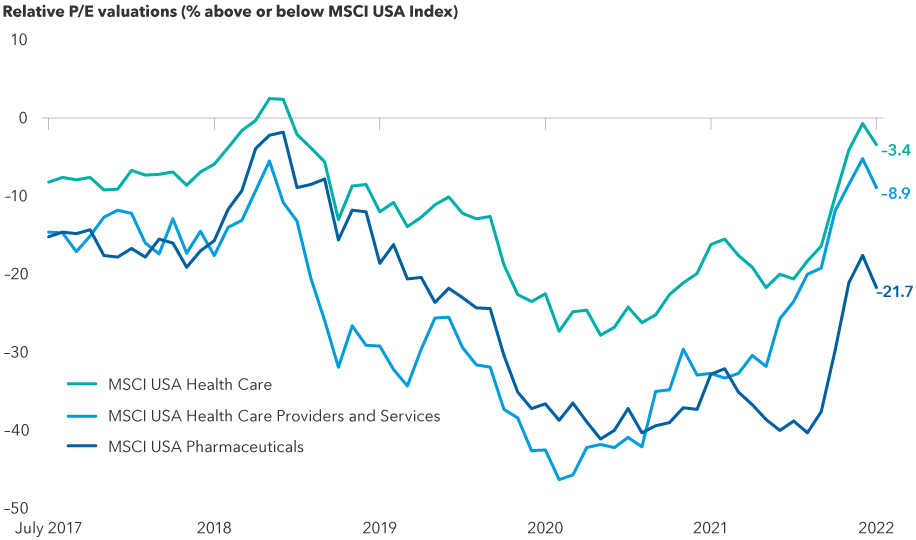

“New market leadership has often emerged at the end of a bear market,” says equity portfolio manager Diana Wagner. “I don’t know for certain that the health care sector will lead the next bull market. But what I do know is that many leading health care companies have paid relatively high dividends, have growth potential with accelerating innovation and still offer what I believe to be compelling valuations. I do believe the best managed of these companies could emerge as new market leaders.”

Wagner and Lee identify four reasons why we may be entering a golden age of health care and the potential implications for investors.

1. We are in a golden age of drug discovery

Christopher Lee

We are in the early days of a third major wave of innovation in biotech and drug discovery. In the first wave, old-line chemical companies recognized they could use chemistry to treat disease. The second wave was the emergence of protein-based therapeutics that were more targeted, harnessing the immune system to treat disease.

I would call this third wave the genetic age of medicine. We have the insights from genetic sequencing done in recent years and a wealth of data we can now process at rapid speeds, as well as new therapeutic interventions and technologies that can more specifically intervene in the disease process. It's an incredibly exciting time.

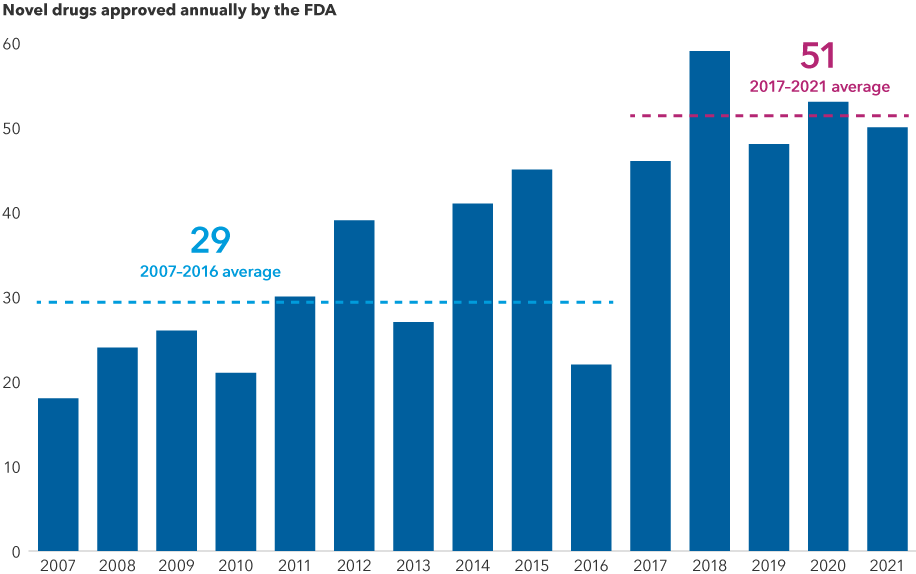

The number of drugs gaining approval has expanded in recent years

Source: Food and Drug Administration. As of 12/31/21.

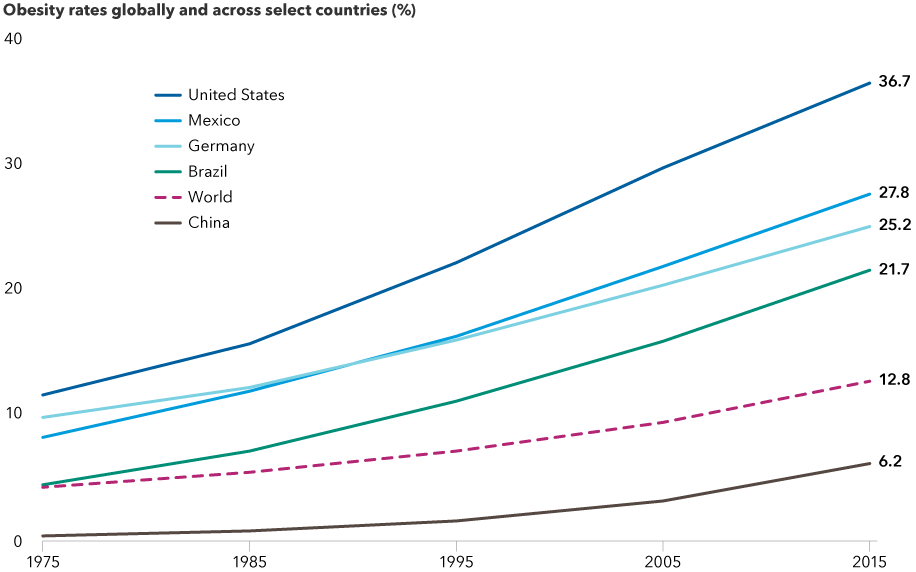

There are several major diseases that we are now starting to tackle. Consider obesity, arguably the world’s leading health risk, afflicting more than 650 million adults worldwide as of 2016, according to the Organisation for Economic Co-operation and Development.

Life-threatening health problems linked to obesity include cardiovascular disease, diabetes and kidney failure, to name a few. It also puts individuals at higher risk for adverse outcomes from infectious diseases like COVID. For decades obesity was unfairly stigmatized as simply a reflection of poor lifestyle choices, but today it is widely recognized as a more complicated health problem.

The good news is leading pharmaceutical companies have developed a new generation of drugs that can reduce a patient’s body weight by as much as 20% to 25% — a level of weight loss on par with the impact of bariatric surgery. These drugs work by mimicking naturally occurring hormones that help people feel full after eating.

Novo Nordisk and Eli Lilly have already introduced these agents for the treatment of Type 2 diabetes, and they are developing versions of these drugs that are exhibiting a level of weight loss that is significant for most patients. I don’t like to throw the term “miracle drug” around, but these are incredibly effective medicines that not only reduce weight but also help bring a prediabetic patient’s sugars under control and offer other potential benefits. I think this is something that will transform the entire landscape of metabolic diseases in the U.S. and around the world.

Obesity is no longer just a U.S. problem

Sources: Capital Group, World Health Organization. Latest data as of 2016.

2. Genetic medicine leads to faster breakthroughs

Investors poured an incredible amount of capital into the biotech and pharmaceutical industries over the last several years. And that drove innovations that resulted in the creation of intellectual property and know-how that we will likely be building on for years to come.

One key advancement is the development of technologies that allow intervention in disease pathways at the level of the genetic sequence or “blueprint," further upstream than many conventional medicines. Through sequencing and data processing, drug developers can apply highly specific and precise interventions like gene therapy, where we transplant normal genes in place of missing or defective ones to address the disease.

To formulate a COVID vaccine with such speed, scientists sequenced the virus within days or weeks of identifying it and then translated that sequence to various vaccines and mRNA. It's an example of how targeting a pathogen genetically can create an effective medicine very quickly compared to the prior way of identifying therapies through extensive experimentation.

COVID became an accelerant for innovation, condensing into two years of work what the industry might have previously needed 10 years to accomplish. This new approach to drug development is likely to lead to a higher success rate and greater number of drugs coming to market at a faster pace.

Another emerging technology is RNAi therapeutics. RNAi is a natural biological process that regulates gene expression by interfering with messenger RNA (mRNA), which carries DNA’s instructions for making new proteins. This will be important for a wide range of diseases.

There's potentially an explosion of new therapeutic opportunities coming over the next decade with these advances. When you find a company that can do it, it may turn out to be a special investment over time.

3. New managed care models improve outcomes and lower costs

Diana Wagner

I agree with Chris that we are seeing a major wave of innovation across drug development, but I am also seeing a new age of innovation on the services side of health care. If you look at how most doctors practice today, particularly primary care doctors, they operate in the traditional fee-for-service model, where they get paid for volume. So essentially the sicker you are, the more services they provide and more money they make.

But today, companies like UnitedHealth Group and Humana — as well as emerging ones like Agilon — are developing models that reward doctors for keeping patients healthy and out of the hospital. This elevates the primary care physician from essentially the bottom of the health care totem pole to the top.

I see these models as an important step toward achieving what's often described as the holy grail or quadruple aim in health care: better health outcomes, higher patient satisfaction, higher doctor satisfaction and lower costs per capita.

We're already starting to see a proliferation of these types of business models. And I suspect in the next five to 10 years they will come to a physician practice near you, where you'll also be able to get your obesity drugs to help drive better long-term health outcomes at a lower cost for the system.

Health care companies are undervalued relative to the broader market

Sources: Capital Group, MSCI, Refinitiv Datastream. Relative valuation is the ratio between the forward 12-month price-to-earnings ratio of the health care sector and the MSCI USA Index. A value below the average (0.5%) indicates that health care is relatively undervalued. As of 7/29/22.

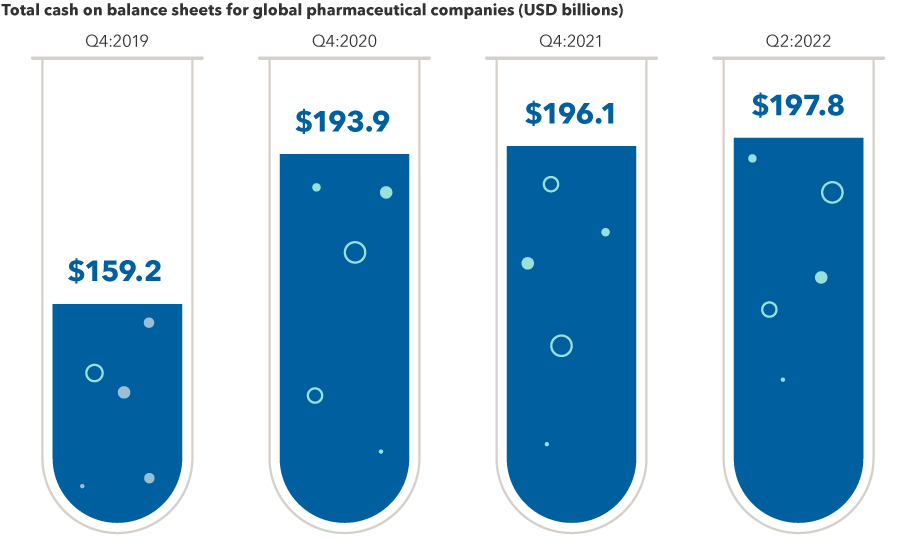

4. Well-capitalized companies can fund their own growth

Periods of accelerating innovation can produce opportunities for good long-term investments. Innovation has often driven earnings and investment returns over many years. What’s more, many large pharmaceutical companies are well capitalized with a lot of cash on their balance sheets, providing them an opportunity to fund their own growth through acquisitions and other strategies.

Global pharma companies stand ready for mergers and acquisitions

Sources: Capital Group, FactSet, MSCI, Refinitiv Datastream, Refinitiv Eikon. Figures above represent the aggregated value in U.S. dollars of cash and short-term investments across MSCI World Pharmaceuticals constituents. As of June 30, 2022.

An incredible amount of capital was invested in biotech over the last several years, and that provided the resources to develop tangible intellectual property that will likely continue to bear fruit. Having cash on the balance sheet is important in a period when rates are rising and the cost of capital is going up.

Ultimately what drives long-term value creation in health care is innovation. Of course, not every innovation will succeed. Some drugs will fail to meet approval or gain market acceptance. But if you identify an innovative product or service that's special, it has the potential to drive an investment thesis for years. This gets me excited because it can result in real earnings and real cash flows. I think several health care companies have the potential to emerge as leaders of the next bull market.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

The MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

The MSCI USA Index is a free float-adjusted, market capitalization-weighted index designed to measure the U.S. portion of the world market.

The MSCI USA Health Care Index is designed to capture the large- and mid-cap segments of the U.S. equity universe. All securities in the index are classified in the health care industry.

The MSCI USA Pharmaceuticals Index and MSCI USA Health Care Providers and Services Index are subcomponents of the MSCI USA Health Care Index and only contain companies within each respective industry.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Institutional investors rely on our newsletter. Have you subscribed?

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Chart in Focus

-

Manufacturing

-

U.S. Equities

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Christopher Lee

Christopher Lee

Diana Wagner

Diana Wagner