Market Volatility

Inflation

- The Fed raised interest rates by 0.25% to a range of 1.5% to 1.75%.

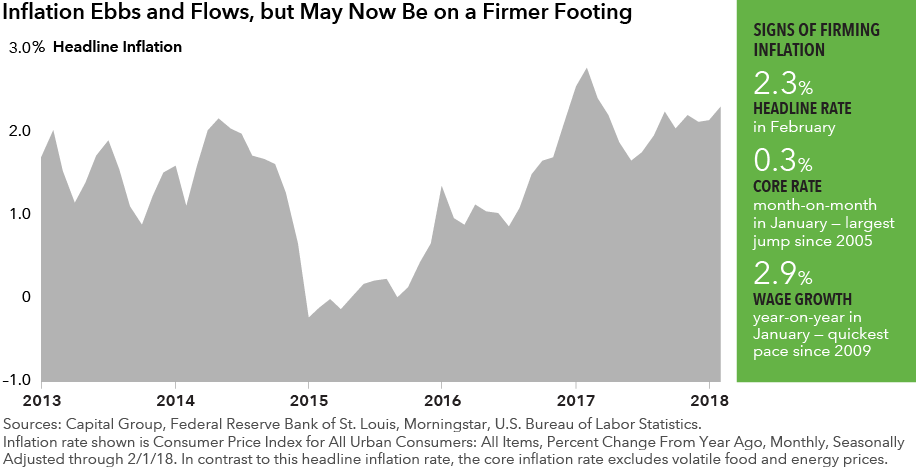

- Weak inflation is now in the rearview mirror.

- Signs point toward inflation that is stable to higher from here.

- Buying protection can help preserve purchasing power.

- Treasury Inflation-Protected Securities (TIPS) valuations remain attractive, and a selective investment approach can add value.

Inflation scare prompts market swerve.

Widely ignored for many years, inflation has emerged as a focal point for market angst. It was a key factor behind renewed volatility in February — when a jump in wage growth spooked investors.

For now, there’s less concern that inflationary pressures will prompt the Federal Reserve to speed up rate hikes. The Federal Reserve raised interest rates by 0.25% to a range of 1.5% to 1.75% at its March 21 meeting, and their current outlook remains consistent with a fairly gradual approach to further increases.

But there’s no room for complacency. Any investor ignoring inflation does so at their own peril.

Even at the modest levels we currently see, inflation can erode wealth over time. So, what’s behind inflation’s recent rise, and where is inflation headed?

Weakness in the rearview mirror

Last year, we argued that a handful of temporary factors were dragging down core inflation — the measure that strips out volatile energy and food prices.

Changes to wireless plan pricing and the lagged impact of past dollar strength on clothing prices were among the main culprits. Fast forward to the present and the long shadow cast by these one-offs is receding.

Already in 2018, the headline inflation rate has edged higher. Other relevant indicators have also ticked up, with a number hitting multi-year highs. In short, inflation seems to be better supported.

Destination: Higher inflation?

Break-even rates — the average inflation required over the life of a bond for TIPS and nominal Treasuries to generate the same total return — offer a gauge of inflation expectations. Since mid-2017, break-even rates for 10-year bonds have trended higher, rising by 0.5% to top 2%.

When it comes to inflation, there are various forces that can get the gears turning.

At present, the scene is set for stable to higher prices for consumer goods and services. Key supportive factors include:

- Tight labor markets. Low unemployment should push wages higher (eventually).

- Global manufacturing recovery. We anticipate a rebound in the price of core goods.

- Dollar weakness. Higher dollar costs for imports can create pent-up inflation.

- Asset price gains. This could still spill over into inflation — if enough consumers start to feel wealthy enough to splurge.

- Medical costs. The budget deal further delays the Affordable Care Act’s high-cost plan tax; caps on Medicare spending are unlikely to materialize. These developments will likely create a tailwind for medical inflation.

Net upward pressure on consumer prices also makes good sense, if you step back and look at the big picture. Years of modest but steady economic growth are beginning to lift resource utilization in the economy. Core inflation stood at 1.85% in February and, according to our analysis, it could eventually reach 2.5%.

Time to buy inflation protection?

Preserving purchasing power is important for all investors, and critical for those who rely on investment income, such as investors who are in or close to retirement. That’s why we view inflation protection as one of the four primary roles of fixed income in a balanced portfolio (alongside diversification from equities, income and capital preservation).

Hedging strategies have proliferated as inflation has bumpily moved higher. Some strategies invest in high-yield or equities. Others turn to commodities. Only those that focus on TIPS, however, offer investors a potential source of explicit inflation protection.

Importantly, TIPS also complement other bond investments that may not hold up well in an inflationary environment (or provide diversification to equity-heavy portfolios).

Maybe you’re worried that TIPS gains in 2016 and 2017 make this a bad time to allocate? We think that, although break-even rates have marched higher, the potential for inflation to surprise on the upside means that TIPS continue to look attractive.

Of course, the specific allocation to an inflation protection strategy that is appropriate depends on individual circumstances — soon-to-be or current retirees, for example, might want to consider an allocation of up to 10%.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. While not directly correlated to changes in interest rates, the values of inflation-linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Market Volatility

-

-

Artificial Intelligence

-

Interest Rates

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Ritchie Tuazon

Ritchie Tuazon

Timothy Ng

Timothy Ng