Market Volatility

Europe

- After a stellar 2017, European equities have disappointed investors so far this year.

- Global trade disputes and slowing economic growth are pressuring markets.

- We see more challenges and uncertainty on the horizon for 2019.

What happened to the enthusiasm for European equities in 2017? The election of reform-minded President Emmanuel Macron in France, the staying power of Chancellor Angela Merkel in Germany and signs of improving economic growth in the eurozone supported double-digit gains in European stocks. European markets, as we penned in our 2018 Outlook, were finally in position to reverse a years-long period of trailing behind a powerful U.S. bull market.

This year, those hopes have faded like the paint on a rusty old container ship. Amid investor worries over global trade skirmishes, the trade-oriented European economy has slowed appreciably. The political scene in several key countries has tumbled into turmoil. And European stock markets have reflected this unfortunate turn of events, failing to keep pace with U.S. stocks yet again. Here are three underlying issues contributing to the dislocation in international markets:

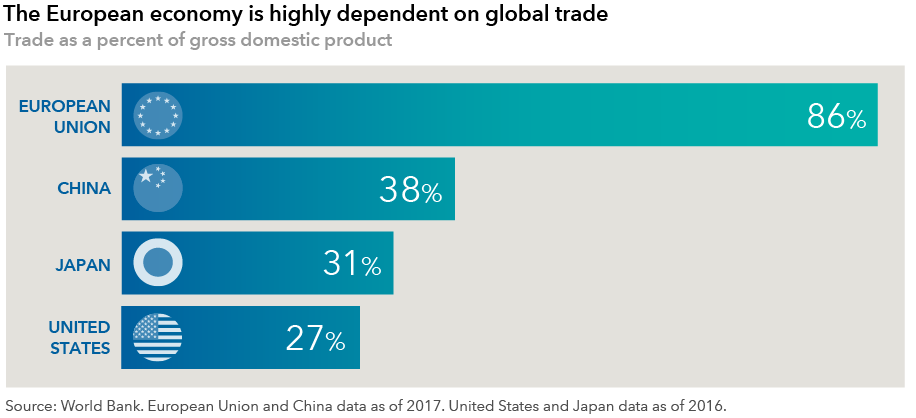

1. Global trade disputes hurt Europe more than any other major economic region.

“Europe is particularly vulnerable to trade disruptions,” explains Robert Lind, a Capital Group economist based in London. “The headlines tend to focus on conflicts between the U.S. and China, however, it is Europe that has the most to lose in a trade war. In my view, this is a critical reason for lackluster returns in European stocks this year.”

Through the end of the third quarter, the MSCI Europe Index is down about 2% for U.S.-dollar based investors. That compares with a return of roughly 11% for U.S. stocks, which have repeatedly hit new record highs during the 9-month period. In currency markets, the euro has slipped 3% against the dollar this year as higher U.S. interest rates, a strong U.S. economy and a flight-to-safety trend have supported U.S. asset flows.

2. Divisive politics are calling EU stability into question.

In addition to trade fears, politics got in the way. A European stock market rally that started with the May 2017 French elections slowly petered out as it became clear that Macron’s economic reforms would face stiff domestic opposition. In Germany, Merkel came under fire as her Christian Democratic party lost significant ground in the parliamentary elections, though she narrowly managed to hold the chancellorship.

Across the Channel, rancorous Brexit negotiations have imperiled the administration of U.K. Prime Minister Teresa May. It is possible that the U.K. may leave the European Union without a trade deal, which could be highly problematic for both parties, Lind notes.

At the same time, following recent elections in Italy, a new populist-coalition government has reignited fears about the fiscal policies of Europe’s third largest economy and its long-term desire to remain in the European Union and the 19-member eurozone.

“European politics is continuing to fragment,” says Talha Khan, a political economist at Capital Group. “Populist, nationalist, fringe-party movements are reasserting their influence across the continent. They are not going away. If anything, they are gaining ground in countries such as Germany, Italy and Norway, among others.”

Looking ahead, the calendar of events for 2019 does not inspire much optimism, according to Khan. “We could see a change of leadership in Germany, a ‘hard Brexit’ outcome in the U.K., political and financial turmoil in Italy,” Khan says, adding that European Central Bank president Mario Draghi is set to leave office in October 2019.

On top of that, the ECB is expected to wind down its bond-buying stimulus program by December and consider raising interest rates in mid- to late 2019. The ECB has held its key policy rate in negative territory since 2014 in an attempt to jumpstart the European economy.

“That’s a lot of uncertainty in a relatively short period of time,” Khan says. “It’s a recipe for more market volatility ahead.”

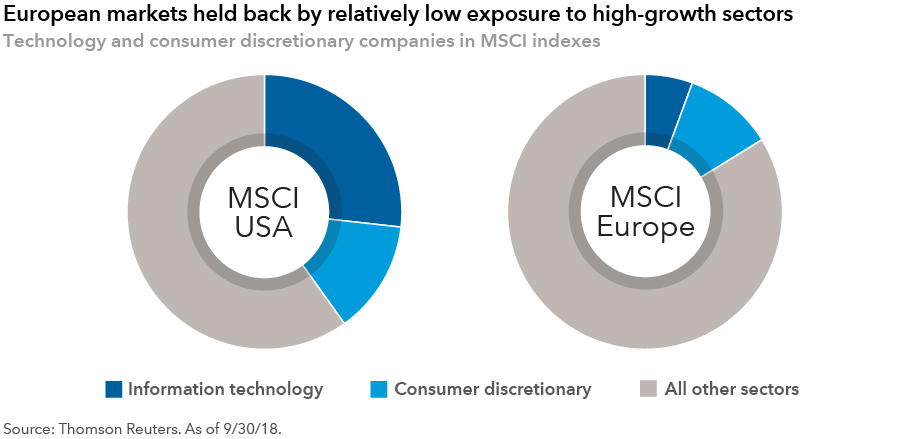

3. Secular growth companies favor the U.S. over Europe.

Another reason for the disparity in returns between U.S. and European stocks is Europe’s relative lack of high-growth, tech-oriented companies. The technology and consumer discretionary sectors, which have led the U.S. bull market since 2009, make up a much smaller percentage of the European market.

It’s no secret that extraordinary market leaders such as Amazon, Apple, Facebook, Google, Microsoft and Netflix are all based in the U.S. By comparison, just two companies – Germany’s SAP and the Netherlands’ ASML – account for nearly half the market capitalization of the European tech sector. Europe’s dearth of innovative tech and consumer-tech companies has left the region trailing in a long-term, tech-centric rally.

Investment implications

“This is why we invest in companies, not sectors or economies,” says Capital Group portfolio manager Brad Freer. “From a macro point of view, I’m not sure if the situation in Europe will improve any time soon, but it doesn’t have to improve for fundamental investors to find compelling, secular-growth companies.”

European aircraft manufacturer Airbus is the most obvious example, Freer says. Its shares trade at a significant discount to U.S.-based Boeing. According to Freer, other companies in this group include Irish low-cost airline Ryanair, chip equipment maker ASML and British bank HSBC, which is looking to Asia for faster growth opportunities.

“Based on index returns, European equities have been disappointing, no question about it,” Freer says. “But the fact remains, there are like-for-like companies in Europe that are far more attractive from a price perspective than their U.S. counterparts. Those opportunities are just very stock specific and they don’t hinge on any sort of tailwind from the European economy.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

All Capital Group trademarks referenced are registered trademarks owned by The Capital Group Companies, Inc. or an affiliated company. All other company and product names mentioned are the trademarks or registered trademarks of their respective companies.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Talha Khan

Talha Khan

Robert Lind

Robert Lind