Fixed Income

Currencies

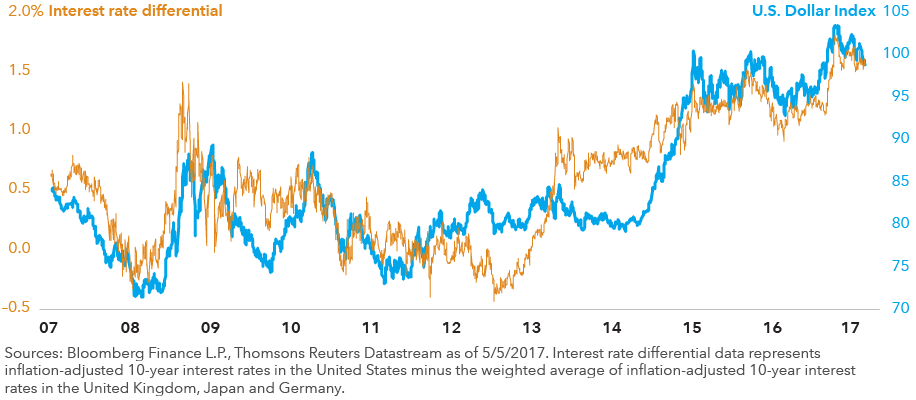

Interest rate differentials and the dollar usually trend in the same direction — but since early 2016, the two have moved in near-lockstep. Some might say that means the dollar is set to appreciate even further as the Federal Reserve quickens its pace of interest rate hikes.

But Capital Group currencies analyst Jens Søndergaard thinks that with real interest rate differentials already at 10-year highs, it’s more likely that the relative rates will narrow and the dollar will weaken.

“It’s hard to imagine that foreign real rates won’t follow the U.S. if the U.S. growth acceleration helps bring about an upturn in global growth. It’s equally hard to imagine foreign real rates falling further, given their current very low levels,” Søndergaard says. For U.S.-based investors, a weaker dollar would boost international equity returns, which have lagged domestic equities in recent years.

Our latest insights

-

-

World Markets Review

-

U.S. Equities

-

Global Equities

-

Economic Indicators

RELATED INSIGHTS

-

-

Asset Allocation

-

Demographics & Culture

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.