Real Estate

Is commercial real estate (CRE) the proverbial next shoe to drop for the beleaguered banking sector? Even before the collapse of Silicon Valley Bank, the outlook for parts of the CRE market appeared dim. Now with lending standards growing tighter, investors are getting increasingly nervous about problematic properties lurking on bank balance sheets.

First, some context: Banks account for about half the lending in the approximately $5 trillion CRE loan market, mostly through fixed rate loans. The other half comprises commercial mortgage-backed securities (CMBS), lending from federal agencies such as Fannie Mae and Freddie Mac, insurance companies, and to a lesser extent, mortgage real estate investment trusts (REITs).

Overall, CRE is a heterogeneous market and cannot be painted with a broad brush. Office and retail properties look like the biggest concern, while other areas such as multifamily units and industrial warehouses could hold up relatively well.

On average, the debt maturities of CRE loans are laddered, or spread out, across 8 to 10 years, which mitigates potential risks typically associated with a surge in refinancing needs. Real estate borrowers who do have to refinance, or have high loan installments with falling property values, are likely to negotiate hard for lower payments or threaten to surrender properties — a tactic known as a strategic default.

The upshot is banks that hold significant portions of CRE loans on their books will likely see a hit to earnings. However, it appears unlikely these will trigger a banking insolvency crisis.

Meanwhile, most REITs seem relatively well positioned in this cycle, given their debt is generally well diversified and they have access to a broad set of lenders across banks and capital markets.

Regional banks are at greater risk

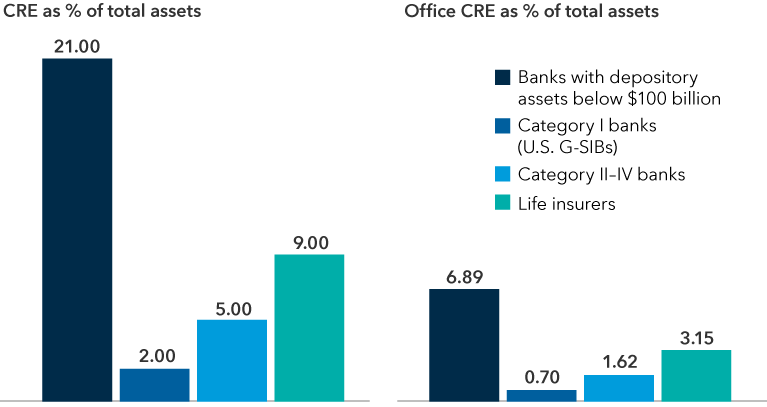

Looking across the banking sector, the megabanks (the largest systemically important institutions) appear to be the best positioned, as CRE typically comprises less than 10% of their loan portfolios.

Large regional banks tend to have around 20% of their loan portfolios in CRE. That number rises to a range of 40% to 70% at some smaller regional banks, which remain the most vulnerable. Within banks’ CRE portfolios, exposure to higher risk subcategories (retail, office, construction/development) is greater at the regional banks than the megabanks.

Smallest banks have outsized CRE exposure

Source: U.S. Federal Reserve Board staff calculations. Data as of May 8, 2023. Commercial real estate holdings in Q4 2022 nonfarm nonresidential, including office and downtown retail. U.S. G-SIB: global systemically important banks headquartered in U.S. Category II: greater than or equal to $700 billion total assets or $75 billion in cross-jurisdictional activity. Category III: greater than or equal to $250 billion total assets or $75 billion in nonbank assets, weighted short-term wholesale funding or off-balance sheet exposure. Category IV: other firms with $100 billion to $250 billion total assets.

How bad could it get for the banks?

Current interest rates can make refinancing uneconomical, even for properties that are still performing well. This means some leading major real estate investors are likely to “turn in the keys” and hand properties back to the lenders.

As these strategic defaults pick up, banks will face losses. The CMBS market has already seen a few highly publicized defaults on office property loans, and ongoing negotiations are very likely on many others.

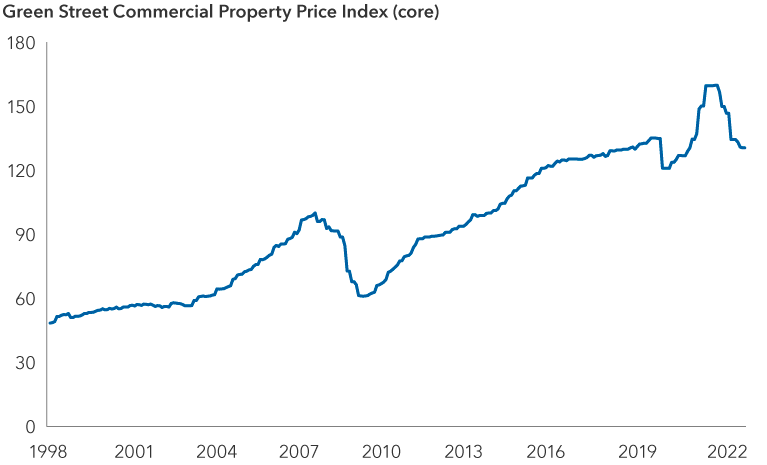

CRE prices have fallen 18% from their peak

Sources: Capital Group, Green Street Advisors. Green Street's Commercial Property Price Index is a time series of unleveraged U.S. commercial property values that captures the prices at which commercial real estate transactions are currently being negotiated and contracted. Core CPPI is based on sector weights of: apartment (25%), industrial (25%), office (25%) and retail (25%). Data as of May 1, 2023.

To get a sense of the impact, our analyst team looked at all outstanding CRE loans that underlie CMBS and assessed them as if they were underwritten to current terms (30-year amortization, 6% to 7% coupon, 1.25x-1.50x debt service coverage ratio). The exercise reveals that all subsectors of CRE have at least some borrowers that will either be (1) required to inject equity to successfully refinance or (2) economically incentivized to strategically default.

Currently, office properties make up about a quarter of CRE loans for banks. Based on Capital Group analysis, even office property portfolios losing half their value would translate to about a 5% decline on banks’ CRE portfolios.

How will REITs hold up?

Commercial REITs are relatively well positioned compared with private CRE in this cycle. They have much better loan-to-value ratios than other real estate borrowers.

REITs have tended to have easy access to debt markets. Their debt has usually been well-diversified across unsecured, secured, bank loans and lines of credit. This has given them numerous options to turn to as credit availability dries up. But this may not insulate the sector if there is a wave of office loan defaults due to a combination of banks pulling back on office lending and refinancing that does not materialize due to declining asset values and significantly higher interest rates.

Will problems in office space spread to other areas?

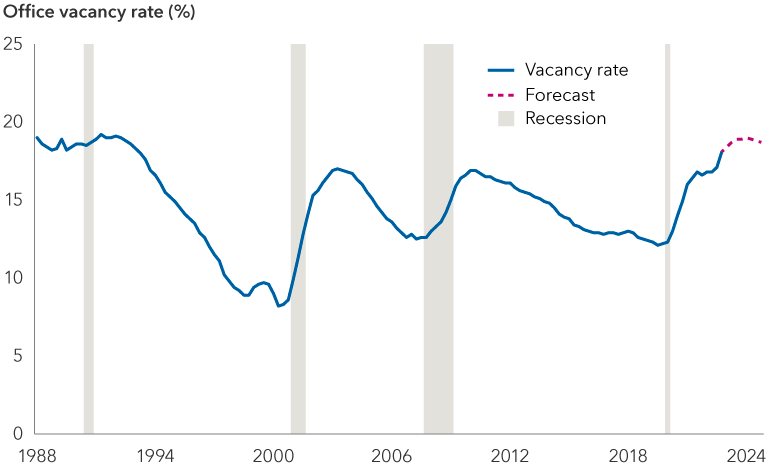

Office buildings across many American cities are likely to struggle more than other areas of the CRE market. With the growing number of companies embracing work-from-home, a surplus of office space is available. Much (but not all) of it can survive at occupancy rates lower than pre-pandemic levels, although inevitable value markdowns need to occur.

U.S. office vacancy rate reaches historic levels

Sources: Capital Group, CBRE Econometric Advisors, data as of 5/1/2023. CBRE forecast begins Q2 2023.

The central location of many office properties boosts the incentive for redevelopment. In other cases, demolition makes more sense than conversion. But office building values have not corrected to the point of obsolescence. Where possible, banks will likely kick the can down the road through extended maturities.

In terms of fundamentals, the commercial real estate market outside of office space has remained relatively resilient. There should be room for continued growth in rents in these markets, as long as a sharp recession is avoided. For example, multifamily properties continue to enjoy strong demand, as high home prices and mortgage rates are making it necessary for many people to continue to rent. Meanwhile, robust growth in e-commerce is fueling demand for warehouses and other types of industrial real estate.

Some have suggested converting unused offices to housing, but the oversupply of office properties is not likely to impact the multifamily sector. Converting office buildings to apartments is not easy: Commercial plumbing and electrical do not typically align with residential needs, and that says nothing about the inevitable permitting problems in many of America’s largest cities. Multifamily also has a backstop in the government-sponsored enterprises (Fannie Mae, Freddie Mac, etc.), which makes fire sales unlikely.

Great financial crisis part deux?

So, will exposure to troubled CRE assets result in a new financial crisis? After all we’ve seen unfold in the banking sector this year, the answer is “never say never.” But as of now, the most likely outcome seems to be a hit to bank profitability rather than a systemic crisis.

While increasing capitalization rates and defaults on office CRE loans may result in losses in the coming years, the impact should be manageable for most financial institutions. The credit losses we may see are likely to play out over a couple years.

Banks do not appear likely to incur sizable near-term charge-offs for a couple of reasons: The impact of higher rates may not be felt until loans mature and borrowers need to refinance. And as mentioned, debt maturities for CRE loans tend to be pretty well laddered across 10 years or more. Second, office properties tend to have longer tenant leases, which should support occupancy and profitability for a period of time.

Overall, the impact of office CRE loan losses from defaults to smaller banks could be around 40 basis points of total loans outstanding. On average, this could equate to about 20% of these banks’ annual pre-tax earnings. This earnings hit seems manageable, but given the overall headwinds facing U.S. banks, it could be problematic for some.

The real cure to all of the banking sector’s ills would be “immaculate disinflation” that allows the Federal Reserve to cut rates without economic pain. If the Fed keeps rates higher for longer, the risk will grow.

Investments in mortgage-related securities and other asset-backed securities involve additional risks such as prepayment risk and interest rate risks. They are also subject to the risk that underlying borrowers will be unable to meet their obligations and the value of property that secures the mortgage may decline in value and be insufficient, upon foreclosure, to repay the associated loans. Investments in asset-backed securities are subject to similar risks.

Debt service coverage ratio is measure of a borrower’s ability to repay its loans, calculated by dividing net operating income by total debt service.

Institutional investors rely on our newsletter. Have you subscribed?

Our latest insights

-

-

-

U.S. Equities

-

Global Equities

-

Economic Indicators

RELATED INSIGHTS

-

U.S. Equities

-

-

Global Equities

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Michael Habib

Michael Habib

Ben Zhou

Ben Zhou

Marc Nabi

Marc Nabi